- BNB might remain range-bound between the $580 and $520 zones for now, unless the market registers and sticks to a new trend.

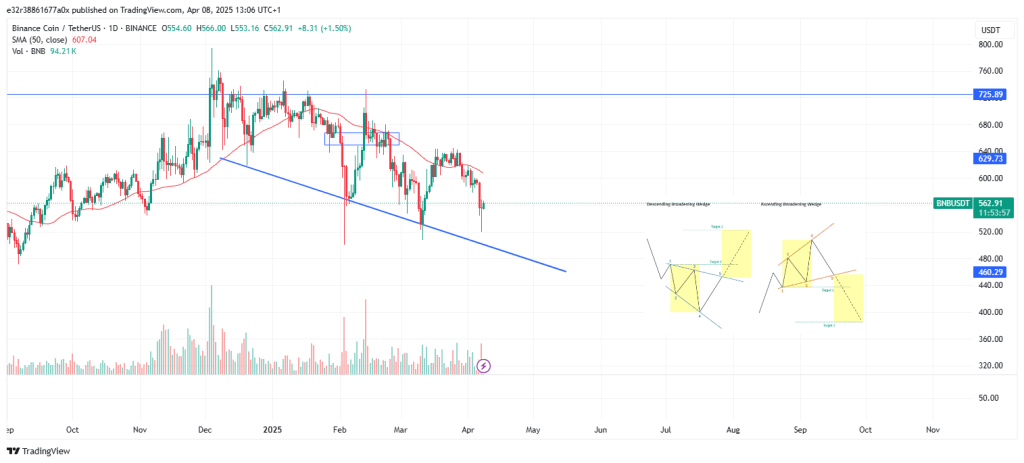

- The daily chart shows that BNB has now formed a “broadening wedge formation,” which is bullish in the medium to long term.

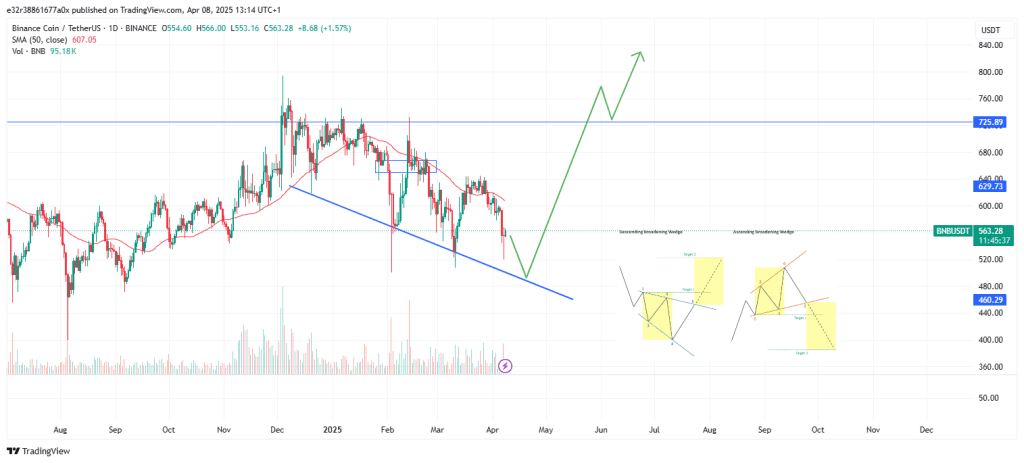

- If BNB rebounds from $485 with buying pressure, it could rally 40% to $790.

Binance Coin has seen a challenging start to April, especially with its 5% drop on the seventh day of the month, alongside drops across the general crypto market. Despite this dip, there are now emerging signs that BNB could be in for a major accumulation phase.

This phase could trigger a major rebound if the bullish momentum holds, and here’s what the current price action has to say. Is a rebound truly possible?

BNB Faces Resistance in the Short Term

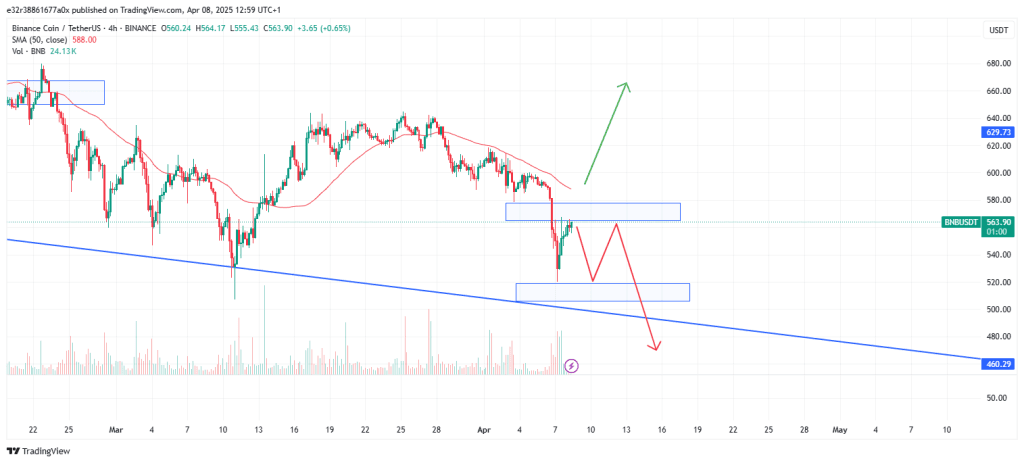

To begin, the 4-hour chart shows that BNB attempted a break above the $565.75 resistance level sometime on 7 April. However, it quickly fell back in what turned out to be a false breakout. Generally, with most of the cryptocurrency’s daily average true range (ATR) already played out, the price could become less volatile in the short term.

