- Santiment reported a surge in Chainlink’s social dominance after a private meeting.

- Whale and shark wallets now hold 43.8% of Chainlink’s supply after accumulating 26M LINK.

- Analysts identified key resistance levels for Chainlink while accumulation trends suggested market confidence.

Chainlink’s price movements throughout March reflected heightened volatility, with notable fluctuations shaping its performance. Data from CoinGecko indicated a series of surges and pullbacks, highlighting both bullish and bearish trends.

Chainlink’s Price Fluctuations in March

Chainlink (LINK) started the month trading above $14.50 before experiencing a sharp rally past $17. However, the price retraced soon after, signaling volatility. A mid-month decline saw LINK drop near $12.20 before finding stability. Toward the end of March, a recovery pushed the token above $15, though resistance levels led to another pullback near $14.60.

Short-term movements reflected continued fluctuations. LINK lost 6.6% in the past 24 hours, which is probably due to selling pressure. Moreover, the 1-hour trend had dipped 0.9%, adding to the short term trend by this press. It also showed signs of resilience in regard to mid to long term trends.

While LINK had moderate bullish momentum, it gained 3.0% over the last seven days. In the 14-day performance, the trend was strengthened as it recorded a rise of 9.3%. Regardless of this, the 30-day chart showed a decline of 4.3%, implying but not confirming a consolidation.

Increased Accumulation and Social Dominance

According to Santiment data, a major surge in Chainlink’s social dominance across crypto platforms was witnessed. The growth came after a private meeting between the Chainlink team and US government officials. Since March 10, the token’s value has risen about 25% in the market.

Meanwhile, significant accumulation from large investors contributed to shifting market dynamics. Whale and shark wallets, holding between 10,000 and 10 million LINK, reached an all-time high balance of 438.33 million LINK.

These wallets now control 43.8% of the total circulating supply. Since September 2024, these key holders have collectively acquired an additional 26 million LINK, reinforcing long-term confidence in the asset.

Chainlink’s Future Movement

Crypto analysts have assessed LINK’s chart patterns to predict potential price movements. Analyst CW identified a bull flag pattern on LINK’s daily chart, suggesting a possible price breakout. If LINK surpasses the $18 resistance level, it could target $43 in the coming months.

Ali Martinez, another analyst, additionally mentioned that if LINK manages to climb above $15.50, it could reach $17.

But he added $17 remains a vital resistance mark, and any continued move will hinge on having strong momentum. Simultaneously, Javon Marks also predicted a prolonged rally. His price target $47.154 would mean more than 192% increase.

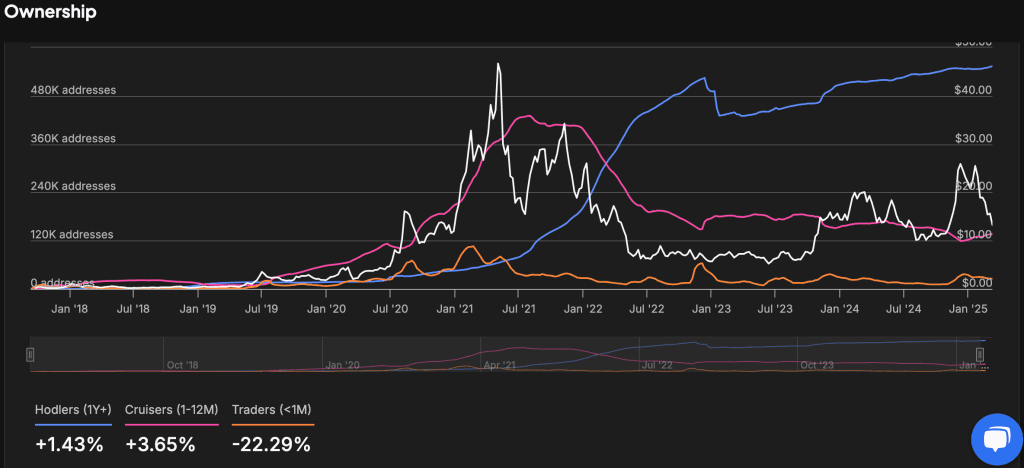

On chain, there was visible shift in investor behavior. The “Addresses by Time Held” chart showed that long term holders (1Y+) had gone up by 1.43%. Furthermore, mid term holders (Cruisers, 1–12M) rose by 3.65%, suggesting it was a period where people were for sure dumping their LINK for multiple reasons.

On the other hand, short-term traders (<1M) decreased by 22.29%, and this may imply lower speculation. Historically, a growing number of long-term holders has correlated with reduced selling pressure, potentially reinforcing Chainlink’s upward trajectory.