- Bitcoin rallies past $88K, boosted by strong spot trading, ETF inflows, and weakening US dollar amid inflation concerns.

- Traders favor BTC call options; a low put-to-call ratio and rising futures open interest signal growing market optimism.

- BTC ETFs record $381.3M in inflows, the highest since January, with ARKB and FBTC leading institutional investment activity.

Bitcoin’s strong outing last night further strengthened the narrative that it is decoupling from traditional financial markets. With the recent weakening of the US dollar, investors are seeking refuge in hedging assets to guard against inflation. In light of this, BTC and gold have become the top gainers of the capital rotation from the USD. In the Bitcoin options market, more traders are betting on “call” options, indicating optimism about BTC’s rise.

Bitcoin Breaks $88K as Bullish Signals Stack Up and Spot Demand Soars

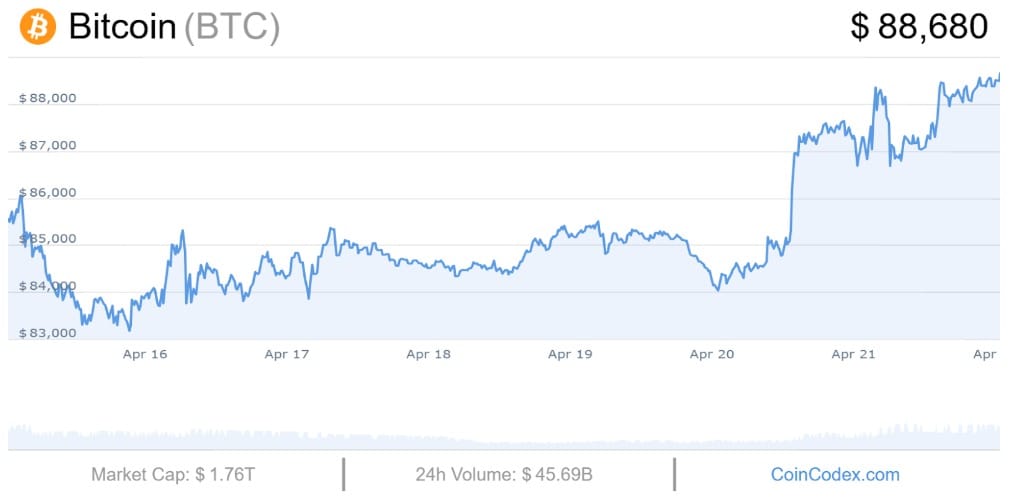

Bitcoin broke the $88,000 mark to reach its highest price level since early April. At the time of writing, the coin trades at $ 88,680 after rallying 1.98% in the past session. BTC has surged 34% over the past year, outstripping several other crypto assets during that period. It has seen 18 green outings in the past month and currently trades close to its cycle high.

Furthermore, the coin is positioned above the 200-day SMA, signaling a potential bullish (uptrending) market trend. Plus, Coincodex’s technical indicators are overwhelmingly bullish, with twenty-six bullish signals and only five bearish pointers.

Bitcoin’s price performance last night was further amplified by the increased demand from spot traders during the US trading hours. During that timeframe, spot transactions exceeded perpetuals, and BTC sold for higher prices on Coinbase compared to other exchanges.

Traders Bet Big on Bitcoin as Bullish Momentum Builds in Options and Futures

Per insights from Deribit, BTC’s put-to-call ratio in the options market is pegged at 0.71. The ratio helps measure the current Bitcoin sentiment among market participants. The current score means that more people are buying “call” options (bets that Bitcoin will go up) than “put” options (bets it will go down). This market trend further supports the ongoing market optimism regarding the crypto asset.

Further solidifying this outlook is the futures open interest, which surged 5% to $58.46 billion. If open interest and price move up at the same time, it is often interpreted as new cash flowing into the market. Experts typically view this trend combo as a bullish indicator.

Bitcoin Spot ETF Posts Record Inflows, Led by Ark Invest and Fidelity

Bitcoin spot ETF recorded its largest single-day inflow since January, indicating renewed interest from top market participants. BTC ETF inflows on Monday reached a record $381.3 million, the highest level since January 30. Notably, the peak BTC ETF inflow earlier this year occurred shortly after Bitcoin crossed the $100,000 mark.

Ark Invest and 21Shares’ ETF (ARKB) led the Bitcoin ETF inflow scoreboard on April 21 after raking in an impressive $116.13 million, per SoSoValue data. In second place was Fidelity’s Bitcoin ETF (FBTC), with inflows totaling $87.61 million. Other vehicles, including the iShares Bitcoin Trust (IBIT) and the Bitwise Bitcoin ETF (BITB), also posted impressive inflow scores.