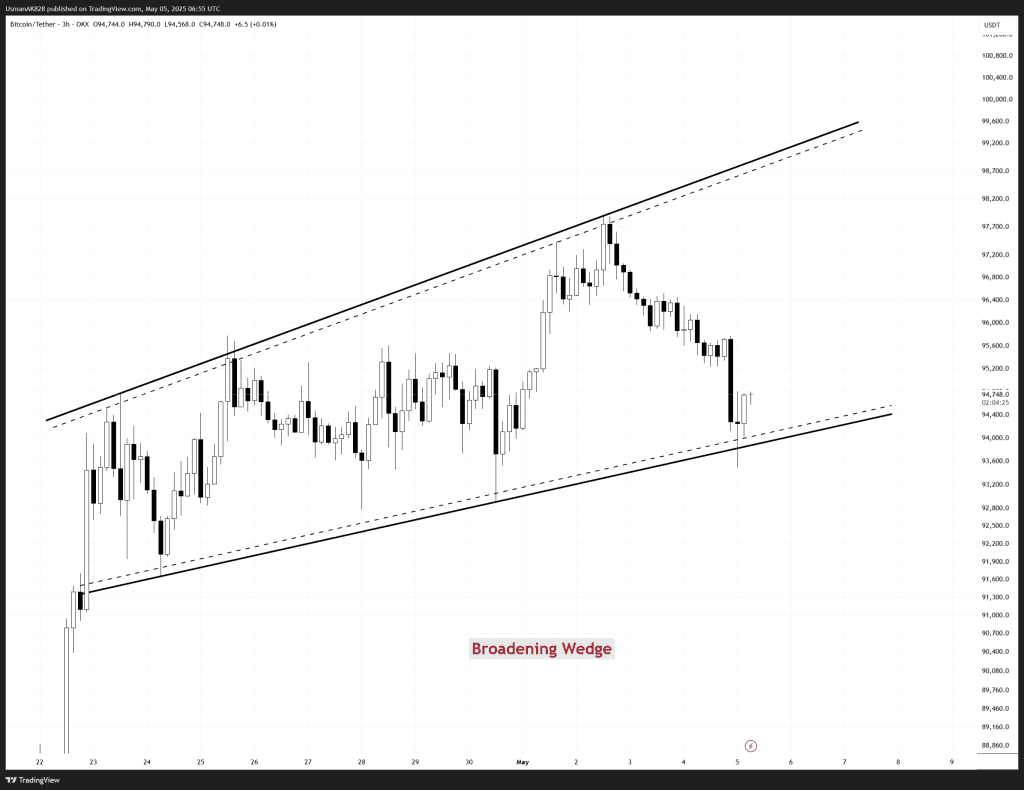

Bitcoin Technical Analysis: 5 MAY 2025

Bitcoin is in a broadening wedge formation. Source: TradingView

General View

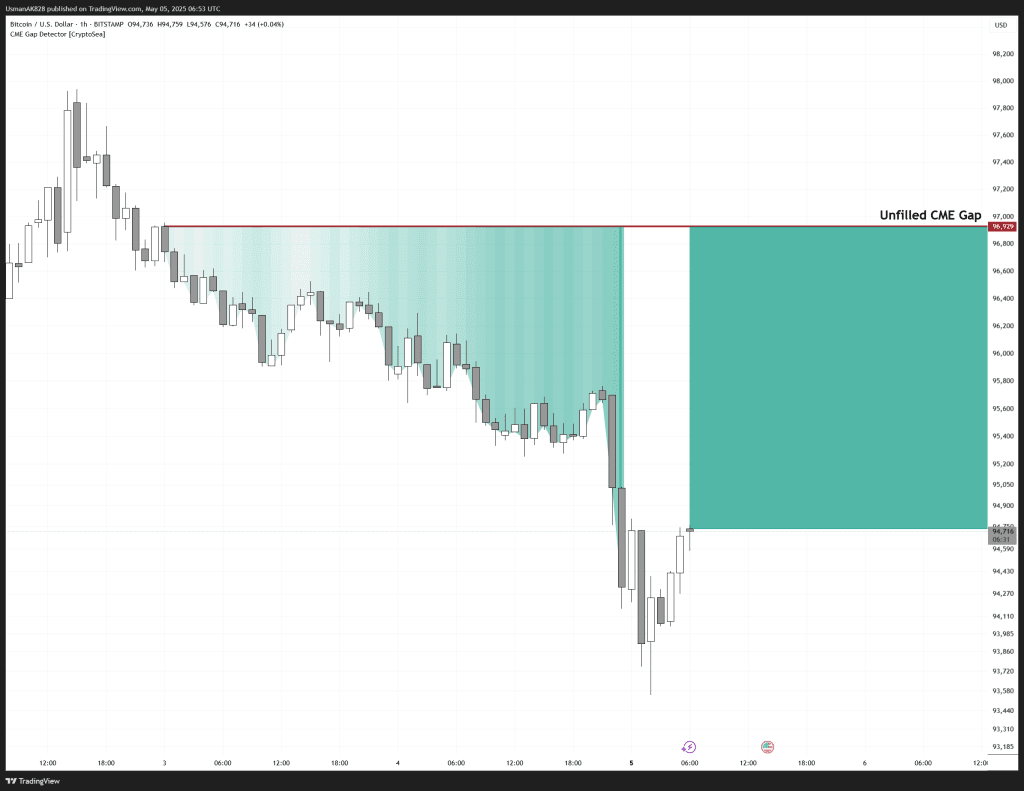

Bitcoin printed a clear 3-Drive bearish reversal pattern just below the $97,500 level, which triggered a sharp weekend sell-off. The repeated rejection at that zone created exhaustion among buyers and set off aggressive profit-taking, sending BTC tumbling to the lower boundary of a broadening wedge. Price has retested the wedge supports, and the recovery phase is now underway. Notably, an unfilled CME gap near $97,000 looms overhead and could act as a magnet if bulls maintain momentum.

On The Upside

To regain control, Bitcoin bulls must break through the $95,200 to $95,500 short-term resistance zone. A stronghold above this level would likely set sights on the CME gap fill at $97,000, followed by the upper trendline of the wedge near $98,200. This is where the struggle is likely to be seen once again.

On The Downside

The lower wedge trendline, which is currently near $93,800 to $93,650, remains the immediate support to watch. This is an essential level for bulls to hold to keep Bitcoin gradually trending higher. A breakdown below this would open $92,800 support, next followed by $91,600.

Price has an unfilled CME gap till the $97,000 level. Source: TradingView