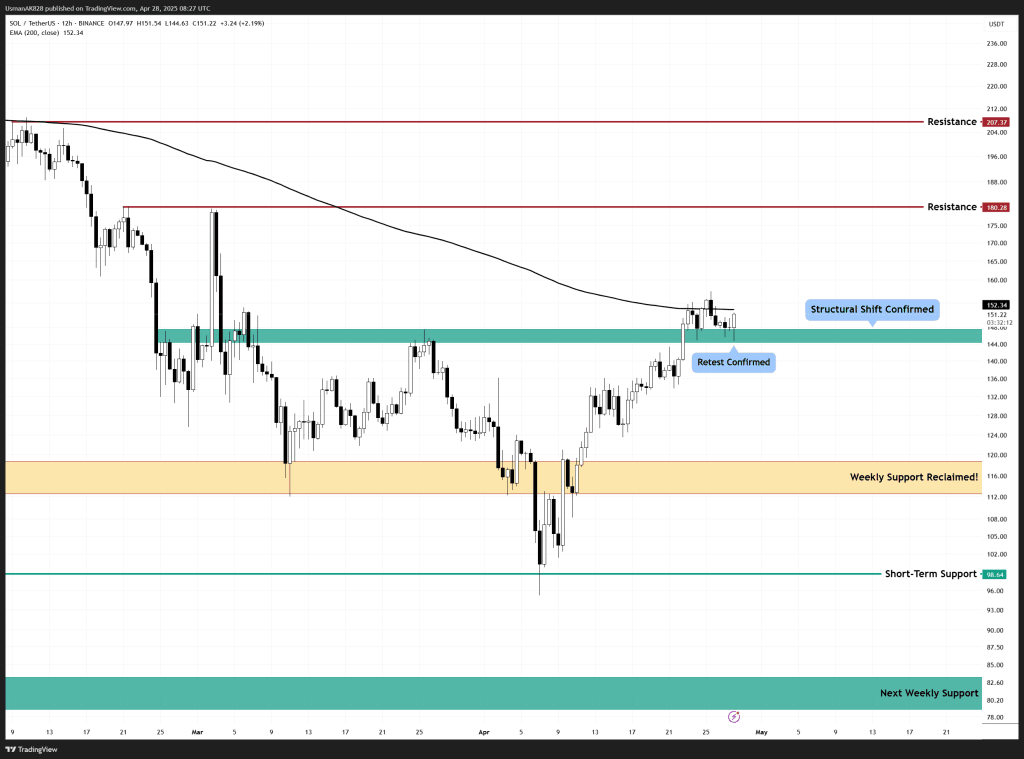

Solana Technical Analysis: 28 APR 2025

EMA-200 will be the primary resistance for the session. Source: TradingView

General View

Solana in previous weeks showed a strong momentum, as it reclaimed a few key levels. Price has held to that strength and is now confirming another support build-up, and now looks ready for another leg higher. In the short term, it’s in a sideways consolidation, and by breaking the immediate resistance, the price can see another similar rally higher.

On The Upside

A break above the immediate resistance at around $155 could set the stage for a renewed surge toward the next major resistance zones around $165 and $180. However, the 12-hourly EMA-200 at $152.50 is a major hurdle that needs to be breached for a sustainable rally higher.

On The Downside

Consistently failing to break above $152.50 and $155 could result in short-term profit-taking, which can drag the price lower before another rally is shaped. The support levels for the session are at the $150 and $148 levels. These levels are expected to restrict sellers from gaining any ground for the day as long as they hold.

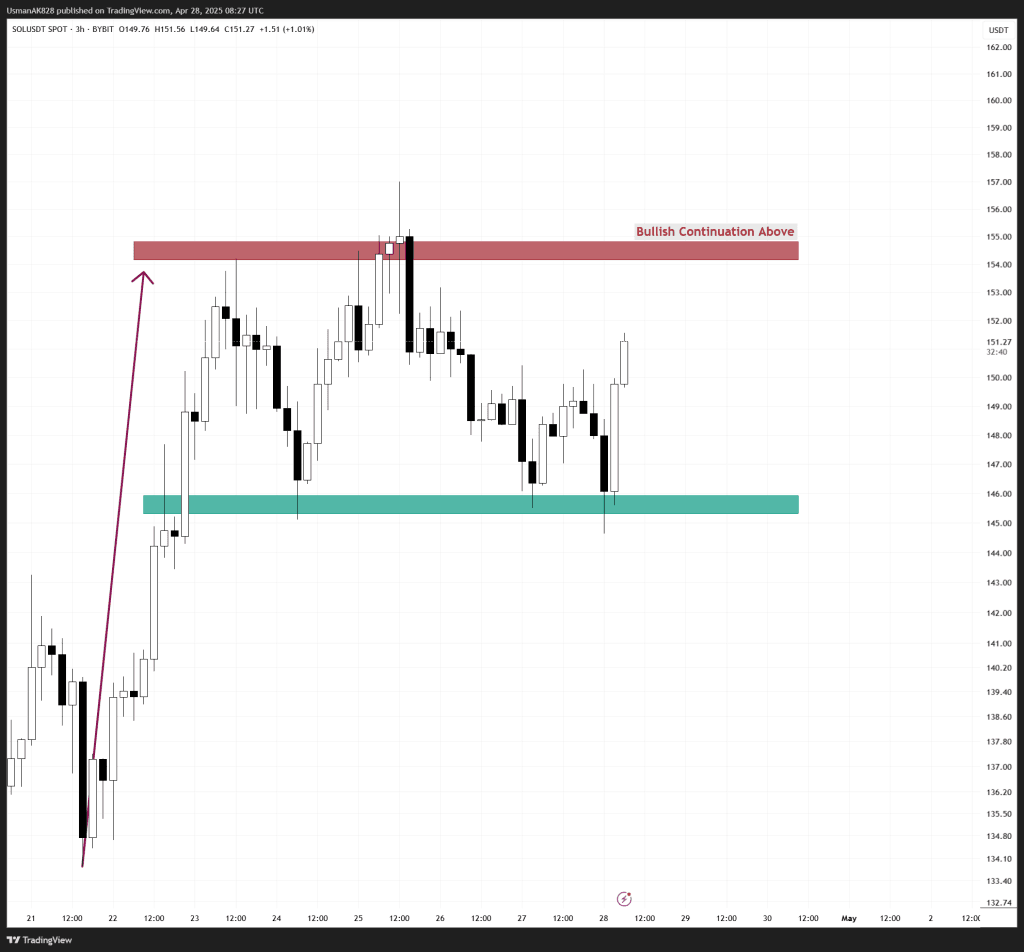

A potential bullish flag is appearing on lower-time frames. Source: TradingView