- Dogecoin faces significant selling pressure as whales offload 1.32 billion DOGE in just 48 hours.

- The meme coin has dropped over 70% since December with geopolitical tensions and economic instability.

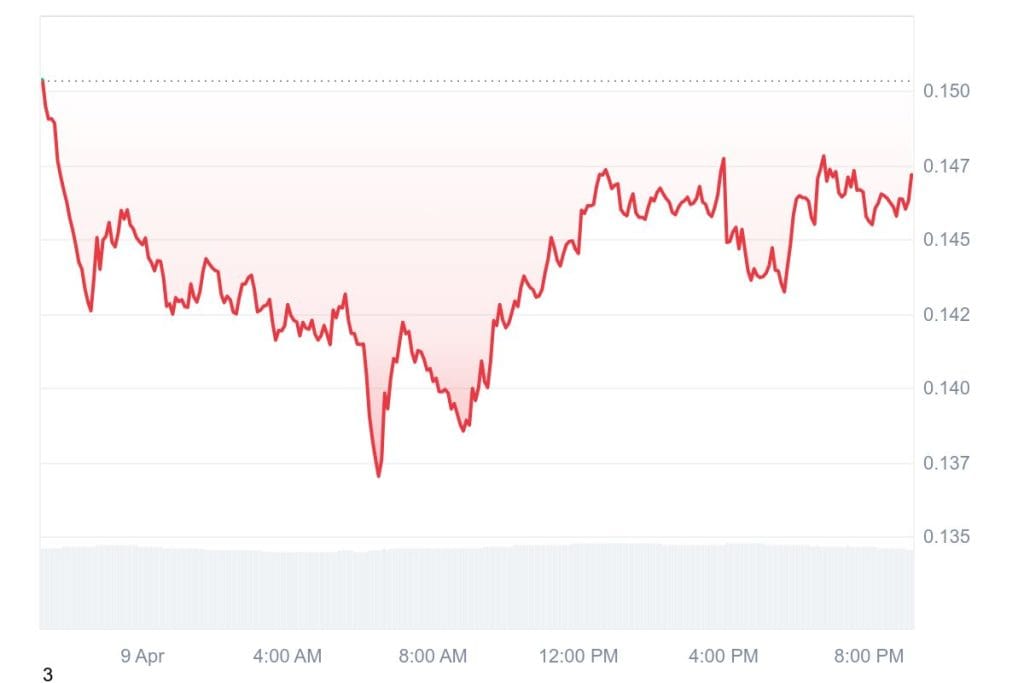

- Dogecoin’s future remains uncertain, with the $0.14–$0.15 support level crucial for any potential recovery.

Dogecoin now suffers from deep scrutiny because of unfavorable elements. The marketplace meme token faces substantial selling stress lately which stems from worsening geopolitical conditions and lasting economic insecurity. The digital currency reached its most current regional minimum value of about $0.129 on Monday, which demonstrated the continuing bearish momentum observed throughout multiple weeks.

Investors now maintain a defensive approach toward Dogecoin while the cryptocurrency faces cautious market sentiment because of the broader risk-off conditions that affect traditional markets as well as crypto assets. The figures from Santiment show that Dogecoin whales sold more than 1.32 billion DOGE during the last 48 hours, which indicates a growing doubt about market trust.

The massive token discharge leads to important inquiries because large holders might be following a strategic rebalancing approach or smaller investors are selling quickly due to worsening volatility. The present status of Dogecoin marks its vital transition point. The absence of new buyers could lead the market toward additional price drops. The upcoming period will be decisive for Dogecoin because the large-scale withdrawals and market price fluctuations will decide its path: stabilization or complete breakdown.

Dogecoin Faces Steep Decline as Whale Selloff Fuels Bearish Trend

Dogecoin has plummeted more than 70% of its value since December with no sign of a recovery. The meme coin was once a bellwether for retail enthusiasm and speculative trading, with its hot hands at the front of the bleeding industries, as the crypto market grinds out of life. Meme coins such as Dogecoin have been hit the worst as persistent macroeconomic uncertainty puts tremendous pressure on risk assets.

International tensions are driving selloffs on the back of global financial instability, including interest rate spikes, particularly as the latter intensify. The latest round of aggressive tariffs and retaliatory measures by U.S. President Donald Trump and China in the latest chapter of the battle between the United States and the world’s second-largest economy have exacerbated fears of a full-scale trade war. In a move driven by investors warily circling speculative assets, DOGE is taking a beating in bearish territory and pushing further and further into uncertainty in global markets.

The grim outlook is worsened by top analyst Ali Martinez, who shared on Sentiment data from Santiment, that whales have sold more than 1.32 billion Dogecoin in the last 48 hours. This represents a clear sign of the ‘risk off’ sentiment that is now running the market. Martinez believes it’s a case of panic and increasing expectations of an even longer bear market.

If the current market sentiment is negative and there is no stability in the macroeconomic situation, Dogecoin’s future tends to remain uncertain. Heavy whale selling, the marketwide fear, and the simultaneous global economic strain send mixed signals such that DOGE can see strong pressures in the short term. While bulls will have to quickly reclaim key price levels to pull any signs of recovery for now, there is firm ground in bearish territory.

Bulls Struggle as Selling Pressure Continues

At $0.14, Dogecoin is trading 75% below its 200-day moving average of just over $0.25 and is a clear indicator of how far the coin has fallen. After DOGE dropped below support at $0.25, the downtrend picked up, and bulls have been unsuccessful at staging a decent recovery since. Macroeconomic stress continues with weak investor sentiment and this is only compounding the selling faster each week.

For Dogecoin to start any positive movements at this stage, holders must hold above the most critical $0.15 level. If that is the case, this price zone could be used as a short-term support base for the bulls to regroup. Nevertheless, this won’t be enough to simply stabilize at that level. To regain momentum and break the prevailing bearish trend, there is a need to move to the $0.20 mark. Bringing DOGE back to its 200 day MA would also bring the dogecoin closer to the $0.20 threshold that would enable the reclaim of it; this is an important technical milestone that could kickstart a trend reversal.

A failure for Dogecoin to hold the $0.14 – $0.15 support range suggests more losses from the crypto. If this level is broken, this could mean a rapid slide down to the $0.10 buoy, signaling a return to the lowest levels during the bear market. At the moment, DOGE is still under heavy selling pressure and sellers have the upper hand, and the time is limited before a breakdown.