- Crypto market capital inflow dropped by 70% in 14 days, indicating weakening investor confidence and reduced new investments.

- Bitcoin and Ethereum saw withdrawals surpassing $757 million, while stablecoin net position shrank from $6.15 billion to $3.13 billion.

- Gold ETFs attracted a record $8 billion weekly inflow as investors shifted focus from struggling digital assets to traditional safety.

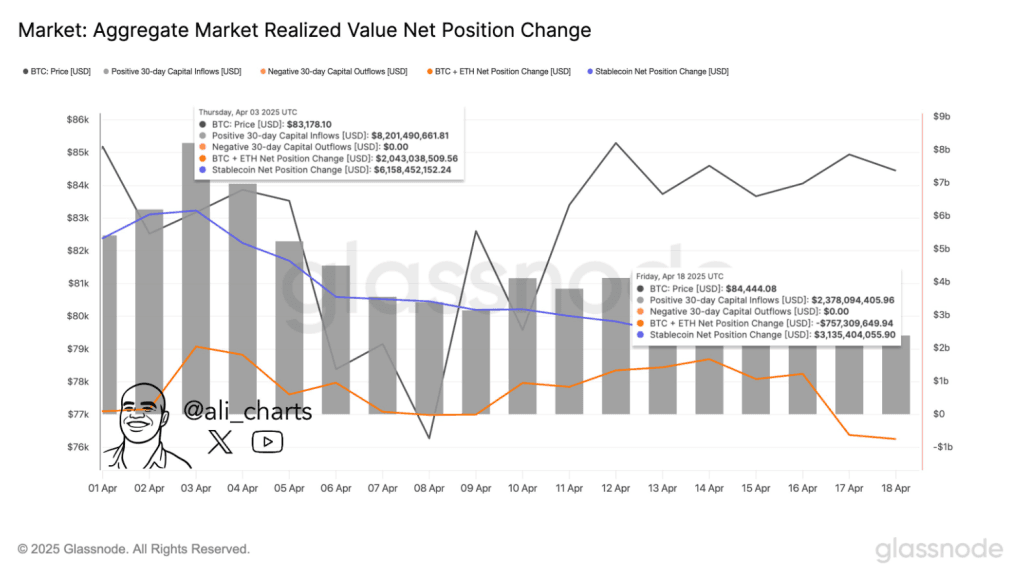

The capital inflow into the crypto market has drastically reduced and is down by 70% in the previous 14 days, according to the data by crypto analyst Ali Martinez. On April 3rd, 2025, the crypto market reflected the inflow of $8.20 billion in a 30-day inflow capital period, but the figure has now shrunk to $2.38 billion as of April 18th.

Although the price of Bitcoin had seen a small jump to $84,444 from $83,178 during the same interval, the general flow of capital indicated the investors fading confidence and a fall-off in the arrival of new money into the market. With the Bitcoin and Ethereum combined net negative position of the funds, the withdrawal amounted to more than $757 million.

Stablecoin net position changes have also seen a major contraction—from over $6.15 billion to $3.13 billion—indicating reduced stablecoin inflows, which often act as a precursor to major crypto buys. The chart reflects a cooling sentiment in the market, despite relatively stable BTC pricing.

Crypto Market Crashed or Corrected in Q1 2025?

The first quarter of 2025 should have been a home run for digital assets. A pro-crypto president stepped into office, major SEC lawsuits cooled off, and clearer policies for Bitcoin and stablecoins began to take shape. The industry, long stifled by the Biden administration’s clampdown, finally looked poised for liftoff. But reality stepped in with a different outcome.

According to Bitwise’s April 16 report, things didn’t play out as hoped. “The best worst quarter in crypto’s history,” said Matt Hougan, CIO at the firm. He wasn’t being dramatic. Crypto equities fell 27%, Bitcoin fell 17% Ethereum plunged 45%, large-cap assets slid 18%, and altcoin market market crashed 30%. Altogether, the market’s value was cut by $650 billion, erasing months of growing optimism.

Then came April. From its January high of $3.9 trillion, total market cap is now down 30%. The correction, or crash, depending on one’s position, has left many wondering what went wrong. Some believe the rally ran too far, too fast. Others think it never got started in the first place.

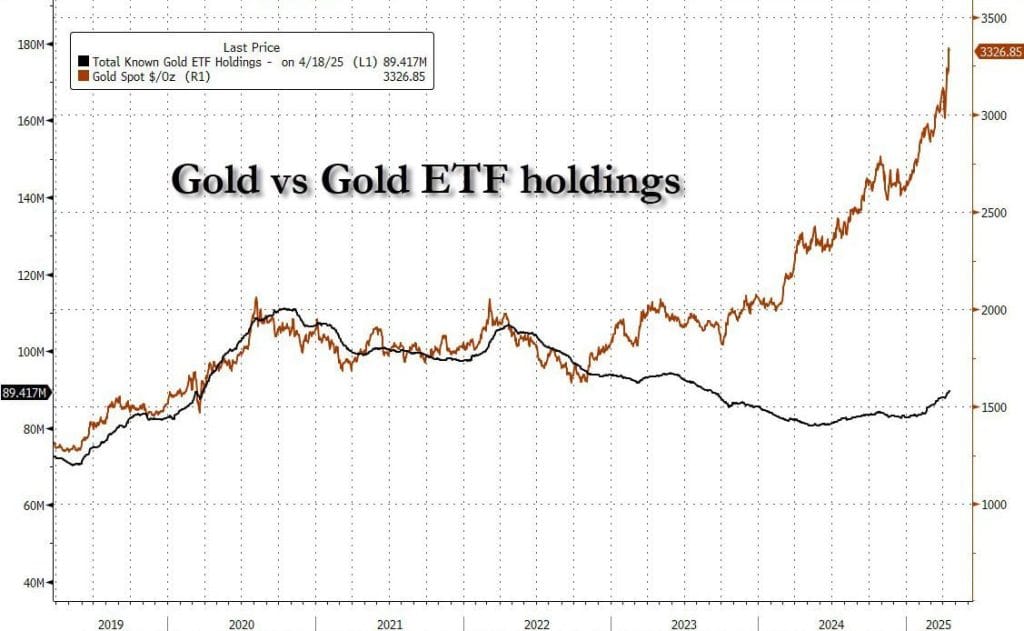

$8 Billion Pours into Gold ETFs—Largest Ever Weekly Flow

Amid this retreat, one thing surged—gold. As digital assets stumbled, gold became the investor’s favorite fallback. On April 20, 2025, Gold ETFs drew in an astonishing $8 billion in just one week. Cas Abbé called it on Twitter: “This monumental influx marks the largest weekly inflow ever for Gold ETFs.” That alone turned heads, with some traders now asking if gold is hitting a peak or just getting warmed up.

The timing is hard to ignore. Gold’s shine returned just as crypto struggled to regain its footing, reinforcing the old idea that when volatility spikes, investors reach for what they know. While crypto may be called “digital gold,” the real metal seems to be winning the safety race for now.

But not all signals are red. Institutional trading volumes in regulated Bitcoin futures hit new highs recently. Even in chaos, money moves—just differently. Stablecoin supply also touched a record $218 billion in circulation. And the real-world asset space saw tokenized investments climb 37% last quarter. These aren’t small numbers, and they hint at potential resilience.