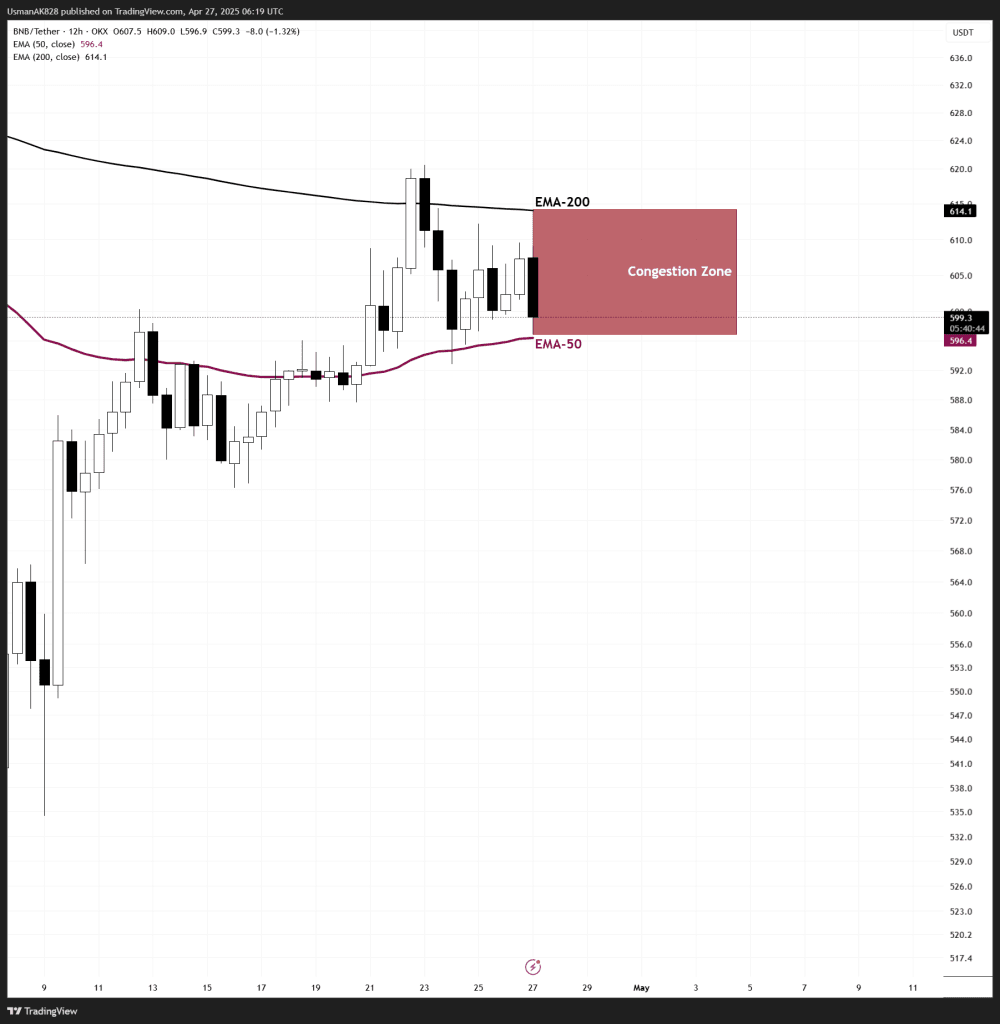

BNB Technical Analysis: 26 APR 2025

BNB is entering a choppy environment. Source: TradingView

General View

BNB has shown a steady recovery over the past few days; however, the momentum is starting to show signs of exhaustion. Price has once again been knocked back by the intra-day resistance, highlighting the hesitation among buyers. Moreover, the congestion zone between the EMA-50 and EMA-200 continues to create a challenging environment where bulls and bears are closely battling for control. Until bulls can secure a decisive break above the key resistance zone, BNB is likely to remain trapped within this tight range.

On The Upside

Immediate resistance is seen around the $605 level, with the next significant intra-day resistance at $618. This level has marked the rejection that is currently slowing the price. Until BNB clears $618, any momentum towards the upside will remain unsustainable.

On The Downside

BNB is currently holding at the psychological level of $600. If this support breaks, BNB will likely slide lower again towards $588. This is going to be an important support retest as holding this level would push for a reversal. Meanwhile, if this support is breached, BNB is likely to extend its downside towards $665 next.

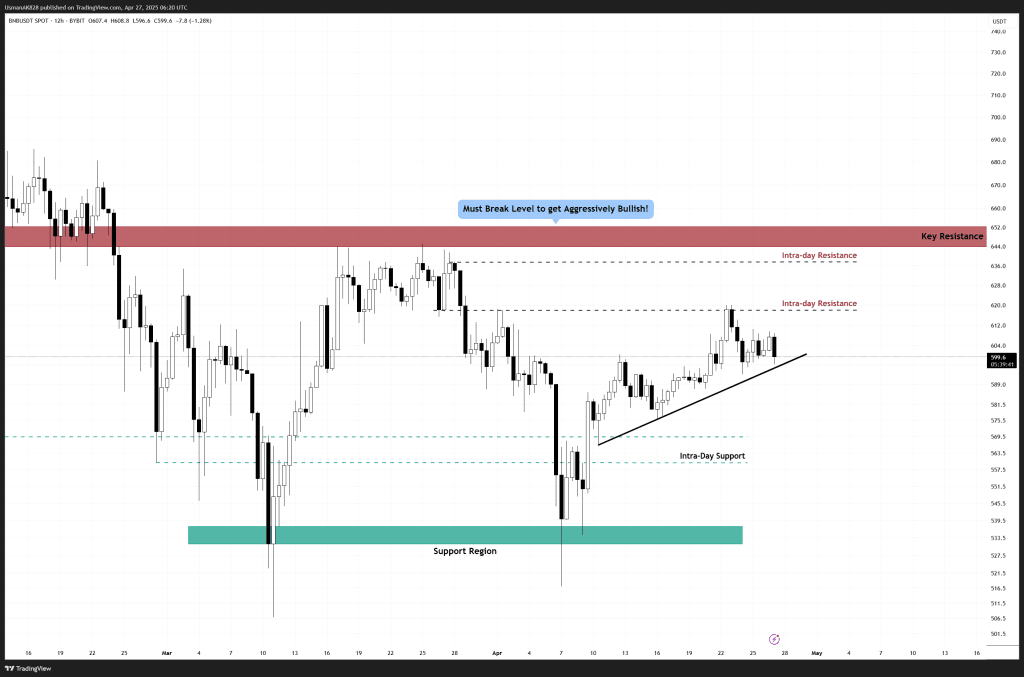

BNB is about to test the ascending support. Source: TradingView