- Avalon’s FBTC-backed stablecoin lending offers fixed interest rates and high-yield strategies with DeFi assets.

- Users can earn stable returns by depositing FBTC as collateral on the Avalon platform through Bybit Earn.

- Avalon secured a $2B credit line to scale its Bitcoin-backed lending services, boosting BTC utility.

Avalon Labs is set to expand its on-chain lending services on centralized exchanges by integrating with the crypto trading platform Bybit to launch a stable income product. Through this partnership, Bitcoin holders can earn interest on their crypto by leveraging Avalon’s fixed-rate arbitrage strategies and lending systems.

Avalon Boosts BTC Utility with FBTC Lending and $2B Credit Line

In a recent post, Avalon explained that the core asset for this new product is the FBTC, which is backed 1:1 by Bitcoin. It has $1.25B in total value locked (TVL) and is supported on networks like Mantle, Antalpha Prime, and more. As such, unlike traditional BTC, it can be used across Ethereum and other blockchains.

The CeDeFi lending platform also clarified how its yield engine works behind the scenes. First, users can deposit FBTC as collateral on the Avalon platform. In return, Avalon lends stablecoins like USDT against this collateral at fixed interest rates. Since stablecoins are pegged to the US dollar, they offer more stability and security.

After lending the USDT, Avalon then invests the coin in high-yield strategies using DeFi assets such as USDe and sUSDE, offered by Ethena Labs. The returns generated through this strategy are forwarded back to users through Bybit Earn.

Avalon stated:

Returns are stable, secure, and passed back to Bybit Earn users—making Bitcoin a productive asset while maintaining simplicity and risk control.

In the past year, Avalon has made notable strides in the field of BTC stablecoins and on-chain lending. Towards the end of last year, the platform secured $10 million in funding to advance its Bitcoin decentralized finance (DeFi) offerings. Ventures like UXTO Management, Kenetic Capital, and Presto Labs actively participated in the fundraising.

Last month, the CeDeFi platform raised a minimum $2 billion credit line to scale up its Bitcoin-backed lending. To date, this remains one of the largest institutional lines of credit in the crypto space.

Bitcoin Shows Strong Recovery Amid Positive Market Sentiment

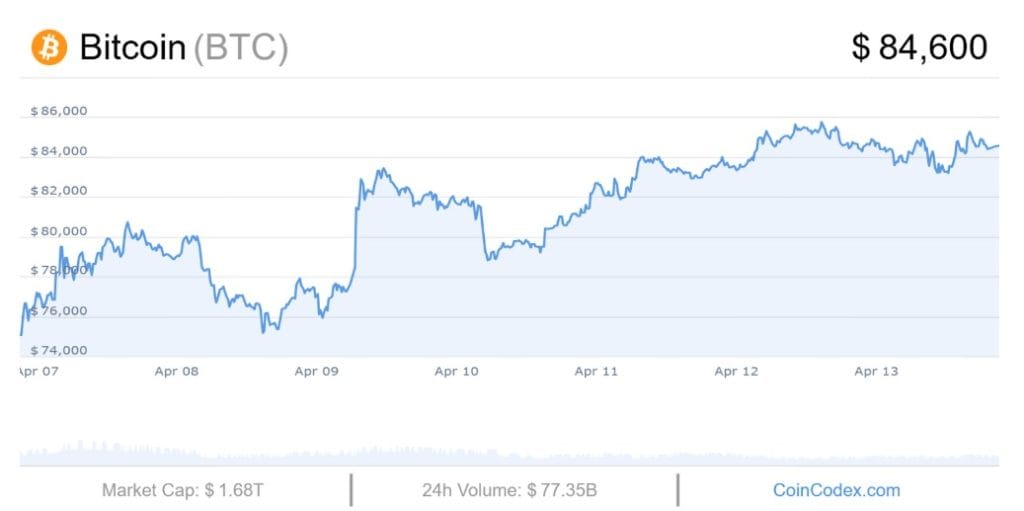

Bitcoin has bounced from its recent woes in the past month as the financial market reacts positively to President Trump’s import tax waiver on tech products. At the time of writing, Bitcoin changes hands at $84,600, indicating a 12.17% week-to-date rally. It has rallied by 31% in the past year, surpassing the performance of several crypto assets. In addition, BTC has seen 15 green outings in the past month and is positioned close to its cycle high.

Source: Coincodex

Despite the recent uptick, Coincodex’s technical indicators show that the current Bitcoin market outlook remains neutral. In tandem, the Fear and Greed score signifies that investors remain cautious, with the score pegged at 31.

However, experts forecast that Bitcoin’s price will exceed market expectations in 2025. For instance, Cardano Founder Charles Hoskinson predicts that BTC could hit $250k within the next twenty months. Analysts also suggest that the recent Avalon and Bybit Earn collaboration could strengthen BTC’s price trend by boosting its mainstream finance exposure.