- The crypto market suffered an 18.6% drop in Q1 2025, losing $633.5 billion after peaking at $3.8 trillion.

- Bitcoin hit $108,786 in January but fell over 12% to $76,329 by March, increasing its dominance to 59%.

- Altcoins declined, with Ethereum’s market share falling to 7.9%, while stablecoins like Tether gained investor confidence.

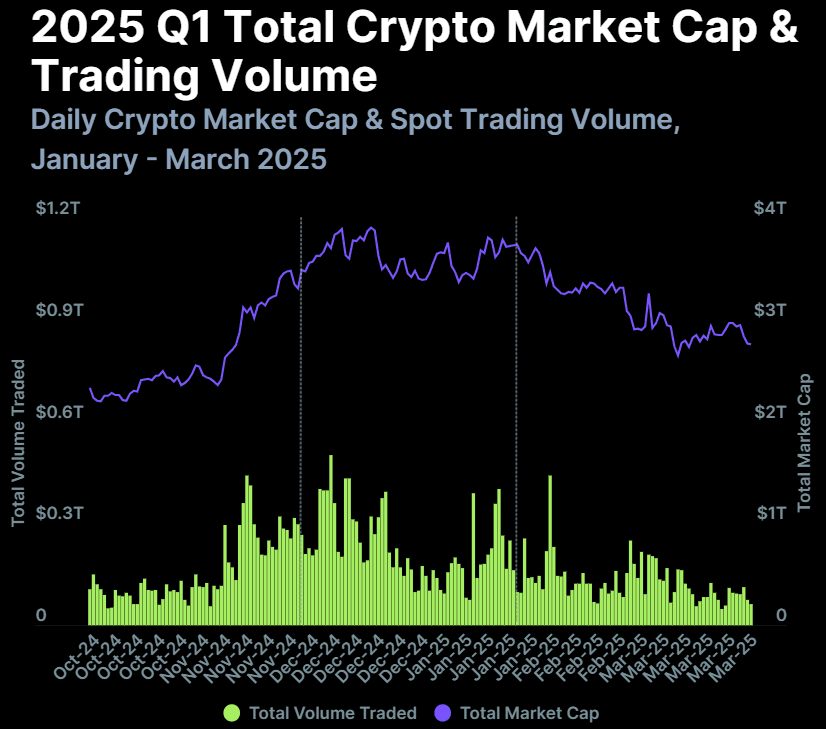

The start of 2025 hasn’t been in favor of broader crypto market. CoinGecko’s recent industry report portrays the most difficult situation: the crypto market has lost as much as 18.6% in Q1 — a loss of a staggering $633.5 billion. That massive downtrend comes after the market reached a peak of $3.8 trillion on January 18. At the end of March, it was only $2.8 trillion left.

This massive wipeout didn’t just shrink portfolios—it scared off traders, too. Daily trading volumes fell hard, plunging over 27% compared to the previous quarter. It was a sharp drop in momentum that mirrored waning investor enthusiasm, as traditional safe-havens started looking better than risk assets.

