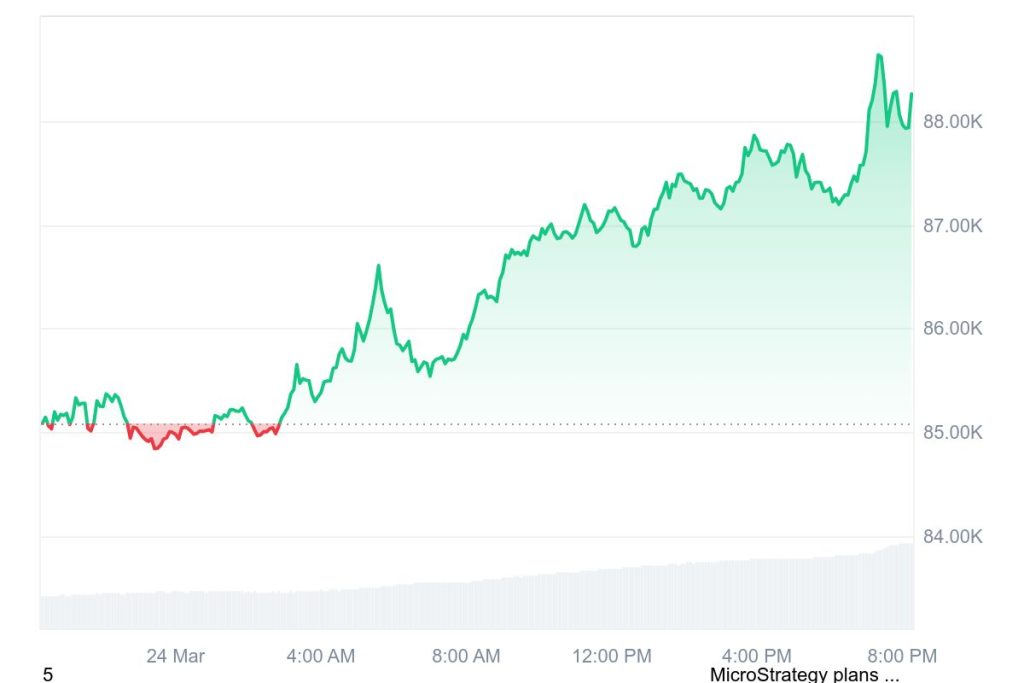

Bitcoin (BTC) continued its upward momentum on Monday, trading above $87,000 after registering a 3.50% gain in the past week. The recent price growth is backed by US spot Exchange Traded Funds (ETFs) when they brought $744.30 million during the week to positive investor sentiment.

Arthur Hayes, co-founder of BitMEX predicts that Bitcoin would reach $110,000 and then experience a price retreat to $76,500. Hayes explained that the Federal Reserve’s inflation policy together with Donald Trump’s position regarding tariffs would potentially drive Bitcoin towards $110,000 while likely facing a correction to the $76,500 range.

The cryptocurrency achieved more gains due to reports showing the White House developing a new tariff strategy before its April 2 deadline. Administration officials plan to remove specific trade barriers yet they intend to add equal trade responsibilities on main trading partners to minimize market insecurities.

In early trading of the European session Bitcoin held its position at $87,000 as it carried forward the substantial 5% price increase from last week. The Federal Reserve’s upcoming policy direction and alterations in international trade relations will serve as major price determinant factors for BTC during the upcoming weeks according to market analysts.

MicroStrategy Buys 6,911 BTC

MicroStrategy, led by Michael Saylor, has expanded its Bitcoin holdings beyond 500,000 tokens with a fresh acquisition last week. The company added 6,911 BTC tokens to its holdings using $584.1 million to pay for them at $84,529 per Bitcoin through its regulatory filing documented on Monday. MicroStrategy now holds 506137 Bitcoins which it purchased for $33.7 billion at an average Bitcoin price of $66,608 Each token cost. Using stock share sales totaling 1.975 million shares of common stock the company obtained $592.6 million for capital acquisition.

Bitcoin Institutional Demand Strengthens as ETF Inflows Surge

Institutional demand for Bitcoin demonstrates strength through ongoing investor confidence which recent statistics reveal. The Bitcoin spot Exchange Traded Funds (ETFs) data provided by Coinglass shows investors brought in $744.30 million during the latest week while the week before had shown $830.50 million in outflows. Technical analysts predict Bitcoin to experience price appreciation because sustained sell-side pressure reduction will occur.

The stablecoin reserves on Binance have achieved their highest level ever and currently surpass $31 billion according to CryptoQuant data. The remarkable increase in ERC-20 stablecoin adoption reflects investor confidence which indicates their intention to rejoin the market thus showing a typically positive sign. Binance’s stablecoin reserves seem to be growing in response to expanding investor interest as well as to provide required liquidity for market participants who need to hedge.

Bitcoin Faces Key Resistance at $87,500, Analyst Warns of Pullback

Ali Martinez, a prominent crypto analyst, warns of a coming brief price drop while Bitcoin experiences its current surge. According to his analysis, Bitcoin holds a potential resistance point at $87,500 which appears through a red arrow combined with indicator “13” from the TD Sequential tool for price reversal analysis. The indicator’s latest signal points to a possible pullback after Bitcoin’s recent upward momentum.

TD Sequential joins a variety of predictive analysis tools that traders use to optimize their entry and exit strategies in the highly volatile Bitcoin market of 2025. Various market participants track essential support and resistance zones because they need them to understand Bitcoin’s changing market values during periods of shifting investor opinion.

Bitcoin Price Analysis

Bitcoin reached a price level of $88,243 on March 24 which signified a 3.67% price increase from its previous value. BTC demonstrates resistance at the crucial price barrier of $90,000 which corresponds with the 50-day Exponential Moving Average.

The breakout of this market barrier indicates more upward price momentum is likely to follow. The value of Bitcoin maintains strong defensive positions at $84,899 which links perfectly with its 200-day Simple Moving Average (SMA) to help support Bitcoin’s overall price direction.

From a technical perspective, the 200-day Moving Average at $84,899 serves as an important long-term trend indicator. A bearish divergence detected in the Relative Strength Index indicates the upcoming slowdown of upmarket movement. The indicator should be used by traders to detect overbought or oversold conditions.

A MACD cross above its signal line occurred recently yet specific values remained undisclosed. Trading activity has intensified according to the volume profile whenever Bitcoin comes near the $90,000 resistance level. Increasing volume levels indicate that investors have growing interest as well as an increased possibility for market volatility.

Bitcoin maintains an overall bullish trend while it interacts with the $90,000 resistance threshold. Individuals in the market should watch both essential technical levels and indicators for effective market movement forecasting.