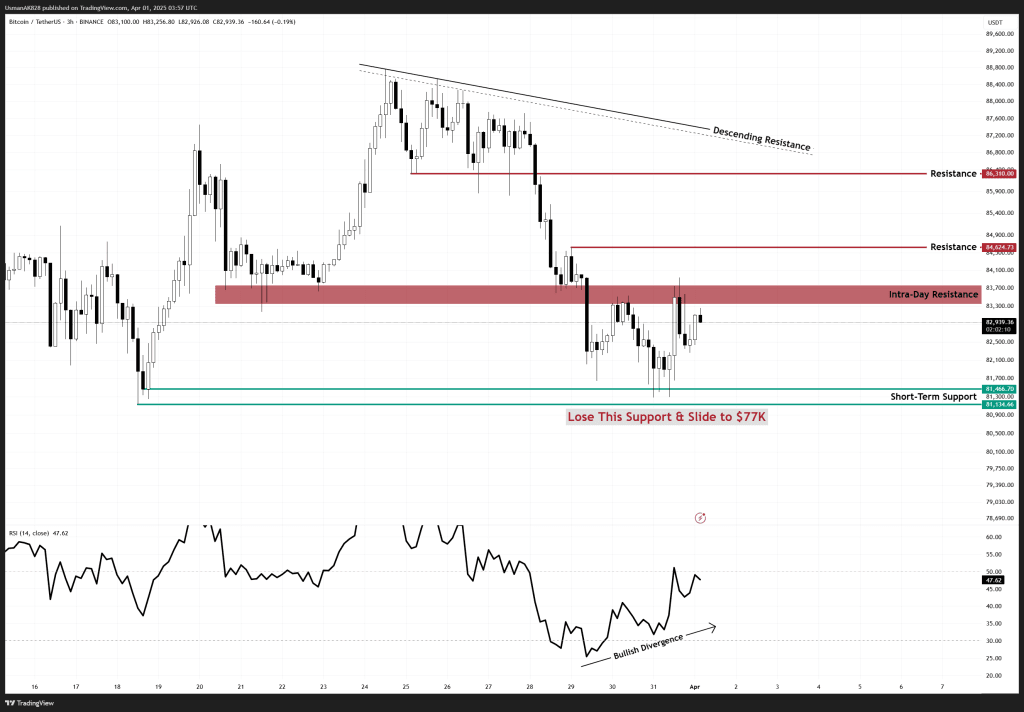

Bitcoin Technical Analysis: 1 APR 2025

Bitcoin’s 3-hour time-frame shows a bullish divergence on RSI. Source: TradingView

General View

Bitcoin has been consolidating after a sharp pullback, with bulls attempting to regain control despite the 12-hour timeframe now being in a death cross formation, signaling caution. However, a bullish divergence on RSI suggests early signs of recovery, provided key levels hold. The CME gap is half-filled, leaving room for further volatility, while the price remains stuck below intra-day resistance. If buyers sustain momentum and reclaim lost ground, a broader rebound could take shape, but failure to do so may keep Bitcoin vulnerable to deeper downside moves.

On The Upside

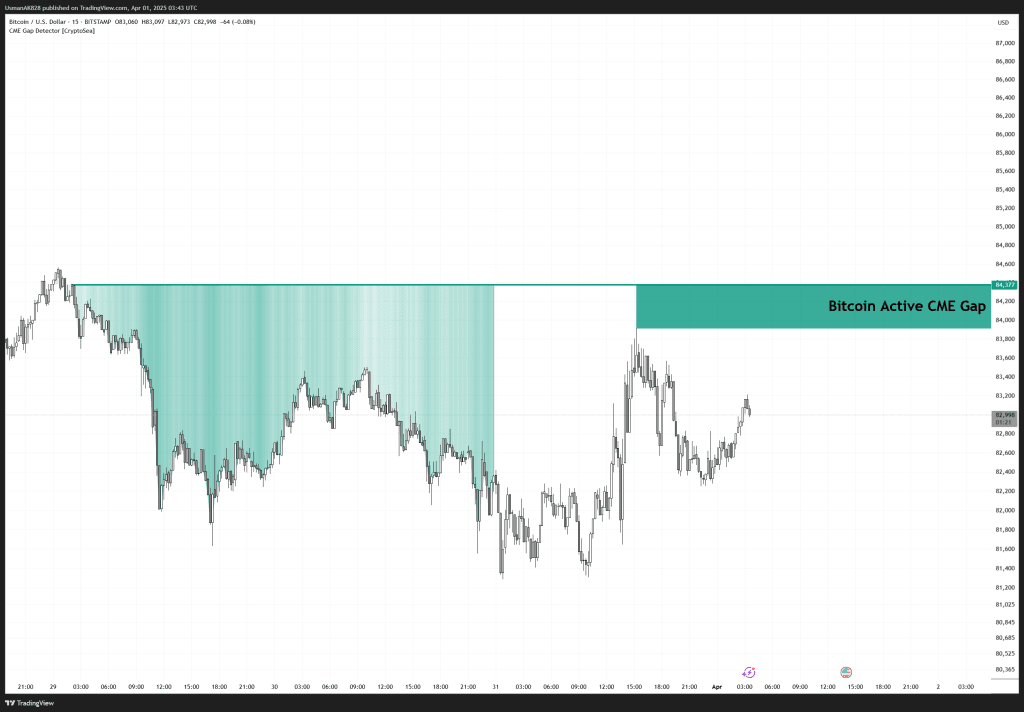

Bitcoin is currently testing the intra-day resistance near $83,100-$83,500. A break above this zone could trigger further upside towards the next resistance at $84,400, which would fill the leftover CME gap. Meanwhile, if the strength sustains, bulls can see higher levels, however, it’s going to be challenging for the bulls to achieve such a milestone.

On The Downside,

Bitcoin now has multiple intra-day support levels in place, with the first key supports at $82,800 and $82,200, both of which could trigger positive reactions if tested. However, for the session, the major intra-day support zone positions at $81,450–$81,150, making it an important level for bulls to defend.

Most of the CME gap has now been filled. Source: TradingView