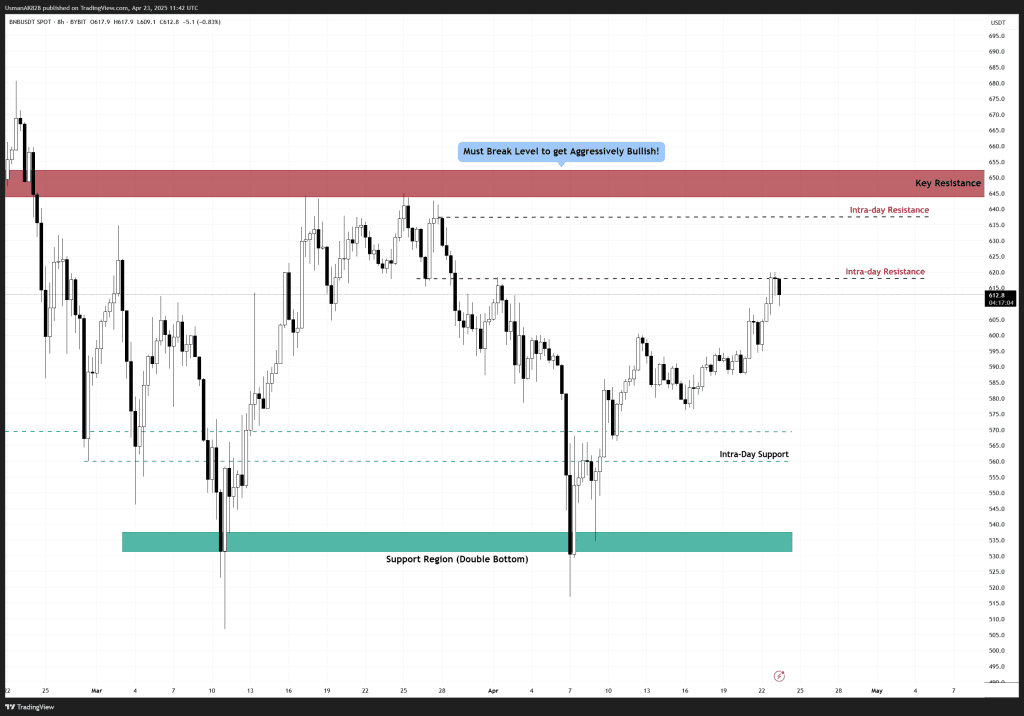

BNB Technical Analysis: 23 APR 2025

BNB is feeling the heat at the $620 level of resistance. Source: TradingView

General View

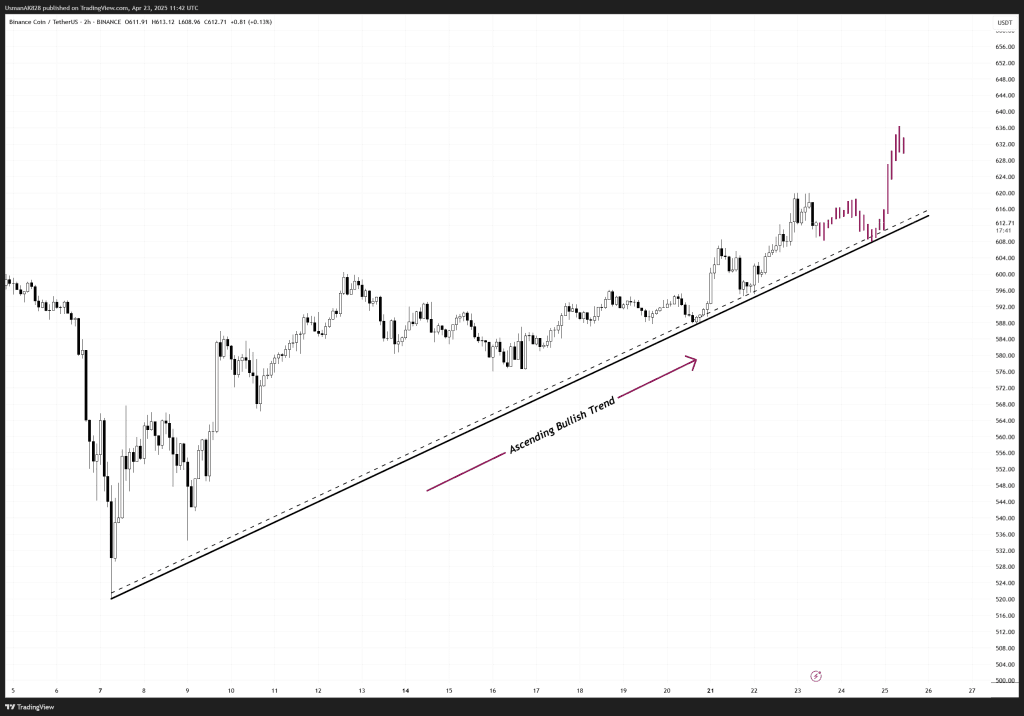

Price has rallied strongly in recent sessions, reclaiming key intra-day levels and pushing back into the main congestion zone seen in March. Bulls are once again testing the upper resistance range near $620 and showing good momentum. If buyers can maintain control and sustain pressure above immediate resistance, a broader rally towards the key resistance is likely. Meanwhile, in the short term, BNB is in a general ascending trend, getting support from the trendline levels.

On The Upside

Immediate resistance is seen at $620, marked by intra-day resistance. Since 28th March, BNB has failed to exceed this level, and today as well, the first test has resulted in a rejection. A strong breakout above this level is essential to extend BNB’s upside toward the $645 to $655 key resistance band.

On The Downside

If BNB fails to force a breakout above $620, short-term pullbacks may emerge. Initial support now lies at the $600 level. Ideally, bulls should hold this to maintain their dominance. If this support level breaks, BNB can dip towards $580 before a fresh attempt higher.

Bullish ascending trend on BNB. Source: TradingView