- XRP has spent months sending mixed signals, confusing investors and straying further below its all-time high.

- Data from Glassnode shows that around 81.6% of XRP’s circulating supply remains in profit.

- The $1.90 and $2.10 zones could contain the price action of XRP, and a break above this range could set it on its way towards $2.20 before $2.57.

XRP has spent months sending mixed signals, confusing investors and straying further below its all-time high. However, the cryptocurrency is back in the spotlight once again, with technical indicators that show a possible incoming breakout.

80% of the cryptocurrency’s circulating supply is currently in profit, despite a surge in sell orders from South Korean exchanges. Could the token be gearing up for a move toward $2.50?

XRP Supply Mostly in Profit Despite Market Volatility

According to the charts, XRP hit a cycle peak of $3.40 on 16 January before joining the rest of the market in the brutal late-February decline. So far, XRP has declined by as much as 46% and is making its way back upwards from its 7 April low of $1.61. Despite this sharp correction, data from Glassnode shows that around 81.6% of XRP’s circulating supply remains in profit.

This figure is down from a year-to-date high of 92% but is still significantly high compared to other major cryptocurrencies. At present, only TRON stands higher than XRP in terms of profitability, with around 84% of its circulating tokens in the green. Trailing behind these two are Bitcoin, Ether and Solana, with 76.8%, 44.9% and 31.6% declines, respectively.

These numbers show that a majority of XRP holders are now sitting on gains. While this seems positive, it does raise questions about possible profit-taking behaviour from these investors if the market becomes uncertain once again.

Korean Traders Turn Bearish on XRP

Amid this cloud that hangs over XRP, one of the biggest shifts in sentiment is coming from South Korea. This country is known for its high retail activity and how it influences the momentum of altcoins.

Recent data shows that Korean traders were quick to scoop up XRP when it first dipped below the $2 zone on 3 February. There was some heavy buying activity on platforms like Upbit and Bybit, which helped push the price back to $2.89 by mid-February.

However, the tables appear to have turned because between 6 and 7 April, these Korean investors executed around 1.4 million XRP/KRW trades. More importantly, 62% of these orders were on the sell-side with a net sale of $120 million worth of XRP within two days. This uptick in selling coincides with the waning retail confidence in the cryptocurrency, with whales reportedly offloading positions.

Could a Rally Towards $2.5 Be in the Works?

According to the charts, XRP sits at a peculiar position and could be on its way towards new highs soon. This is despite the selling from Korea and the possible profit-taking from large-scale investors.

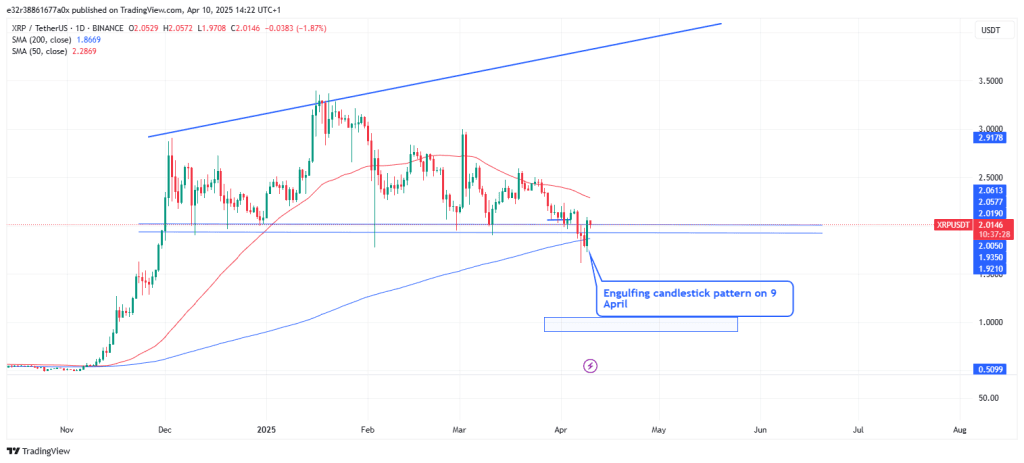

To start with, the cryptocurrency recently formed a bullish engulfing candlestick pattern on the daily chart. This indicates that the $1.61 price level is a possible local bottom, and a rebound could be in the works.

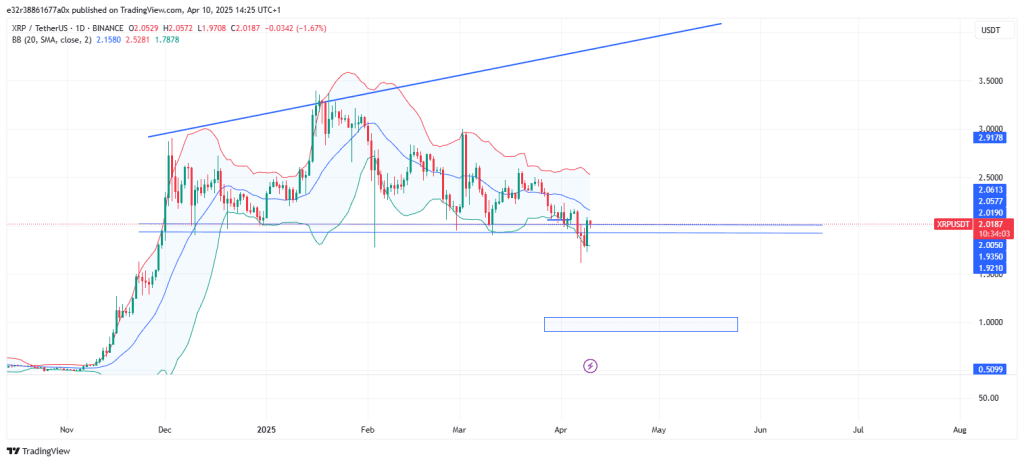

The formation in question also appeared on most other major cryptocurrencies like Bitcoin and Ethereum, indicating that the $1.90 and $2.10 zones could contain the price action of XRP going forward. As such, if XRP breaks above this range convincingly, the cryptocurrency could be on its way towards $2.20, before $2.57, where the upper resistance of its Bollinger Bands sits.

According to data from CoinMarketCap, volume is rising once again, especially with the engulfing pattern on 9 April. While this return of volume has not been explosive, it does lend some hope to the bulls for a rally towards this $2.57 price level.