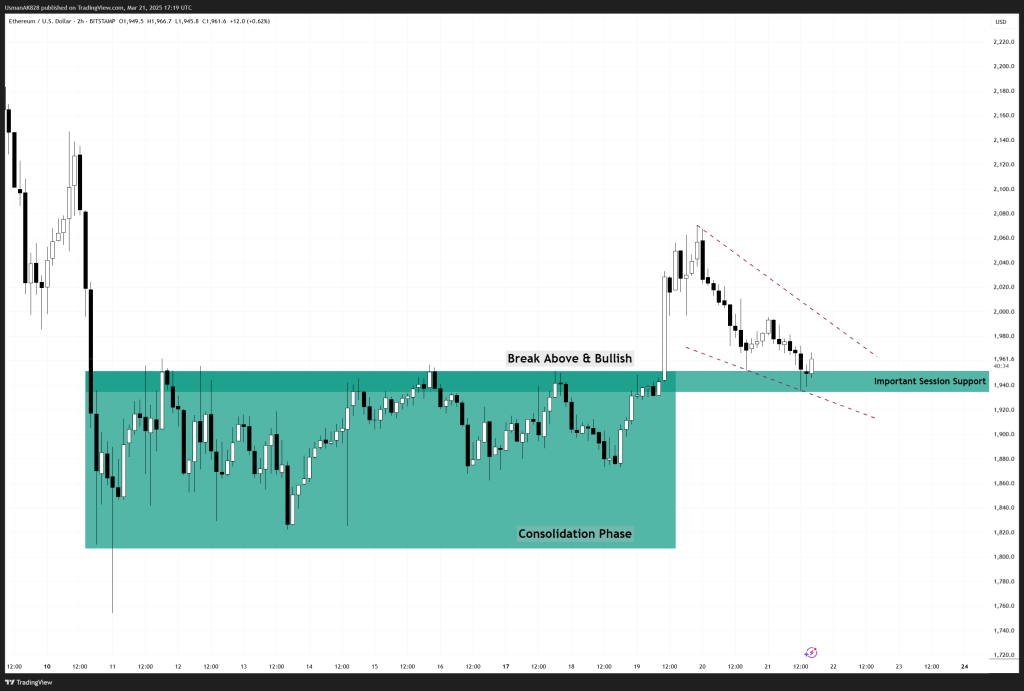

Ethereum Technical Analysis: 21 MAR 2025

$1940 is an important session support. Source: TradingView

General View

Ethereum has been consolidating in a tight range, attempting to sustain its latest breakout. Price action remains confined within key levels, with $1,940 acting as a pivotal zone. The short-term bullish momentum allowed ETH to push into resistance, but the lack of follow-through has resulted in another rejection. The broader structure indicates that Ethereum is still battling to regain strength after previous sell-offs. A sustained hold above $1,940 is crucial to maintain bullish momentum and avoid a deeper retracement.

On the Upside

A successful breakout above the $1,940 resistance level would be a strong bullish signal, opening the door for Ethereum to target $2,020. If buyers manage to push the price beyond this level, the next key resistance comes at $2,100, where the broader congestion zone begins. A confirmed break above $2,100 could accelerate Ethereum’s recovery, bringing $2,300 into focus. This would mark a key turning point for Ethereum’s larger trend, potentially signaling a shift towards a more sustained bullish phase.

On the Downside

Ethereum is holding at the recent breakout levels, attempting to establish support after its latest push higher. Price action remains within a key range, with $1,940 acting as a critical pivot. Failure to hold above $1,940 increases the likelihood of further downside. Immediate support lies at the session lows near $1,900. If selling pressure intensifies, ETH could revisit the $1,850 region, a key area from the recent consolidation phase.

Ethereum’s deviation is getting established on a daily time frame. Source: TradingView