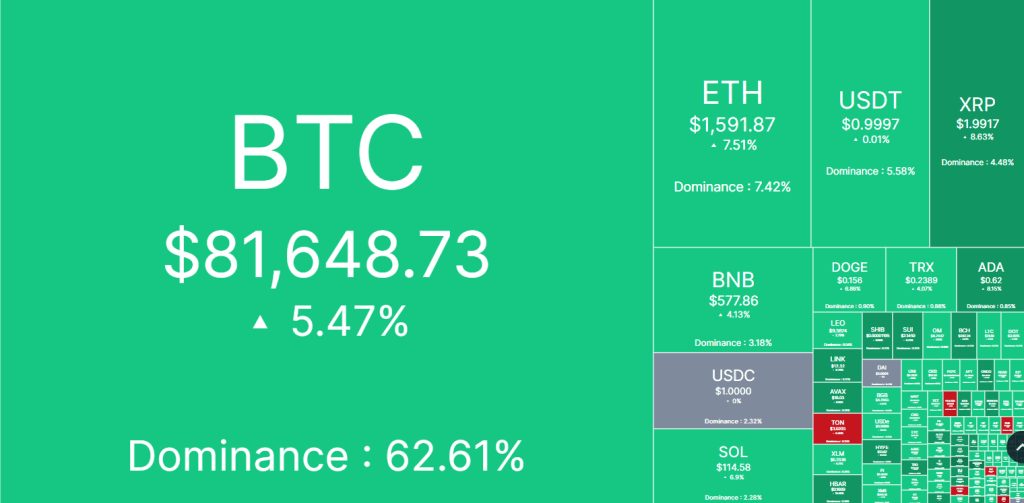

- So far, Bitcoin trades at around $81,650 amid green across the crypto market, as illustrated.

- Avalanche has turned out to be one of the only altcoins with double-digit gains on the daily timeframe.

- A break above $20.1 could lead to a retest of $30.66. However, a retest of $15.21 puts AVAX at risk of further decline.

The crypto market appears to be recovering once again, especially after the brutal dip earlier in the week. Bitcoin now trades above the $80,000 zone once again, after hitting a low of $74,620 on Binance.

The altcoin market has followed Bitcoin upwards once again and is trading in the green, according to data from CoinMarketCap. Amid these greens, certain altcoins are making waves, and Avalanche is leading the charge. What can investors expect from $AVAX, and what happens next if the psychological $20 level is broken?

The Crypto Market Recovers

So far, Bitcoin trades at around $81,650 amid green across the crypto market, as illustrated. Bitcoin itself is up by an impressive 5% over the last day, alongside a 7.5% increase that has brought Ethereum close to breaking above the $1,600 price level. Other major cryptocurrencies like XRP rallied by 8%, Solana and Cardano by 7% each, and Chainlink by 8%.

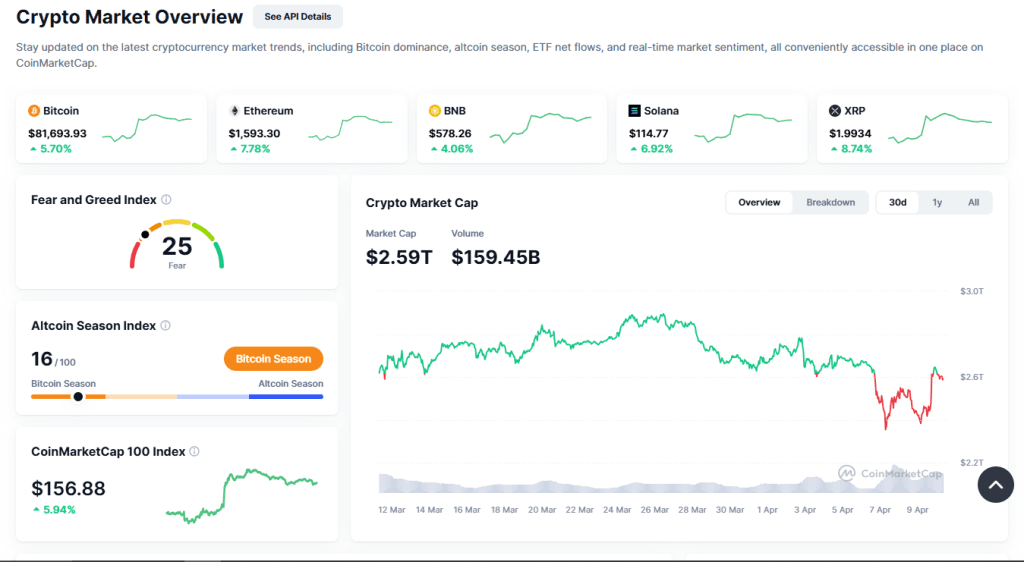

Interestingly, cryptocurrencies like Toncoin and Tezos’ have had relatively muted reactions to this recovery, with dips on the daily timeframe. Overall, the general crypto market has recovered by around 2%, with a market cap of around $2.59.

Still, amid this recovery, the fear and greed index’s reading still sits at an extreme fear level of around 16/100. This indicates that while the market has turned green, most investors are not convinced yet about how sustainable the rally might be in the medium to long term.

Avalanche Leads the Rally

Amid the ongoing recovery, Avalanche has turned out to be one of the only altcoins with double-digit gains on the daily timeframe. According to CoinMarketCap, the cryptocurrency rallied from a low around $15.98 to as high as $18.83 in a 15% move to the upside before settling once again around the $17.99 price level, where it now sits.

Avalanche’s trading volumes also surged within the same timeframe by 26% to an impressive $535 million, indicating a great deal of interest from investors. However, at the time of writing, Avalanche appears to be stalling just underneath the psychological $20 zone. Could a breakout from this price level be incoming, or is a reversal inbound?

Price Action on AVAX

According to the charts, Avalanche formed a death-cross between its 50 and 200-day Simple Moving Averages (SMAs) sometime in late February, when the general market decline first started. This bearish omen played a part in the cryptocurrency’s loss of the $31 price support, as illustrated.

The death-cross eventually led to a retest of the $15.21 price level, where Avalanche formed a double-bottom pattern as shown above. This indicates that the bulls are active around this price level and are ready to defend this zone.

However, Avalanche remains underneath its 50-day SMA (red line) around the $20.1 price level, which could be important for confirming the bulls’ conviction. This said, investors looking to get into the Avalanche market should consider waiting for a confirmation break-and-close above $20.1 with a daily candle.

If this break does not occur, AVAX will likely retest the $15.21 zone again, where the bulls and bears might battle again for dominance. To put all of the above into perspective, a break above $20.1 would be a buy signal and could lead to a retest of the 200-day SMA (blue line) around $30.66. However, a retest of $15.21 puts AVAX at risk of further decline if the bulls fail to step up.