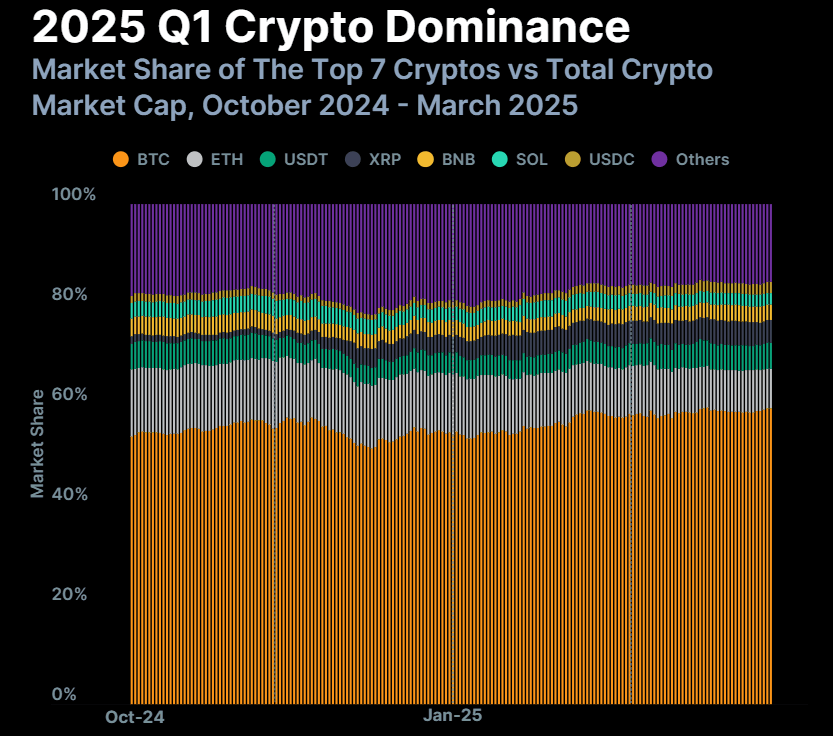

Meanwhile, Bitcoin got much hype early in the year. It soared to an all-time high of $108,786 on January 20, the same day of Donald Trump’s inauguration. But the glory didn’t last. By the end of the quarter, Bitcoin had slid over 12%, landing at $76,329. Still, its dominance grew, reaching 59%—a level not seen since Q1 2021.

BTC Holds Ground While Others Fall Further

Zhong Yang Chan, Head of Research at CoinGecko, pointed out in an interview with FXStreet.

“compared to other risk-on assets, we have actually seen Bitcoin weather the recent uncertainty pretty well, though altcoins have suffered badly in general. This is reflected in its dominance over the rest of the crypto market.”

That dominance increased 4.6% over the quarter, highlighting Bitcoin’s relative strength amid chaos. Altcoins, on the other hand, took a quieter nosedive. Ethereum fell by 3.9%, pushing its dominance down to 7.9%—a number not seen since 2019. Ripple (XRP) and Binance Coin (BNB) were among the few that kept their share. Overall, non-BTC altcoins lost 3.5%, making up 15.7% of the total market by the quarter’s end.

Stablecoins gained quiet strength in the background. Tether (USDT) edged up to a 5.2% market share, showing investors’ shift toward less volatile assets. Meanwhile, USDC climbed back into seventh place, booting Dogecoin from its spot.

Bitcoin’s Test of Resilience—Can It Defy Economic Chaos?

Chan also noted that “the crypto market… is not immune to broader macroeconomic trends.”

He added:

“If Bitcoin is able to continue to remain resilient through this period, it will be on very firm footing for the rebound that will eventually come.”

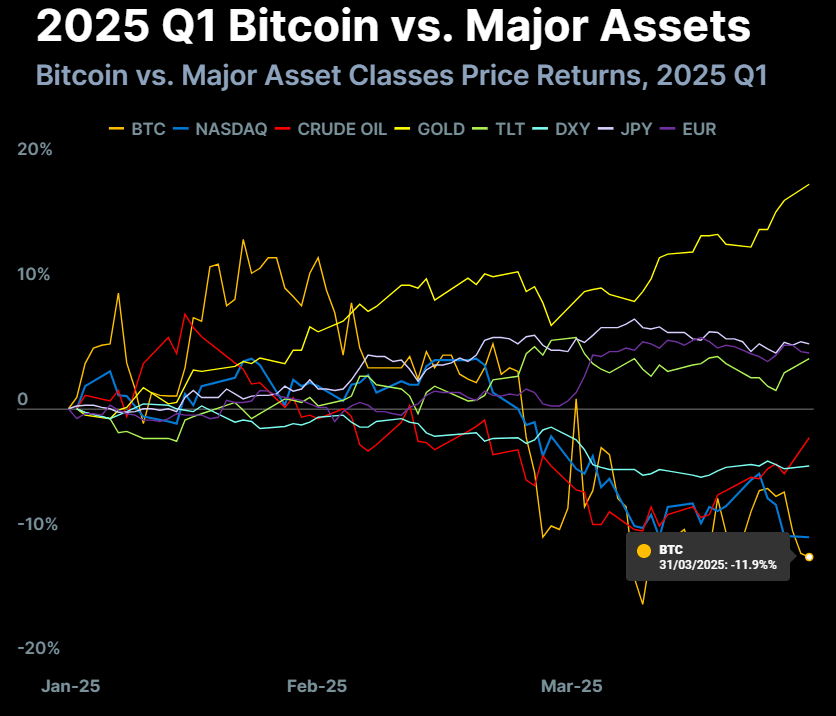

Much of the quarter’s financial turbulence had roots in wider concerns. Uncertainty surrounding US tariffs, looming Federal Reserve rate cuts, and geopolitical tensions pushed investors toward safer bets. Gold surged 18% in Q1, re-establishing itself as a fortress during stormy times.

Traditional stock markets weren’t spared either. The NASDAQ dropped 10.3%, while the S&P 500 slid 4.4%. Meanwhile, the dollar’s performance lagged, with the DXY index falling 4.6%. The yen and euro picked up the slack, climbing 5.2% and 4.5% against the dollar, respectively. The yen’s bounce was helped by the Bank of Japan’s January rate hike.