- Bitcoin soars to $82K after Trump pauses tariffs; global crypto market capitalization climbs to $2.58 trillion.

- The S&P 500, Dow, and Nasdaq saw historic gains, and top tech stocks like Tesla and NVIDIA rallied over 18%.

- Despite gains, Bitcoin trades below its 200-day SMA, and its Fear and Greed score of 32 reflects cautious optimism.

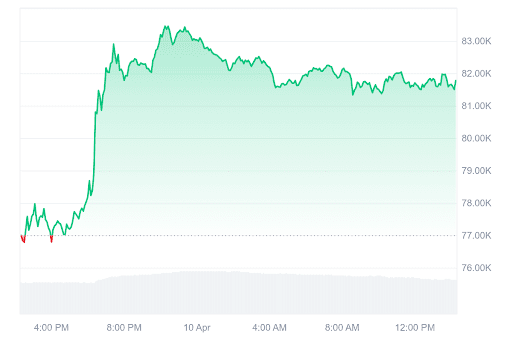

Bitcoin (BTC) soared to $82,000 in the last intraday outing, aligning with the recent breath of fresh air witnessed by the financial markets after President Trump announced a tariff halt against trade partners on Wednesday.

Markets Surge as Trump Pauses Tariffs, Vows 125% China Levy

In the early hours of Thursday, news broke that Trump had paused tariffs on imports for 90 days. However, the president remained adamant about reducing China’s levy. Instead, he hinted at a further levy increase after China announced another reciprocal tariff on the United States.

Taking to social media, Trump said:

Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately.

News of the tariff pause sparked a wave of upward movements among indices in the global financial space. The S&P 500 surged by 9.5% following a long period of slips. The Dow rallied 7.87% to mark its best single-day performance in five years. Nasdaq’s value climbed by 12.2%, its best day in twenty-four years. Notably, the S&P 500’s performance is its best since October 2008.

Top US tech firms also posted green figures following Trump’s tariff U-turn. NVIDIA Corporation rallied 18.72%, and Intel Corporation grew 18.75%. Tesla, Inc. and Apple Inc. also surged 22.69% and 15.33%, respectively.

The broader crypto market also rallied as Bitcoin hit the $82,000 mark following Trump’s announcement. In the past 24 hours, the global crypto market has grown 6.09% to $2.58 trillion as the recent news has spurred investor confidence. Similarly, the total crypto market volume has rallied to $149.77 billion, indicating that more transactions are taking place within the sector.

Crypto Market Rebounds as Bitcoin Surges Amid Renewed Market Confidence

At the time of writing, Bitcoin changes hands at $81,777 after surging 8.6% in the most recent market outing. In that period, the trading volume surged nearly 10% from $62.39 billion to $68.47 billion. Bitcoin has witnessed 16 green trading days in the past month and trades close to its cycle high. For clarity, a cycle high refers to the highest price a crypto asset attained during a bullish cycle before a significant correction.

Source: CoinMarketCap

In the past year, Bitcoin’s price has risen by 18%, outperforming 78% of the top 100 crypto assets. It also performed better than Ethereum, up 162.49%, per Coincodex data. However, the coin trades below the 200-day SMA, raising question marks over a sustained price climb. Although the BTC market sentiment has left the bearish zone, its Fear and Greed score of 32 indicates modest investor pessimism.