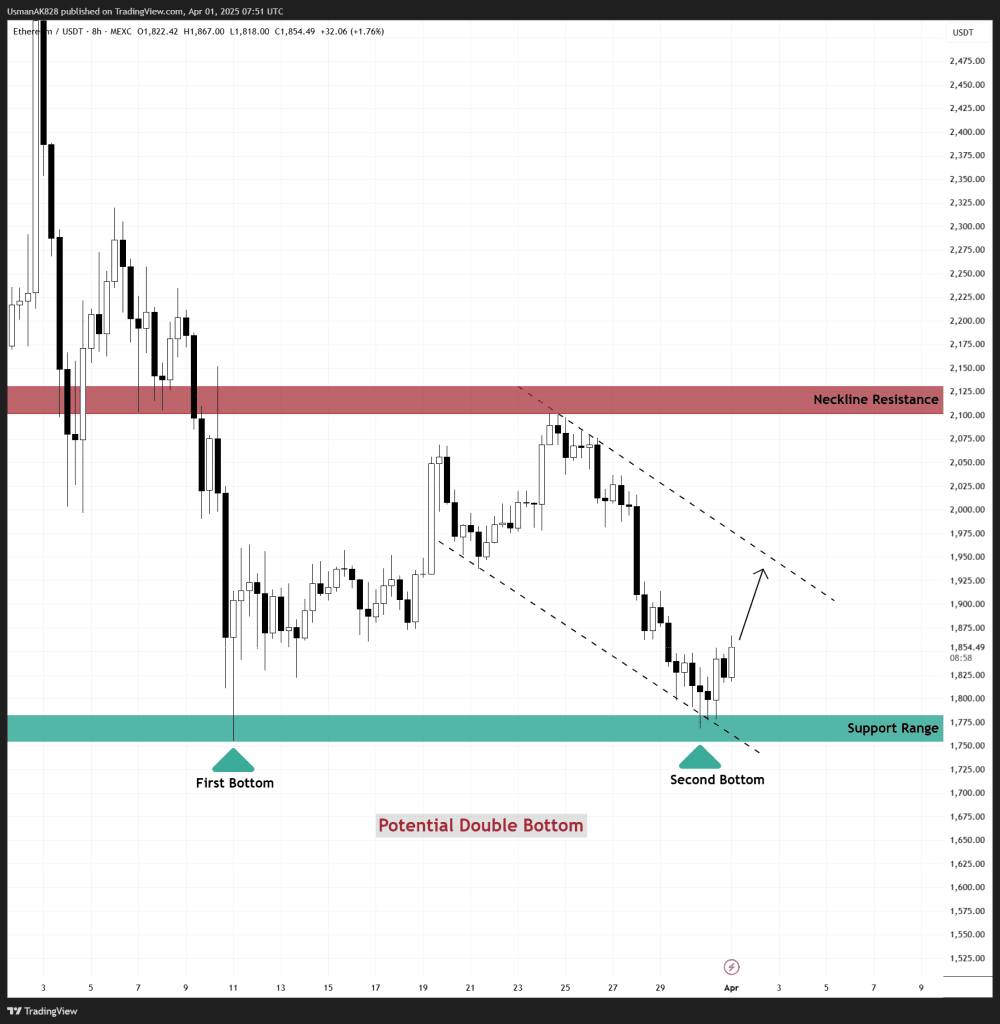

Ethereum Technical Analysis: 1 APR 2025

Ethereum is starting to print a double bottom pattern. Source: TradingView

General View

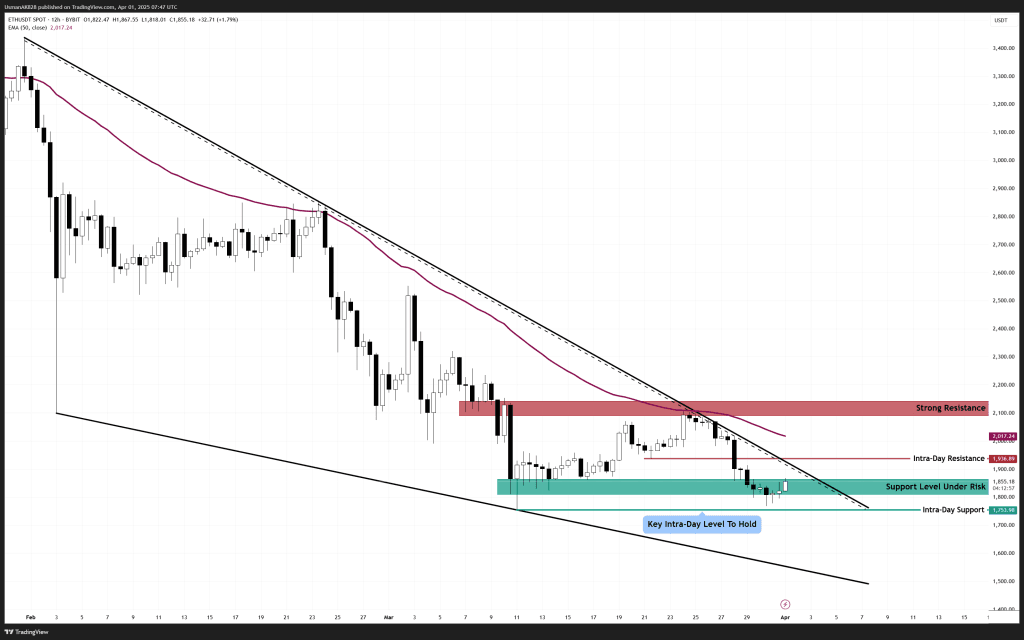

Ethereum is currently trading at a critical range where a potential double bottom formation could take shape if buyers step in with strength. The broader downtrend remains under pressure, with the 12-hour EMA-50 acting as a major barrier for any sustained bullish momentum. This moving average has consistently rejected price recoveries, making it a key hurdle for bulls to overcome. While the price has found temporary support near the intra-day level, a decisive move above resistance is needed to confirm any reversal attempts. Until then, Ethereum remains vulnerable to further downside pressure.

On The Upside

Ethereum is facing immediate intra-day resistance at $1860 and $1880. These are critical intra-day levels that bulls need to overcome to extend the price recovery. Additionally if these primary resistance levels reject price from climbing higher, Ethereum would then once again lose its momentum. Meanwhile, above $1880, the next intra-day resistance is $1950, followed by $2000.

On The Downside

Ethereum is attempting to establish support at the $1,820 level, but bulls need to show stronger commitment before this level can be confirmed as a firm base. Meanwhile, for the session the next supports lower are at $1780 to $1750 levels.

Ethereum bouncing off the intra-day support. Source: TradingView