- The last week alone has seen Chainlink surge by over 20%, which has reduced its YTD losses to around 26%.

- Part of LINK’s success as of late can be credited to a major shift across the general crypto market.

- Platforms like IntoTheBlock and CryptoQuant show a 120 million outflow of LINK from exchanges over the last few days.

Chainlink is making headlines once again, after months of price stagnation and bearish sentiment. As it stands, the cryptocurrency has joined the rest of the market in the recent bullish wave and has staged a powerful comeback. Technical indicators are now flashing bullish signals, and accumulation trends are getting stronger. Here’s why top analysts believe that Chainlink has some strong upside potential.

A Strong Weekly Performance

The last week alone has seen Chainlink surge by over 20%. This surge in its price has reduced its YTD losses to around 26%, making Chainlink one of the most resilient cryptocurrencies this year.

This rally has been fueled mostly by a mix of bullish sentiment within the market, as well as major technical signals that show the tide is turning in favor of the bulls. Over the past day, Chainlink has been up by about 14% and is trading near the $15 price level at press time.

This fresh wave of momentum adds a major recovery from earlier lows and has brought Chainlink back into the spotlight among traders and analysts.

Market Sentiment Is Shifting

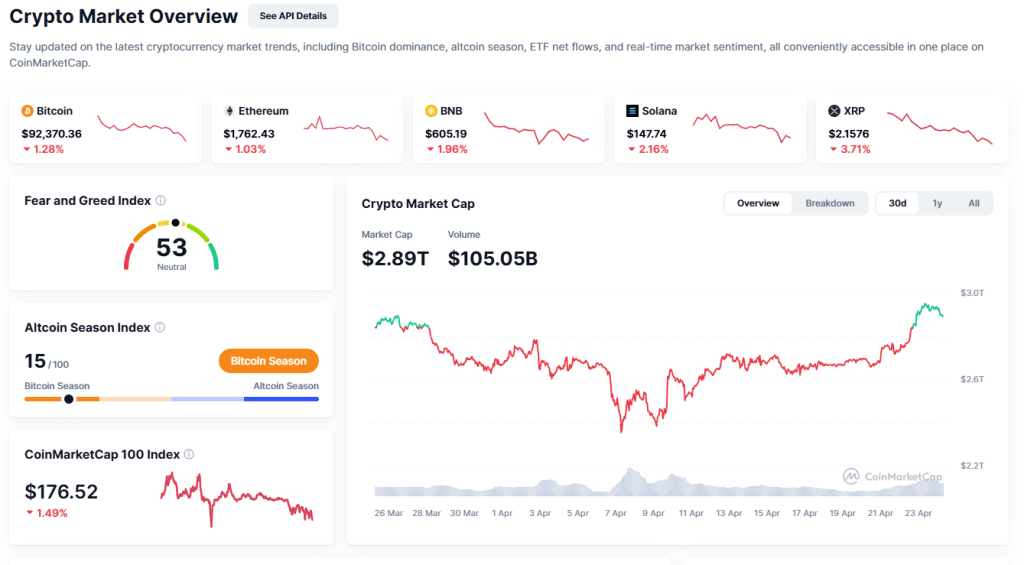

Part of LINK’s success as of late can be credited to a major shift across the general crypto market. As of this week, the Fear and Greed index has improved greatly, from a strong fear reading of 15 in the first week of April to a neutral 53 today. This means that market participants are becoming more confident that Bitcoin and the rest of the market are gaining health

Some of this recovery has been linked to macroeconomic news, especially with U.S. President Donald Trump’s decision to scale back plans for heavy tariffs on imports. All of this has calmed investor nerves and is creating more a more stable environment for crypto to thrive.

$16 is the Breakout Level

According to analytics platforms like IntoTheBlock and CryptoQuant, there has been a noticeable increase in LINK outflows from centralized exchanges, with over $120 million trickling out of these platforms in the last month. Another major sign is the activity among whales, where addresses holding large amounts of LINK have hit netflows of 3.81 million tokens (a two-month high).

This indicates that large players are entering the market and are doing so with more conviction. Chainlink’s fundamentals are also on the rise, with the number of active addresses on the network jumping from a mere 2,300 to 3,600 in the last four days alone.

Analysts have turned bullish as well, with renowned crypto specialist Michael van de Poppe noting in a recent X post that utility and DeFi coins are likely to perform well in this cycle. Moreso, Chainlink has been working on partnerships in the US and is likely to join the incoming bullish wave. The expert went further to attach a chart of LINK against BTC, indicating that Chainlink is one breakout away from outperforming the flagship crypto.

The daily charts show that the $16 price level is an important resistance point. If LINK can clear this barrier, a wide, low-volume zone sits between this breakout point and the $21 zone, where the bears will likely be waiting.