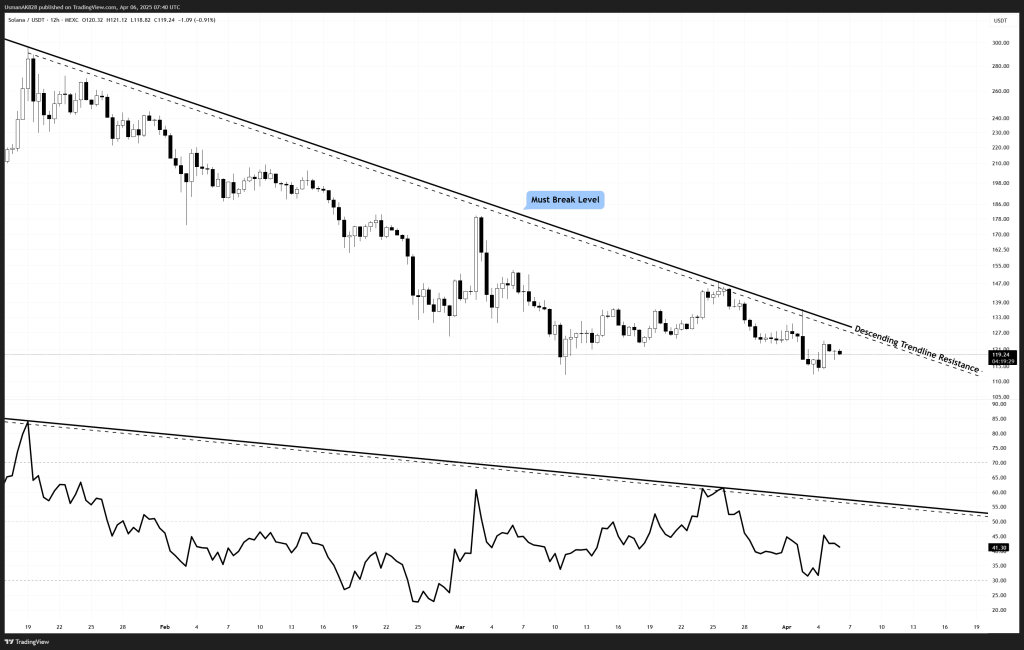

Solana Technical Analysis: 6 APR 2025

Solana could likely re-test the supportive range once again. Source: TradingView

General View

A potential double bottom could be forming around the key supportive range of $112–$115, hinting at an early attempt by bulls to shift momentum. However, price action continues to struggle beneath the descending trendline resistance, keeping the upside in check. For any sustainable and strong bullish breakout to occur, both the RSI breakout and a clear move above the trendline are crucial. Until then, the bears still have the technical edge.

On The Upside

Solana, after having a decent session yesterday, got knocked by the resistance at the $123.50 level. This is going to be an important level once again for the session. A break and hold above $123.50 could open up further upside potential with $128.50 as the initial target, followed by a broader push towards the $135–$137 resistance zone. As these levels are approached, expect partial profit-taking to kick in as bulls test higher resistances.

On The Downside

Failure to break above the trendline could put Solana back under pressure. If price slips below the $115–$112 support zone, bears could aim for deeper levels near $105, followed by $100 psychological support. A breakdown from here would not only invalidate the double bottom setup but also open the door for a retest of lower support clusters.

Price trendline and RSI trendline are both in a descending trend. Source: TradingView