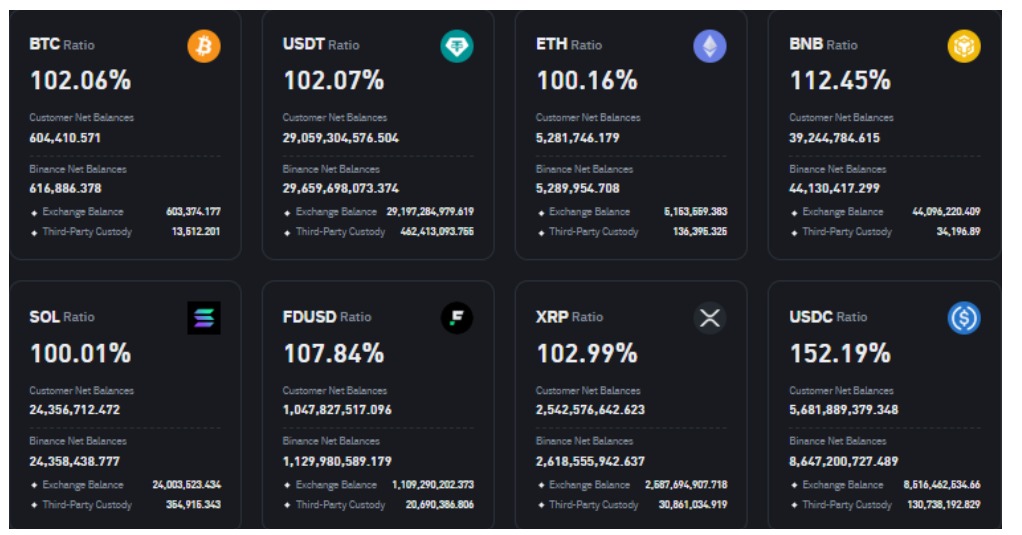

- Binance holds 102.06% of BTC and 112.45% of BNB, reflecting strong asset backing in its May Proof of Reserves report.

- Ethereum, Solana, and XRP all show reserve ratios above 100%, indicating full coverage of user balances.

- USDC leads stablecoin reserves with a backing of 152.19%, followed by FDUSD at 107.84% and USDT at 102.07%.

Binance, the apex crypto platform by trading volume, posted its updated proof of reserves (PoR) report for the month of May. The report reveals the total assets in custody currently backed by the exchange and shows the ratio to which these tokens are backed by the platform.

PoR Report Reveals Strong Backing for Major Crypto Assets

Per a May 8 report, Binance revealed insights into its backed reserve for 37 digital assets. The published data shows that the major tokens, such as Bitcoin, USDT, and SOL, are over 100% backed by the platform, suggesting strong financial health and backing.

As per the disclosure, the platform’s largest crypto holdings are BNB, Bitcoin (BTC), Solana (SOL), Ethereum (ETH), and Ripple (XRP). At present, Binance’s Bitcoin holding stands at 616,886.378 BTC, 102.06% more than the 604,886.378 BTC held by its customers. To add more context, for every 1 BTC a customer owns, the exchange holds 1.0206 BTC.

At the same time, the firm’s ETH, SOL, and XRP reserves are well backed above the 1:1 ratio. Binance’s user-held Solana stands at 24.356 million SOL, while the exchange’s reserve is pegged at 24.356 million SOL, meaning the reserve ratio is 100.01%. Its XRP reserve also crossed the 1:1 ratio by 2.99%, which equates to an 80 million XRP surplus.

Binance-held ETH also exceeded the 100% mark by 0.16%; the platform held 5.29 million ETH, compared to users’ holdings of about 5.28 million ETH. Ethereum is fully backed but has a much smaller buffer than Bitcoin or Tether. Meanwhile, Binance’s native coin, BNB, maintains a 112.45% reserve ratio. Users hold around 39.24 million BNB, while Binance holds over 44.13 million. Since BNB is Binance’s own token, it’s not surprising that they keep a large amount in reserve.

Stablecoin Reserves Strongly Outpace User Balances

The exchange also holds significant stablecoins, like USDT, FDUSD (First Digital USD), and USD Coin (USDC). Binance’s USDT stash stands at 29.66 billion, compared to the just over 29 billion USDT held by customers. Hence, the company’s reserve ratio of 102.07% is more than enough Tether to cover all user balances.

First Digital USD and USD Coin are also fully backed by Binance. In the case of First Digital, Binance holds about 1.13 billion FUSD, which is 90 million more than the 1.04 billion FUSD held by users. Thus, this brings the reserve ratio to 107.84%.

USDC remains the most over-backed stablecoin on the list. Customers have about 5.68 billion USDC, but Binance holds over 8.64 billion. The reserve ratio is 152.19%, showing that Binance is extremely well-prepared to cover USDC balances. Based on current market prices, the combined value of Binance’s holdings across the eight listed assets is approximately $124.87 billion. According to insights by CoinMarketCap, the company’s total user assets reportedly stand at $140 billion.