You drop cash into a shiny new project, buzzing with hope, and then boom, your money is gone. The team bolts with your money. That’s a rug pull, the shady trick of the crypto world. Reports peg scams like these at $2.8 billion in 2021—wild, right? But here’s the upside: they leave hints.

Below are six indicators to use and signs to watch out for, so you can dodge these crypto cons and keep your wallet happy and safe from potential Rug-pulls.

Rug pulls thrive on excitement and trust; scammers rely on them. Reports indicate that 90% of new tokens quickly lose value, often due to fraud. These warning signs act as your shield. If you overlook them, you risk losing your money, so let’s break it down simply by providing you with the 6 essential indicators:

Estimated reading time: 5 minutes

Indicators to Use Which Signal a Potential Rug Pull

1. Hidden Team: No Faces, Big Risks

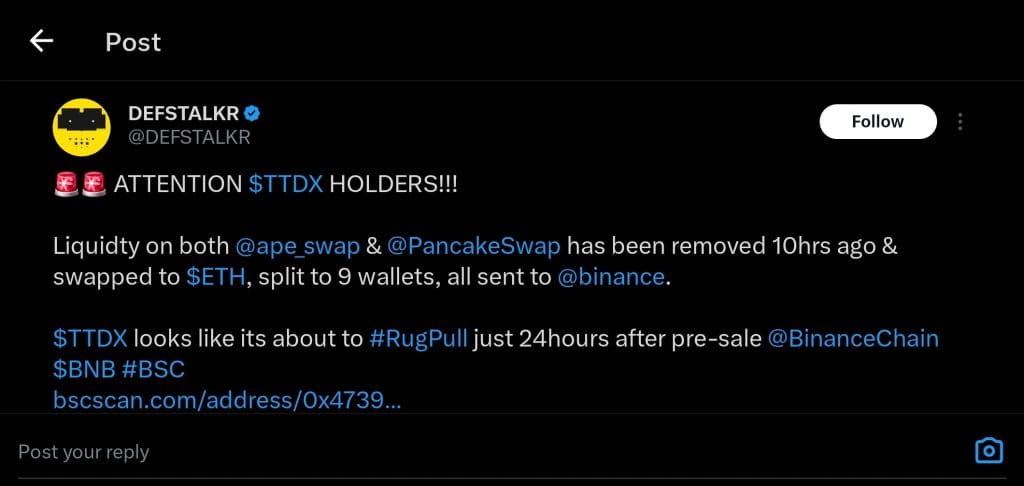

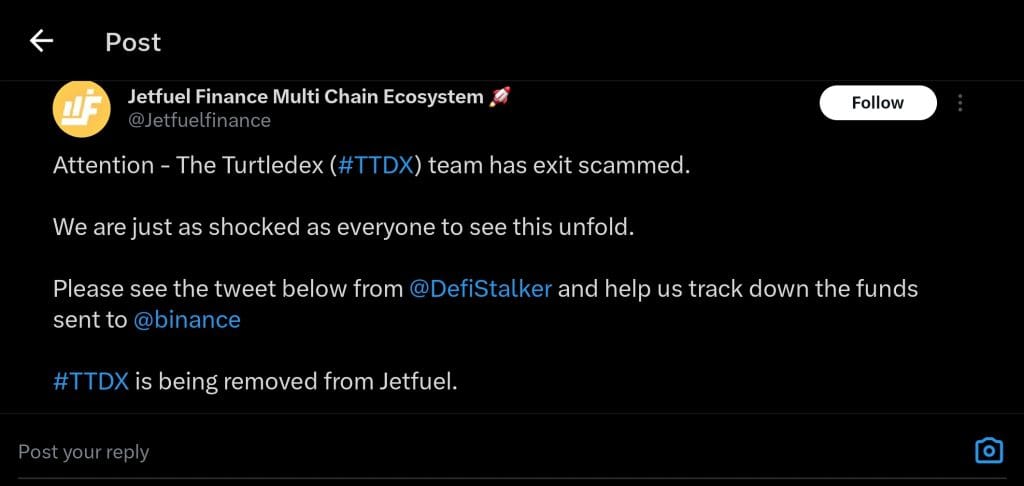

Good projects show off their crew, like big platforms flaunt their developers. But if the team’s a secret, that’s trouble. Take TurtleDex in 2021: Unknown folks grabbed $2.5 million and split. A hidden team doesn’t scream scam every time, but it’s a gamble you don’t need.

How to Check: Hit the website or whitepaper. If there are no names or vital information, please trade with caution.

2. No Clear Info: Secrets Danger Spell

Honesty is the best policy for the projects that lay out all the information and are written out, step by step, in a detailed road map with or without tokenomics or audit reports.

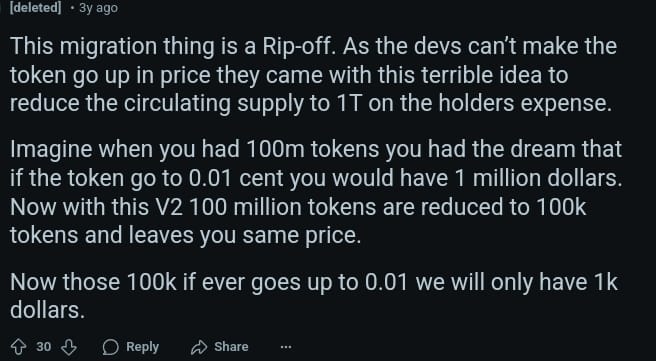

How to Check: They all have refined excuses. The greys surrounding SafeMoon’s evasive “V2” transition in 2022 left investors disappointed. Carefully peruse all their documents. If there is no hard evidence, just get out.

3. Exaggerated Claims: Too Good to Believe

Every single person has their own brand of product they are selling, and the newest cons come with the latest shiny offers to entice new victims. Scammers and frauds have ‘no risks, all rewards,’ but that is not a genuine offer when offered by the likes of Bitconnect. They promised daily returns and enormous profit potential, but annihilated their investors.

How to Check: Any claim that promises effortless income is certainly a scam, and those desperate to walk away from easy earnings fall prey to greater deception.

Quick Tip: Even look at the DEX liquidity pools; if they are scant, the team is most likely bound to hike it out without any further delay. Avoid falling for these lies.

4. Low Volume is a Warning; Trading Requires Activity

Scammers use Quiet markets to manage and alter prices for their gain. Level Finance removed liquidity in 2023, abandoning investors as the developers faded away. Danger also may be posed by low trading volume.

How to Check: View CMC or CG. It is risky if the volume per day is under a million

As a tip, check the DEX pools. Stay away from this threshold if there is inadequate liquidity.

5. Beware of Token Floods: This Is A Sign of Scams

A sudden jump or increase in token supply can crash the price—it’s a common rug pull trick. For example, in 2021, Milkydoge developers created a huge batch of tokens, sold them fast, and the value tanked. If a team can add tokens whenever they want, your investment could end up worthless.

How to Check: Watch the token supply closely. A big increase in new tokens is a big red flag.

Quick Tip: Locked tokens are safer—look for that

6. Community Red Flags: Spotting Crypto Project Warning Signs

A healthy project has a lively crowd—happy and chatting. But silence or fights? That’s a clue. Before the TurtleDex scam in 2021, its Telegram was dead or mad—nobody answered, and people raged. The community shows the truth.

How to Check: Look at X (Twitter), Discord, and Reddit. Too quiet or too wild? Bad sign./