- ARK Invest sees BTC reaching $2.4M by 2030, driven by a 6.5% penetration of the $200T global financial market.

- Institutional adoption and BTC’s role as “digital gold” are key to its rising appeal as a store of value.

- DeFi expansion, corporate treasuries, and inflation hedging help support ARK’s bullish Bitcoin forecast.

In its latest Bitcoin review, ARK Invest has ramped up the coin’s price prediction from $1.5 million to $2.4 million by the end of 2030, citing factors such as supply dynamics and market potential. The asset management firm also pointed to the growing adoption trend among institutional investors as another key factor in the recent bull forecast.

ARK Invest Ups Bitcoin 2030, Cites Institutional Adoption and “Digital Gold” Status

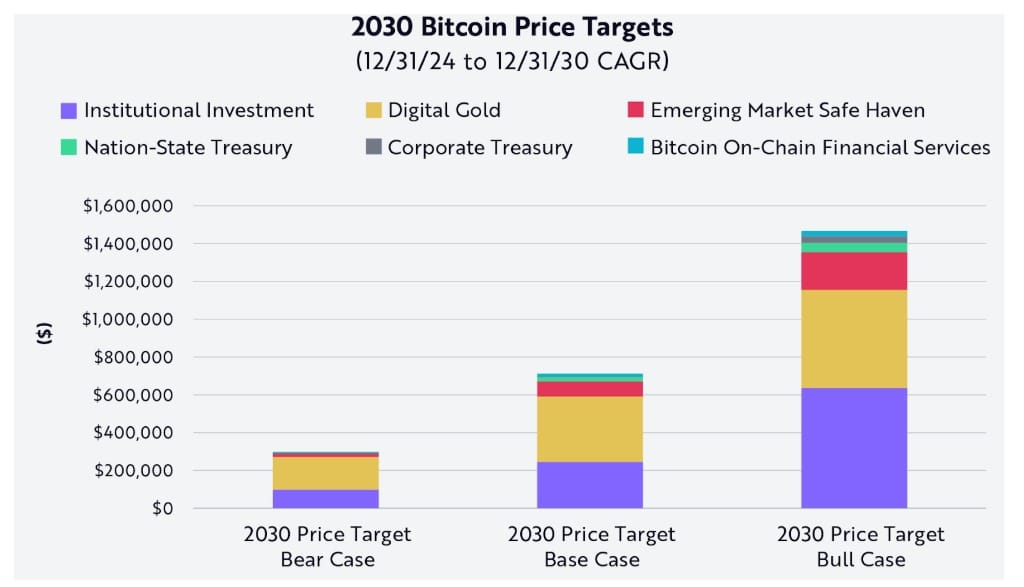

ARK reassessed its BTC bear and base valuations, which it previously pegged at $300,000 and $700,000, each. In its April 24 report, revised Bitcoin bear and base forecasts stand at $300,000 and $710,000, each. In addition, the firm upped its potential bull case price outcome from $1.5 million to $2.4 million.

ARK Invest analyst David Puell explained that the recent revision was premised on the growing rate of institutional adoption. He also highlighted the growing perception of Bitcoin as a store of value, with many in the financial sector dubbing it the “digital gold.”

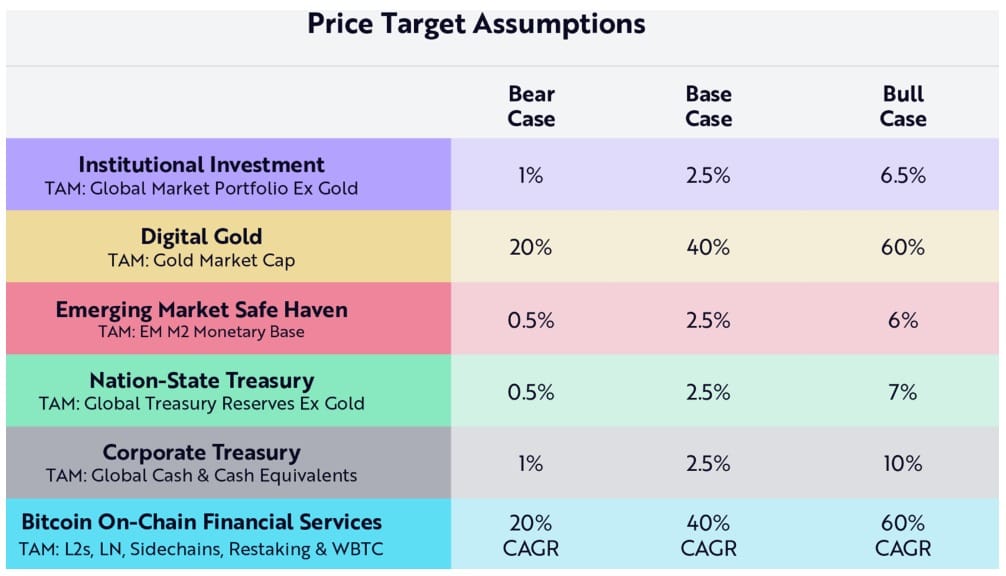

Per the publication, Bitcoin’s price forecasts were attributed to its total addressable markets (TAMs) and penetration rates. For clarity, TAM refers to the highest feasible revenue a company could generate from a product if it captured the entire customer base. Meanwhile, penetration rates measure the percentage of Bitcoin’s TAM that it can capture in certain cases.

Puell Predicts Bitcoin’s 2030 Potential Driven by Supply and Market Reach

Puell opined that the coin’s supply schedule, which is expected to reach 20.5 million units by 2030, could be a major determinant of its price outlook. However, he cautioned that BTC may fall short of the revised price prediction if it fails to reach the TAMs or achieve the desired penetration rates. Puell believes that the asset could penetrate the $200 trillion financial market at a best-case rate of 6.5%. However, he did not factor in gold into the projection.

The report noted that Bitcoin’s view as “digital gold” further adds to its high price estimates. Thus, Puell believes that the coin could hit 60% of gold’s $18 trillion market cap by the end of 2030 if the bulls prevail. BTC asset becoming a “safe haven” in emerging markets added 13.5% to its bull case forecast, according to Puell.

He stated:

This Bitcoin use case has the greatest potential for capital accrual.

Bitcoin’s Future Potential: ARK’s Bold Price Prediction and Key Drivers for Growth

Puell also identified Bitcoin’s hedge against inflation and devaluation, especially in developing economies, as a key driver of the prediction. ARK’s price prediction also took into account government and corporate Bitcoin treasury strategies, as well as financial use cases. Corporate firms like MicroStrategy and Metaplanet have taken center stage for their recent Bitcoin accumulation efforts.

Furthermore, Lightning Network recently disclosed plans to scale Bitcoin transaction capacity and develop a Wrapped BTC (WBTC) on Ethereum. This would ensure BTC’s increased utility in decentralized finance. Puell noted that Bitcoin’s increased use in the DeFi space could generate a baseline 40% CAGR within the next five years.

He added that success with the current corporate holding strategy could bump BTC to the bull case estimate of 10% at the conservative penetration assumption of 1% and 2.5% for the bear and base cases, respectively. The analyst added that the $2.4 million price target would skyrocket BTC’s virtual asset’s market cap to $49.2 trillion, assuming the coin reaches its 20.5 million supply schedule by 2030.