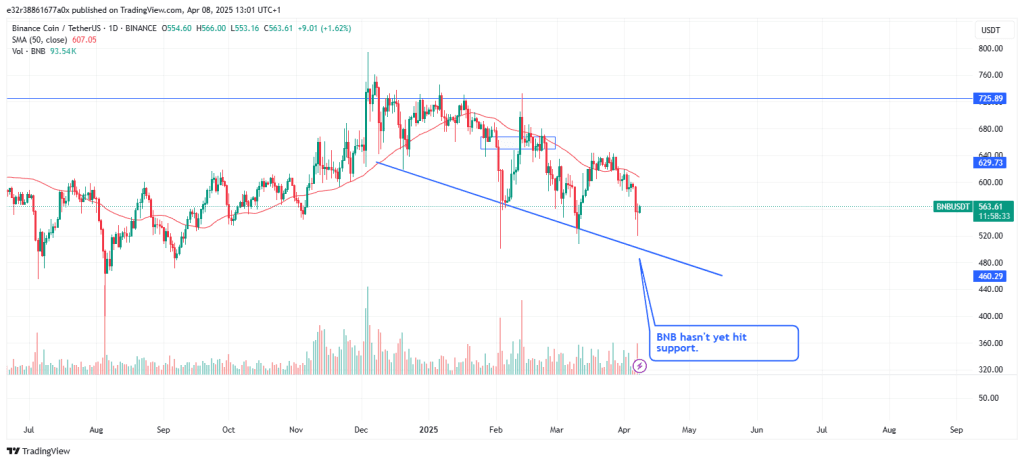

As such, BNB might remain range-bound between the $580 and $520 zones for now. Zooming out into a daily timeframe shows that BNB is still far from any critical support or resistance levels.

Considering the cryptocurrency’s low trading volume and weak momentum from the buyers, the coin is likely to range for a while and then continue further downwards slightly before any kind of rebound. Until a clear uptrend establishes itself, investors must trade BNB with caution.

BNB Enters Historic Buy Zone

More importantly, BNB has entered what traders call a “historic buy zone.” For example, the daily chart shows that BNB has now formed a “broadening wedge formation.”

Historically speaking, this pattern is a bullish one and is likely to lead to a major price rebound if the bulls step in after one last leg downwards. This is without mentioning how the pattern’s lower support coincides with the $485 zone, which has held BNB up since the cryptocurrency broke above in March of last year. The current dips on BNB are likely an attempt to shake out the “paper hands” before a major move to the upside.

A 42% Rally Is on the Horizon—But Only If Momentum Builds

If BNB is able to rebound from this $485 price level and buying pressure starts to grow, analysis shows that the coin can rally by as much as 40% and push upwards to as high as $790. This would bring BNB back to levels last seen since December of last year.

However, it is important to note that a rally of this magnitude depends on continuous bullish sentiment from the spot and derivatives markets. According to recent trading data, buyers are already stepping in.

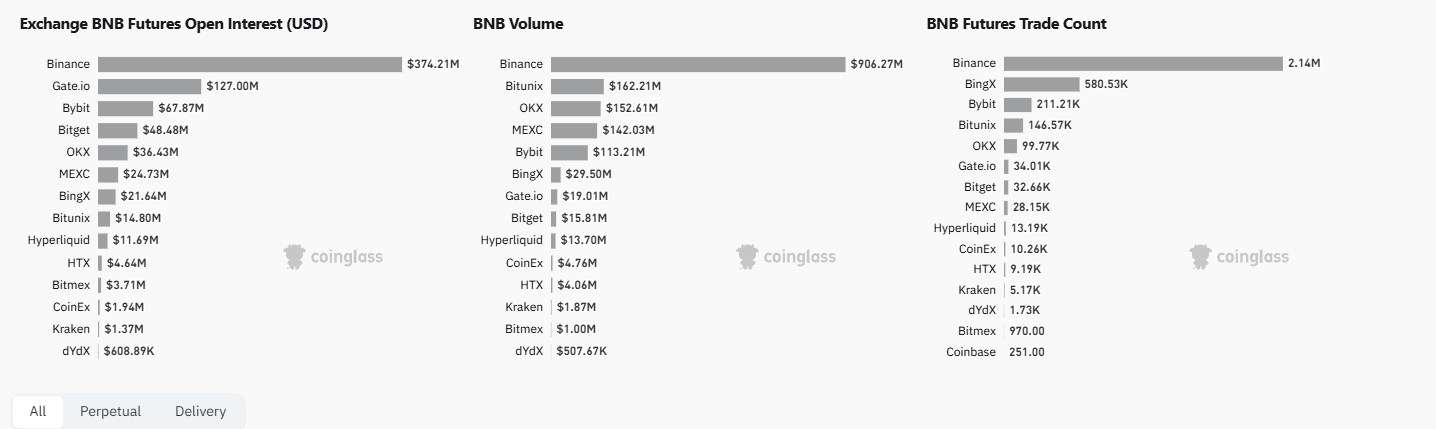

Data from Coinglass shows that nearly $10 million worth of BNB has been scooped up in the spot market since the last dip. Open Interest has also been on the rise lately, with Binance buyers taking charge of the market.

When combined with Coinglass’ long/short ratio, where buyers are taking a 51.65% lead on the sellers with 48.35%, the above data shows that traders are betting on a rebound. Many of these traders see the current dip as the start of a buying opportunity, rather than the start of a deeper sell-off.