- VC investments in crypto slumped to a four-year low in deal count despite CeFi pulling big new funding rounds.

- April’s total investment value jumped to nearly $3 billion, a slight month-on-month rise but a huge 170% yearly surge.

- Ripple’s $1.25 billion acquisition of Hidden Road grabbed headlines as mining firms like Bitdeer and Auradine secured major funding.

Crypto venture capital investments went down to their lowest levels in over four years despite the fact that centralized finance (CeFi) projects saw a significant increase. Only 66 crypto VC deals were publicly announced in April 2025, as reported in Wu Blockchain’s “VC Monthly Report,” representing a 15.4% reduction from March’s 78 deals. It marks a steep 62.9% decline from 178 deals reported the previous year in April 2024, the lowest since February 2021.

In spite of the overall decline in the number of deals, volumes of funding went against the trend. In total, investment for the month of April stood at $2.986 billion, up by a marginal 3.1% from $2.895 billion in March. Its year-on-year increase was even more dramatic, rising by 170.2% from $1.105 billion in April 2024. It made April 2025 the most profitable month for fundraising since May 2022.

Ripple was in the headlines after it acquired institutional broker Hidden Road for $1.25 billion. It’s Ripple’s biggest deal to date and extends its presence into clearing, financing, and institutional brokerage services in a range of digital assets. Hidden Road was established in 2018 and handles more than $3 trillion in trades a year with a solid client base of in excess of 300 institutions, including hedge funds.

Major CeFi and Mining Deals Drive Capital Surge

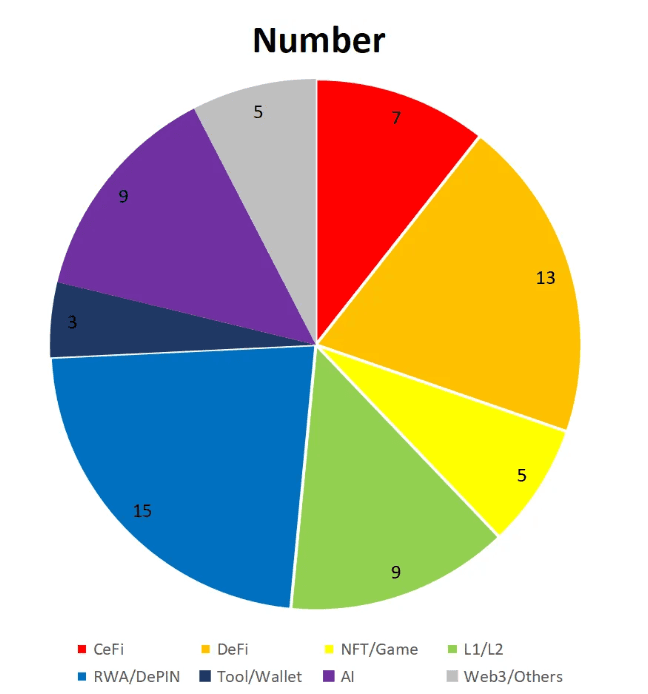

Centralized finance projects accounted for about 10.6% of the total VC-funded endeavors that proved to withstand as other corners such as DeFi and NFT/GameFi trailed. DeFi projects totaled 19.7%, NFT/GameFi 7.6%, and AI-related projects approximately 13.6%. The largest share, 22.7%, went to RWA/DePIN, while L1/L2 networks also had a solid 13.6%. Minor segments such as Tool/Wallet projects amounted to 4.5%.

Bitdeer, a major company in the Bitcoin mining industry, gathered $179 million by combining loans and selling shares to boost its ASIC chip production. In 2024, the company made around $147 million in gross profit from its mining and hosting services. Additionally, Bitdeer got loan agreements worth up to $200 million from Matrixport and raised another $118.8 million by selling stocks. The capital will boost chip development that pits the company against the likes of Bitmain and MicroBT.

Auradine is getting a lot of attention in the mining equipment industry. The company has raised $138 million from investors, plus an extra $15 million through venture debt, with StepStone Group heading the funding. Auradine aims to boost its mining hardware production and also expand its AI infrastructure services.

Strategic Bets on Blockchain and AI Gain Traction

SOL Strategies, a company listed in Canada, revealed it secured up to $500 million in funding through convertible notes from ATW Partners. The first $20 million tranche was scheduled for May 1, 2025, aimed at staking SOL tokens through the company’s validator nodes.

Ripple’s landmark deal wasn’t the only splash in April; GSR also made a bold $100 million investment into Upexi, Inc. to strengthen its crypto-asset-backed treasury, which includes 45,733 SOL tokens currently valued around $6.7 million. The decentralized AI sector also drew big investments. Led by Paradigm, Nous Research is building a decentralized training network on the Solana blockchain, aiming to coordinate global computing power for open-source AI model development.