- Arthur Hayes links potential U.S. liquidity boost to a major Bitcoin rally, forecasting a $1M price target by 2028.

- Market confidence surges as Bitcoin nears $95K, fueled by institutional buying and a strong monthly performance.

- Hayes compares today’s climate to 2022’s turbulence, predicting a similar government response to economic instability.

Maelstrom CIO Arthur Hayes made an ambitious claim regarding Bitcoin’s price trajectory during a keynote speech delivered in Dubai. Hayes believes that the apex asset could reach $1 million by 2028, as investors view it as an inflation hedge.

Hayes Predicts Market Surge Amid Imminent U.S. Liquidity Boost

In a speech at the Token2049 summit, the Maelstrom CIO explained that the US will soon need to pump more cash into its economy to maintain stability. Hayes believes that this unavoidable liquidity boost, which is similar to quantitative easing, could trigger a surge in both traditional and cryptocurrency markets.

He added:

It’s time to go long everything.

Hayes highlighted similar steps taken by the US government to address economic challenges. The CIO noted that such administrative responses have historically led to bullish markets.

The co-founder also discussed a similar occurrence during Q3 2022, which culminated in the FTX crash. During this period, $2 trillion worth of crypto assets were wiped out as investor confidence tanked. This loss of market belief was further amplified by the unstable interest rates at the time. Despite the market turmoil, the US administration injected $2.5 trillion into the economy via its repo program.

Hayes opined that the current economic atmosphere is in a similar situation. The Bitmex co-founder drew attention to the market tension caused by the ongoing regional trade battle, which pushed market prices to their lowest in years. However, investors reacted to the president’s 90-day tariff halt, as market prices witnessed a trend reversal.

Hayes acknowledged that the Federal Reserve Chair may adopt a contrary stance to some ongoing administrative policies. However, he does not expect it to affect what he believes to be an inevitable liquidity injection. He suggested that banks or hedge funds may buy up US Treasury bonds, which would indirectly pump liquidity into the market.

Bitcoin Nears $95K Amid Institutional Buying and Bullish Sentiment

Arthur Hayes has made similar bold predictions about Bitcoin’s price trend in the past. Following Bitcoin’s drop from the $100,000 mark, the CIO predicted that the asset would regain that level. Although the prediction has yet to be fulfilled, BTC has retested the $90,000 mark following an impressive performance in the past week.

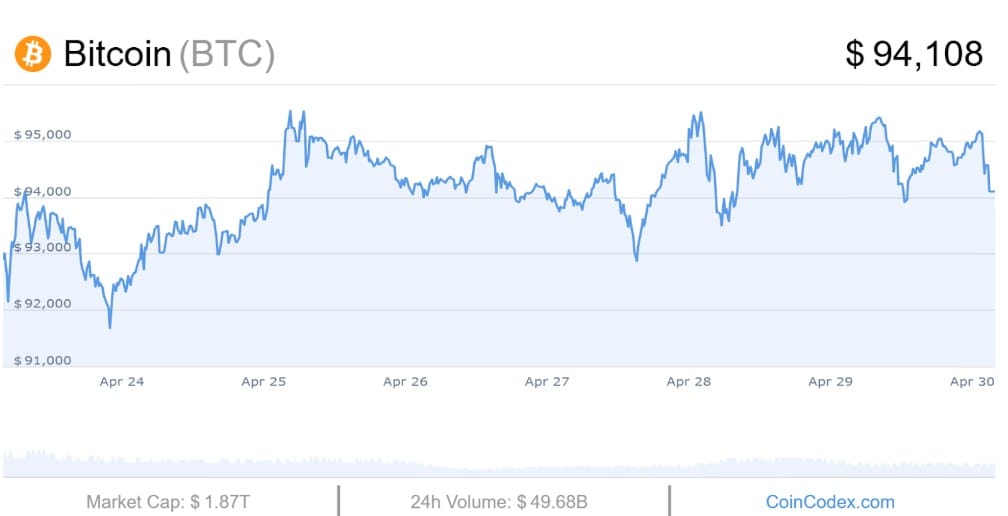

At present, Bitcoin is changing hands at $ 94,108 following a modest dip in the recent session. However, it has rallied 0.97% and nearly 14% in its weekly and monthly charts. The asset has recorded 18 green outings month-to-date, driven by the Greed score of 56, which suggests that buyers have stepped in at this level. Plus, the market sentiment remains bullish, indicating confidence in the coin’s future trend.

Bitcoin’s current surge is partly driven by the ongoing trend of aggressive accumulation by corporate firms and governments, as a hedge against inflation and devaluation. In the past month, top firms like Strategy and Metaplanet have actively bumped up their BTC stash.