- Bitcoin surged past $91,500, sparking renewed interest in altcoins as analysts spot a potential triple bottom pattern in their market cap.

- Growing stablecoin liquidity, including a 27% rise in Tether and an 80% jump in USDC, suggests increased capital inflow for an altcoin rally.

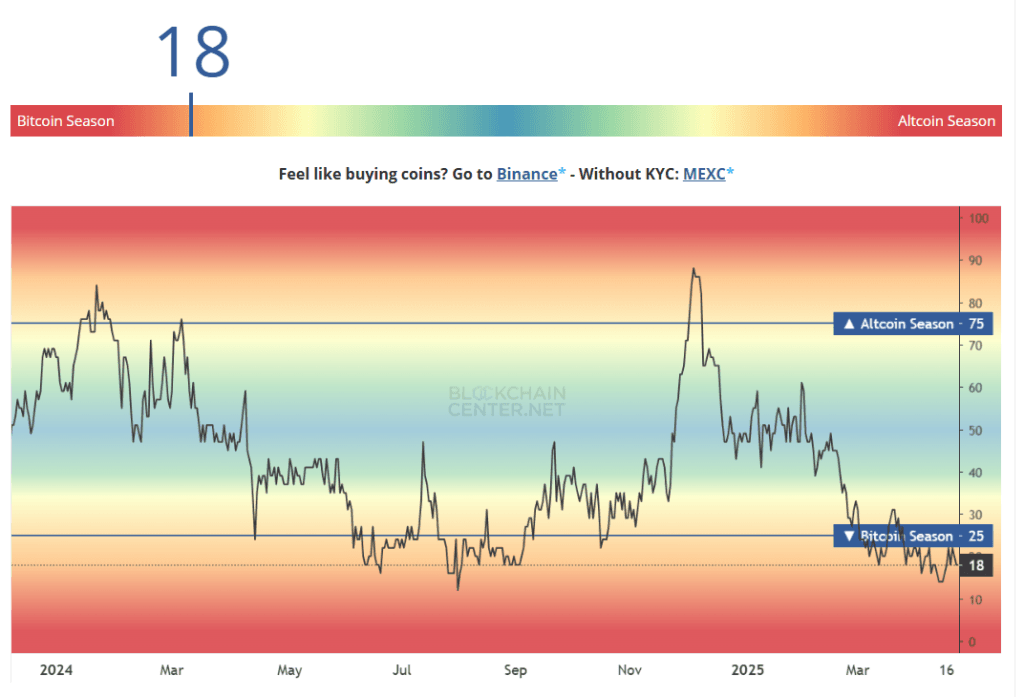

- Despite the Altcoin Season Index sitting at a low 18, historical trends indicate such levels often precede strong altcoin runs.

On April 22, Bitcoin reclaimed the $91,500 mark, which is the highest point since March 25. The leading cryptocurrency set the tone for the broader crypto market along with altcoins too. There is much hope for the possible altcoin rally as the indicators start to tilt to altcoins. Specifically, a possible triple bottom pattern is forming in the altcoin market cap, which remains a positive sign for the market.

Miles Deutscher, a recognized market analyst, recently highlighted this exact pattern, sparking fresh interest across crypto circles. His post pointed to two key signals suggesting altcoins may be ready to rebound. His first observation — a growing divergence between Bitcoin and U.S. equities — stood out. While the S&P 500 has slipped amid ongoing macro uncertainty, Bitcoin gained over 3% in a single day and continues to climb.

Gold also entered the conversation, jumping to a new all-time high of $3,500 before settling at $3,455. Similar patterns have pushed bitcoin prices on the historic frames. As these two assets realign, some investors see it as a renewed case for Bitcoin as a store of value — a narrative that frequently lays the groundwork for wider altcoin momentum.

Tether Grows 27%, Altcoin Hopes Rise with Liquidity Spike

A closer look at market fundamentals adds more pieces to the puzzle. Stablecoins, often considered a liquidity barometer in crypto, have seen notable expansion over the past eight months. USD Coin (USDC) has posted a stunning 80% increase in market cap along with Tether’s (USDT) surge of 27%. That capital inflow suggests investors are still actively moving money into the ecosystem, even with broader tensions in trade policy.

Deutscher’s second point — the triple bottom on the altcoin market cap — is a pattern that suggests strong support at current levels. A triple bottom is generally taken as a bullish signal, and in the case of crypto, it has previously preceded larger rallies across a range of coins. If the trend remains firm for this time, then the investors rush means a huge crypto inflow.

Also catching attention is the performance of U.S.-based spot Bitcoin exchange-traded funds. These ETFs just recorded their highest daily inflows in three months, likely fueled by political developments. Trump’s renewed threats to remove Federal Reserve Chair Jerome Powell have added to the “risk-on” atmosphere, pushing more attention toward BTC and, by extension, altcoins.

Altseason Index Sits at 18, But Calm Could Precede the Storm

Not every analyst is in favor of a possible bull run. Matrixport has pointed out that Ethereum’s weakening dominance and the Federal Reserve’s reluctance to shift into a more dovish stance are still acting as drag factors. Without broader altcoin participation or easier monetary policy, the breakout may take more time.

But charts from The Moon Show’s X account have shown a compelling pattern. April 2025 marks what could be a significant moment. Their shared chart suggests the Altcoin Season Index is hovering around ‘historical lows.’ That metric, now sitting at 18, is well below the 75 level typically associated with full-blown altseason. Yet historically, such low levels often preceded some of the strongest altcoin runs.

Altcoins may not explode overnight, but the signs of a potential turnaround are becoming harder to ignore. From capital inflows to historical chart patterns, the elements are quietly aligning. Whether or not April becomes the launchpad, the market appears to be in a pivotal phase that could shape the months ahead.