- Analysts are speculating on whether Ethereum’s price can soar to as high $8,000 by the fourth quarter of the year.

- According to data from Coinglass, pointed out by Crypto Admiral, May has historically been a positive month for Ethereum.

- So far, Ethereum reaching $8,000 by Q4 2025 would require a roughly 160% price increase from current levels.

Ethereum has entered the spotlight once again, and analysts are speculating on whether its price can soar to as high $8,000 by the fourth quarter of the year. This prediction is based on both historical chart patterns and rising on-chain demand for the cryptocurrency. So far, trading metrics show that the second-largest cryptocurrency by market cap may be on the verge of a massive multi-month rally.

Ethereum to $8K

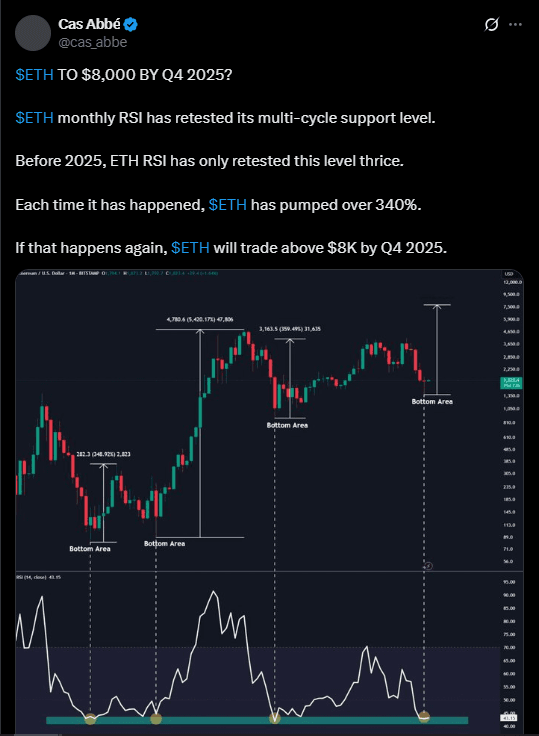

The main source of this bullish speculation is from market commentator Cas Abbé, who pointed out something interesting. The researcher notes ETH’s monthly RSI has revisited its long-standing multi-cycle support. What makes this signal so interesting is that this event has only occurred three times in Ethereum’s history. Moreover, each time this trend showed up, it was followed by price increases of more than 340%.

If history repeats, ETH could be on its way above the $8,000 zone from its current price level of around $1,800. This pattern, when combined with the growing on-chain activity, has had traders paying attention.

The Setup for a Rally?

Over the last week, Ethereum has seen an increase in network activity, with its active wallet addresses jumping by 8% to 1.2 million. This massive surge shows a comeback of interest from both users and developers. Another major indicator of this trend is social engagement metrics, which show that Ethereum-related discussions on platforms like X (Twitter) and Reddit are up 15%. Consequently, investor sentiment is soaring.

Meanwhile, around 28% of Ethereum’s total supply is now staked, which means that its exchange supply is also down. Fewer coins available to trade means that demand could be on the verge of surging along with price. Moreover, there are signs that the aforementioned surge towards $8,000 could start out in the current month.

According to data from Coinglass, pointed out by Crypto Admiral, Ethereum’s price action has been “bloody” over the last few months. Historically, Ethereum tends to thrive in May. If May kick-starts the rally, Ethereum could be on its way towards higher highs over the coming months.

ETFs and Institutional Interest: As Quiet Fuel for the Fire?

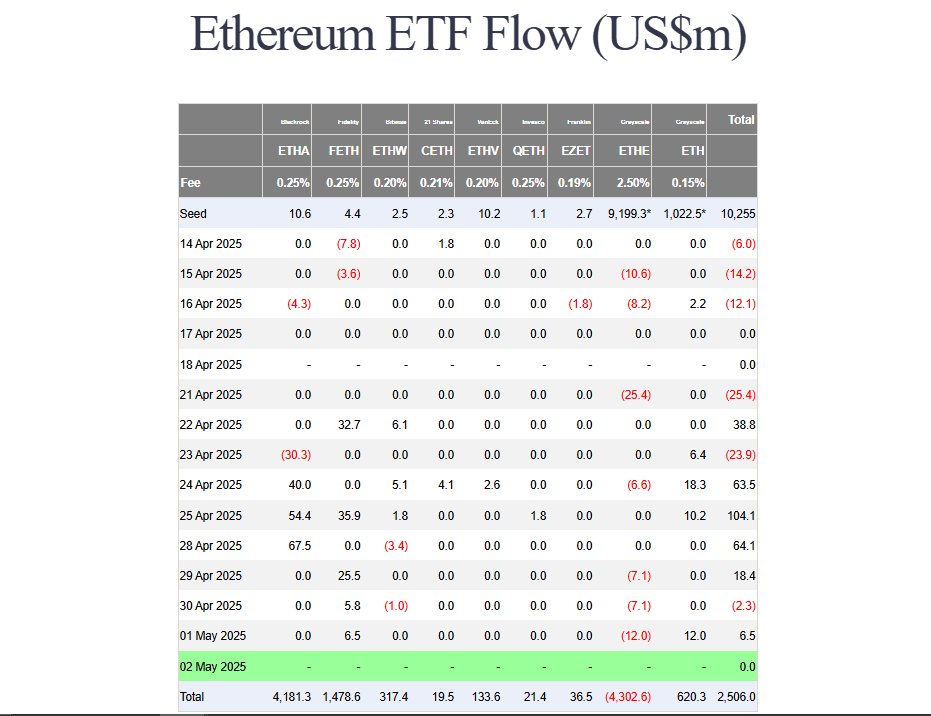

Another major boost for Ethereum’s rally over the long term is its institutional activity. So far, spot Ethereum ETFs in the U.S. have recently attracted $245 million in inflows over just four days, according to data from Farside. Even though ETH’s price remained mostly stagnant during this timeframe, this accumulation shows that investors are indeed confident in what comes next.

Much of this interest has been linked to the possibility of these ETFs gaining staking capabilities soon. If the SEC approves this feature, Ethereum ETFs could be ready to offer investors passive yield.

So far, Ethereum reaching $8,000 by Q4 2025 would require a roughly 160% price increase from current levels. While this is not unheard of in crypto, traders should remain on high alert. Things look promising, but Ethereum’s price is still subject to general market forces.