XRP Technical Analysis: 8 APR 2025

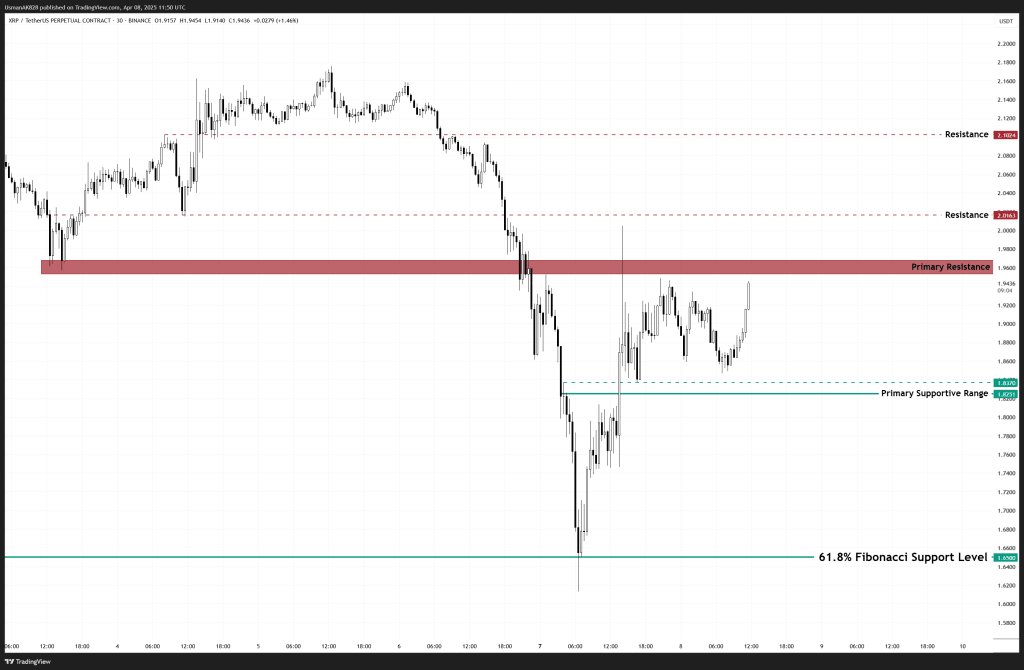

XRP is about to retest primary resistance. Source: TradingView

General View

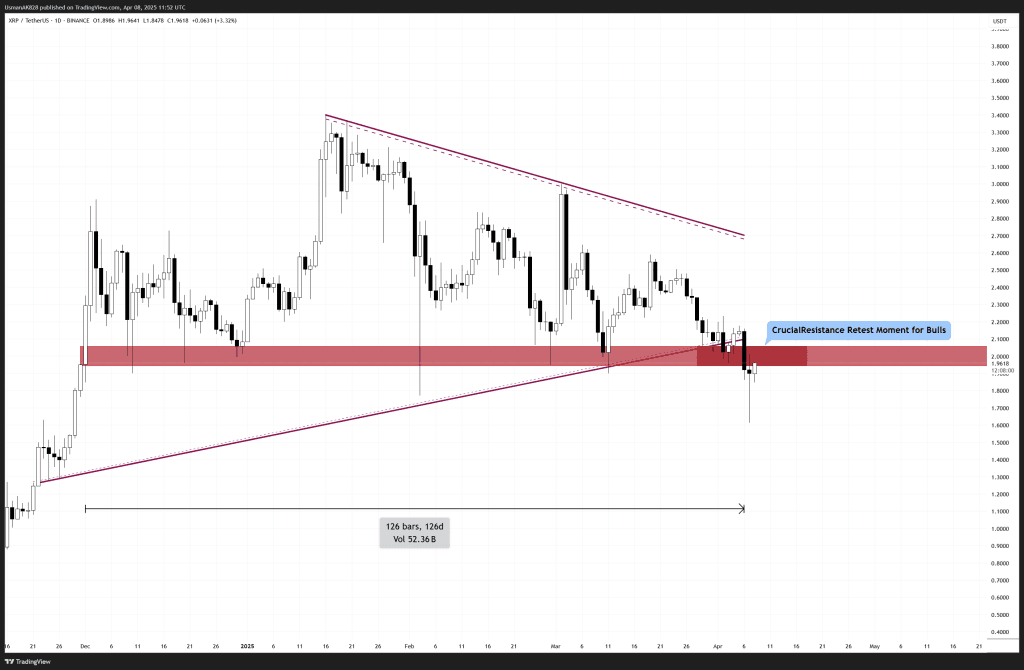

XRP is currently in the middle of a correction to the upside, driven by a combination of short-coverings and fresh buying interest. Yesterday’s session revealed a key clue as the highest hourly volume was recorded during the session’s lowest candle, signaling strong accumulation at discounted levels. This sharp bounce off the $1.66 Fibonacci support highlights aggressive buyer interest, but it’s important to view this within the broader structure. Price is now approaching a previously broken multi-month support zone, now acting as resistance, which points to a potential bearish retest in progress.

On The Upside

The primary resistance zone lies between $1.93 and $1.96. These are the levels that initiated the recent sell-off. This area is critical and could lead to partial profit-taking or attract fresh short positions. However, if bulls manage to absorb the selling pressure here, XRP could extend its recovery toward the $2.02 level and potentially push further towards $2.10.

On The Downside

Immediate support lies in the $1.82–$1.87 range, which has now acted as the base for the latest bounce. As long as this support region holds, XRP should avoid any deeper retests. However, a failure to maintain this zone could expose XRP to another leg lower, potentially targeting the $1.66 level marked by the 61.8% Fibonacci retracement.

XRP’s bearish retest is currently underway. Source: TradingView