- U.S. spot Bitcoin and Ethereum ETFs continue their downtrend, recording significant outflows on April 3 amid market turmoil.

- Bitcoin ETFs saw $99.86M in outflows, with Grayscale’s GBTC and Bitwise BITB leading the losses.

- Ethereum ETFs posted $3.59M in outflows, following Trump’s tariff announcements and a broader market decline.

U.S. spot Ethereum (ETH) and Bitcoin (BTC) ETFs are yet to recover from their ongoing downtrend after recording another outflow-riden intraday outing on April 3. This ETF trend aligns with the sharp crypto market downturn following recent regulatory announcements made by President Donald Trump.

BTC ETFs Shed $99.86M as Only BlackRock’s IBI Sees Inflows

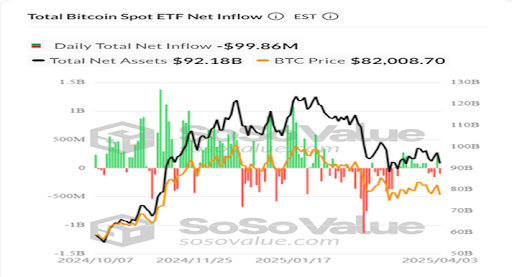

As per data from SoSoValue, BTC ETFs posted $99.86 million in net outflows on Thursday, bringing the cumulative total net inflow to $36.14 billion. The total value traded also slipped to $2.58 billion as the crypto market bleeding continued.

Grayscale’s GBTC topped the outflows after shedding $60.2 million in the past day. So far, GBTC has posted a cumulative net outflows figure of $22.60 billion, tanking its net assets to $15.78 billion.

Bitwise BITB also experienced a sore outing after losing $44.19 million in outflows. As a result, its cumulative net inflow and net assets are now pegged at $2.01 billion and $3.13 billion, respectively. Meanwhile, Fidelity FBTC lost $23.27 million in outflows, bringing its cumulative net inflow and net assets figures to $11.48 billion and $16.116 billion, respectively.

Ark and 21Share’s ARKB, VanEck’s HODL, and WisdomTree’s BTCW are other funds that made up the outflow board. ARKB shed $20.05 million in outflows, while HODL bled $12.18 million. BTCW completed the outflow list with a net outflow figure of $5.22 million which positioned its cumulative net inflows at $49.42 million and net assets at $139.14 million.

BlackRock’s IBIT attracted $65.25 million to become the only spot bitcoin fund to register net inflows. However, this inflow was offset by the overwhelming outflows recorded on the day. The outflows signaled a reversal from the previous intraday outing and the 7-day inflow streak it recorded towards the end of March.

ETH ETFs Extend Outflows Amid Tariff Tensions

ETH ETFs posted $3.59 million in outflows, marking a 3-day outflow streak as its cumulative total net inflow and total value traded slipped to $2.36 billion and $238.09 million, respectively. Notably, Bitwise ETHW saw the only outflow on the day, while other funds recorded zero net inflow and outflow figures.

This trend follows Trump’s recent announcement of a 10% baseline tariff imposition, rising to 50% for some countries. Following the news, U.S. stocks turned red, with the Nasdaq slipping 6% and the S&P 500 dipping 4.8%. In addition, the Dow lost 3.9% of its market value.

The crypto market was also hit by this news as BTC fell by more than 6% after the announcement. However, it has recovered modestly to trade at $82,902, per CoinCodex data. Ethereum also witnessed a 0.77% increase to $1,799 at the time of writing.