- About 64% of Binance traders are betting on a Bitcoin decline, reflecting bearish sentiment despite recent price recovery.

- A smaller group holding long positions believes a rebound is near, possibly fueled by technical or contrarian signals.

- Heavy short positioning raises the risk of a short squeeze, where sudden price spikes force shorts to buy back quickly.

Bitcoin recently recovered from its market lull after hovering around the $85,000 price range in the past two months. Despite the recent market revival, a large section of traders on Binance are betting on the coin to decline, as spotted by market commentator Ali Martinez.

Bitcoin Nears Cycle High Amid Bullish Momentum and Mixed Market Sentiment

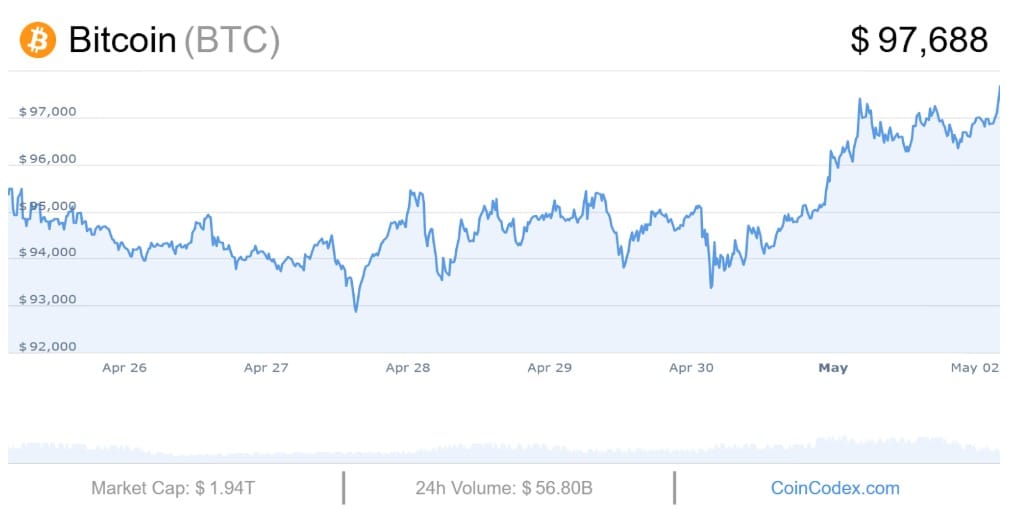

Bitcoin recently crossed the $96,000 market after recovering from its downtrend in early April. It has rallied over 13% in the past month and is currently changing hands at $97,688 at the time of writing. Additionally, the apex asset has recorded 18/30 green days, taking it above its cycle high of $97,409. For context, a cycle high is the highest value an asset attained within a market cycle. In the past year, Bitcoin has surged by 65%, outstripping several top-ranked crypto assets.

Other Bitcoin market indicators are flashing bullish signals. For example, the BTC investor price outlook is currently bullish, likely fueled by the ongoing Bitcoin accumulation by corporate and government bodies. This optimistic outlook is amplified by the Fear and Greed score of 67, which reflects high trading activity. In spite of these bullish trends, Ali charts recently disclosed that about two-thirds of long and short positions on Binance wagered on the coin slipping.

Majority Bet Against Bitcoin, But Short Squeeze Risk Looms

As per Ali’s charts, about 64% of Binance traders are “shorting” Bitcoin, which means they are betting it will drop. If this prediction holds, these traders are positioned to make profits. This shows that most people in the market are feeling negative or cautious about Bitcoin’s near future. Such positioning could be a response to recent market trends or macroeconomic concerns. It could also be due to technical resistance levels that traders believe will trigger a correction.

But when too many people bet on falling prices, there’s a risk of a short squeeze. If the price suddenly goes up instead, many traders could be forced to buy Bitcoin quickly to cover their losses, pushing the price even higher. So, even though predictions are bearish, it also creates the potential for a sharp reversal if market sentiment shifts.

Long Traders Position for Rebound in Bearish Market

Despite the dominance of short positions, 36.24% of Binance traders are still holding long positions, betting on a price increase. While they’re in the minority, these traders may believe that Bitcoin is near the bottom and poised for a rebound. Their stance could be based on long-term confidence, technical signals, or simply a contrary view in an overly bearish market.

This smaller group stands to benefit quickly if the market moves upward. A sudden shift in momentum could reward long traders while forcing short sellers to cover their positions, amplifying any upward move. In a market, these one-sided, unexpected reversals can be sharp and fast.