- Bitcoin breezes past $95K, gaining traction as a hedge against inflation and economic instability, with growing institutional support.

- Options traders show strong bullish sentiment, betting on Bitcoin surpassing $104K and $135K in the coming months.

- Institutional adoption and ETF inflows drive a healthier rally, but critical macroeconomic data could test BTC’s uptrend.

The idea of Bitcoin as a “safe haven” against inflation and political influence is becoming a firmly established narrative among market participants. At the same time, options traders are betting on calls, as Bitcoin’s current rally appears to be premised on more solid fundamentals compared to the previous rallies.

Bitcoin Decouples from Markets as Bullish Bets Surge

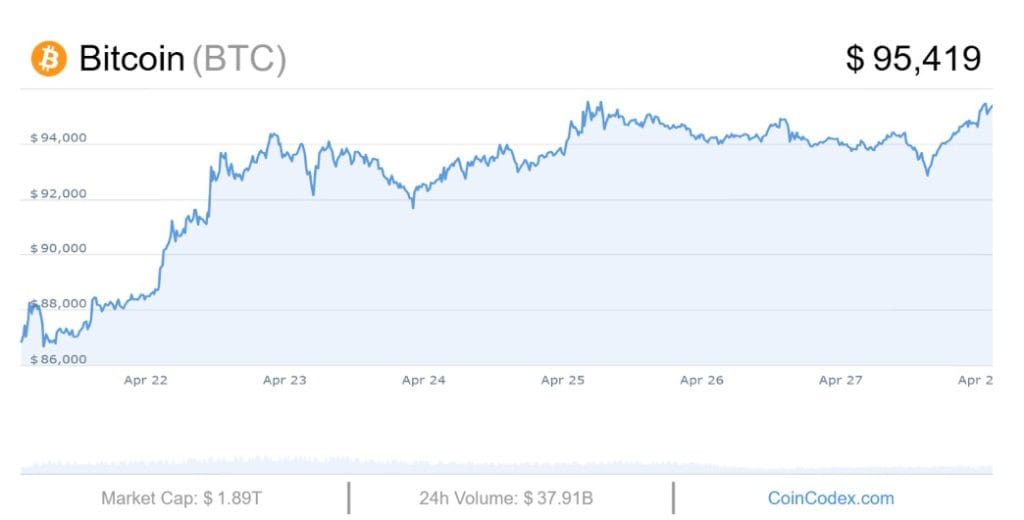

Over the past week, Bitcoin, alongside gold, initiated a northbound rally, according to QCP’s latest report. In contrast, traditional investments, such as stocks, fell due to the slippage experienced by the broader financial market. Following this divergence, market watchers rehashed the conversations around BTC’s decoupling from the equity market.

As Bitcoin reclaims the $95K price mark, more individuals are increasingly viewing BTC as a hedge against market uncertainties and currency devaluation. However, some experts argue that the coin is yet to fulfill its “digital gold” status. These analysts base their position on Bitcoin’s fluctuating behavior between serving as a digital store of value and a risk asset.

Recall that the asset moved in tandem with gold as traditional assets traveled southbound. But by midweek, BTC’s price trend reversed, mirroring equities’ uptrend response to the “21 Capital” news. Given the coin’s behavioral swing, traditional correlation frameworks are becoming less reliable. Instead, market participants are paying attention to Bitcoin’s upward movement regardless of the broader macroeconomic trends.

Meanwhile, Bitcoin option traders are putting in more call options (bets that the price will rally), indicating confidence in the asset’s future outlook. On Friday, a large number of bullish bets were placed on the price trend of BTC over the next 60 days. Per insights by WuBlockchain, over 500 contracts were bought betting BTC will be above $104,000 by May 30, 2025. In addition, over 800 contracts predicted the asset to cross $135,000 by June 27, 2025.

Institutional Support Grows Ahead of Key Market Tests

Experts note that Bitcoin’s market fundamentals look more sustainable compared to past bull markets. In the past, Bitcoin rallies were often fueled by speculation and leverage. This time, the underlying drivers of Bitcoin’s rally include solid elements such as increased institutional adoption.

In this cycle, asset managers such as MicroStrategy and Metaplanet are actively accumulating Bitcoin as a primary investment strategy. Furthermore, perpetual funding rates are flat or even slightly negative, indicating that investors aren’t leveraging to bet on Bitcoin. Spot Bitcoin ETFs also posted six consecutive days of inflows as investors explored more regulated purchase methods.

At the time of writing, Bitcoin trades at $95,419 after breaking the $95K mark in the recent intraday session. It has recorded 17 green outings in the last month and trades close to its cycle high.

However, BTC’s sustained uptrend may face tests by several key events over the next seven days. Important macroeconomic reports and corporate trends could likely play a major role in its “up only” movement.