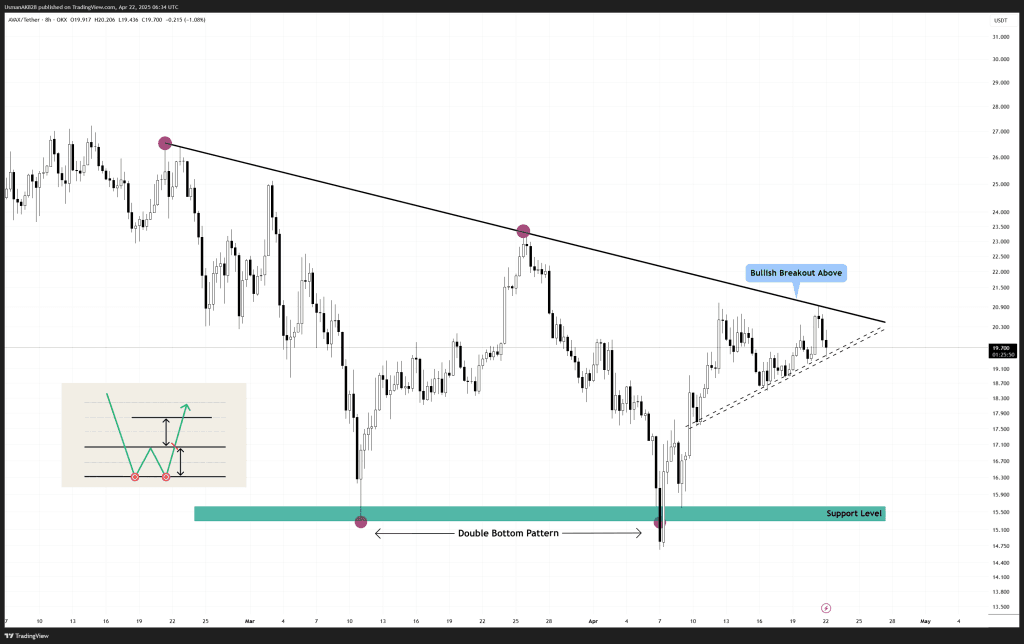

AVAX Technical Analysis: 22 APR 2025

AVAX is slightly facing rejection from the trendline resistance. Source: TradingView

General View

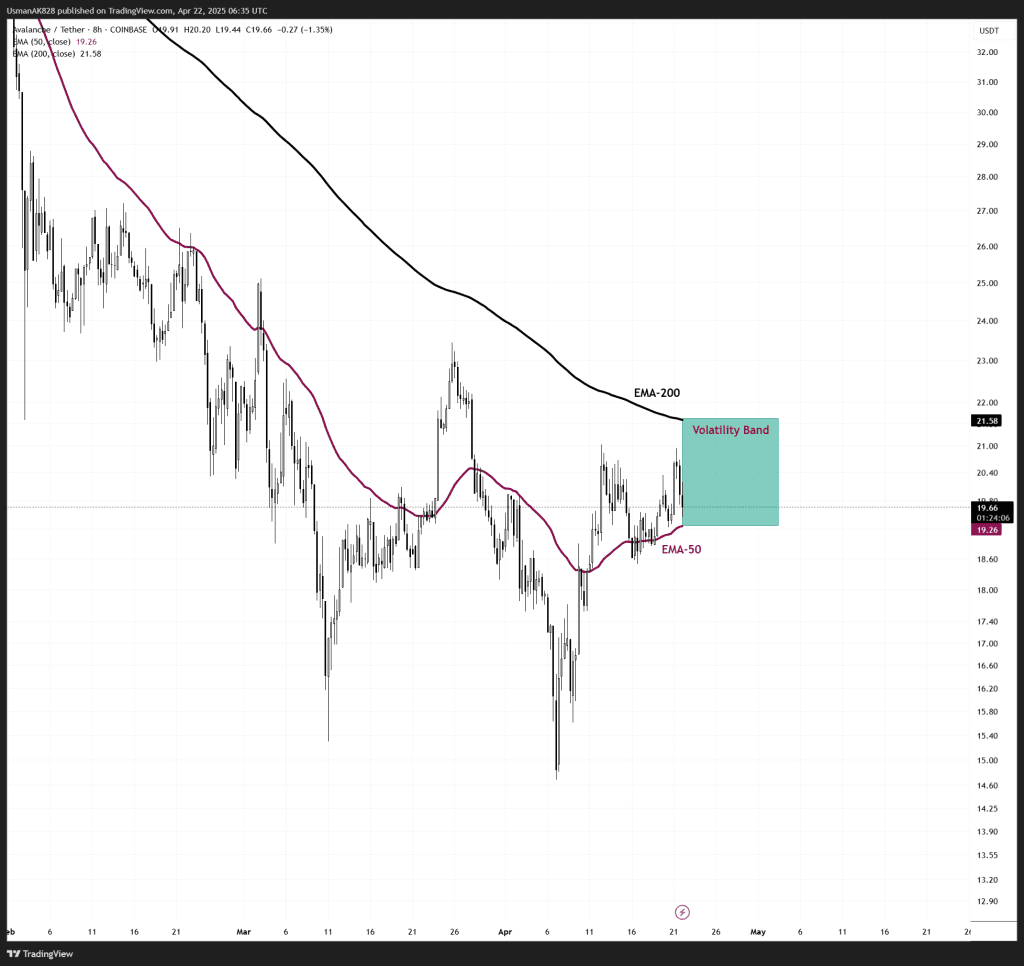

The recovery has brought AVAX back into a familiar congestion area, right beneath the descending trendline resistance. This ongoing compression between this descending trendline and the rising trending support is creating a potential ascending triangle pattern. However, for the short term, AVAX is expected to remain volatile as price struggles between EMA-50 and EMA-200 for a clear direction..

On The Upside

The trendline resistance and the potential neckline level for the ascending triangle both converge at the same point of $20.70 to $20.90 levels. AVAX lately has been facing rejections off this resistance zone. If the upside is to expand towards $22.20 and $23.50 levels, a clean breakout above $20.90 remains essential.

On The Downside

Failure to break the descending trendline could invite short-term selling pressure, which could challenge the trendline supports at $19.35 to $19.15 levels. This is the primary supportive region that needs to be held, otherwise, the downside can stretch towards $18.70 once again.

EMA-50 and EMA-200 are creating a volatility band on AVAX. Source: TradingView