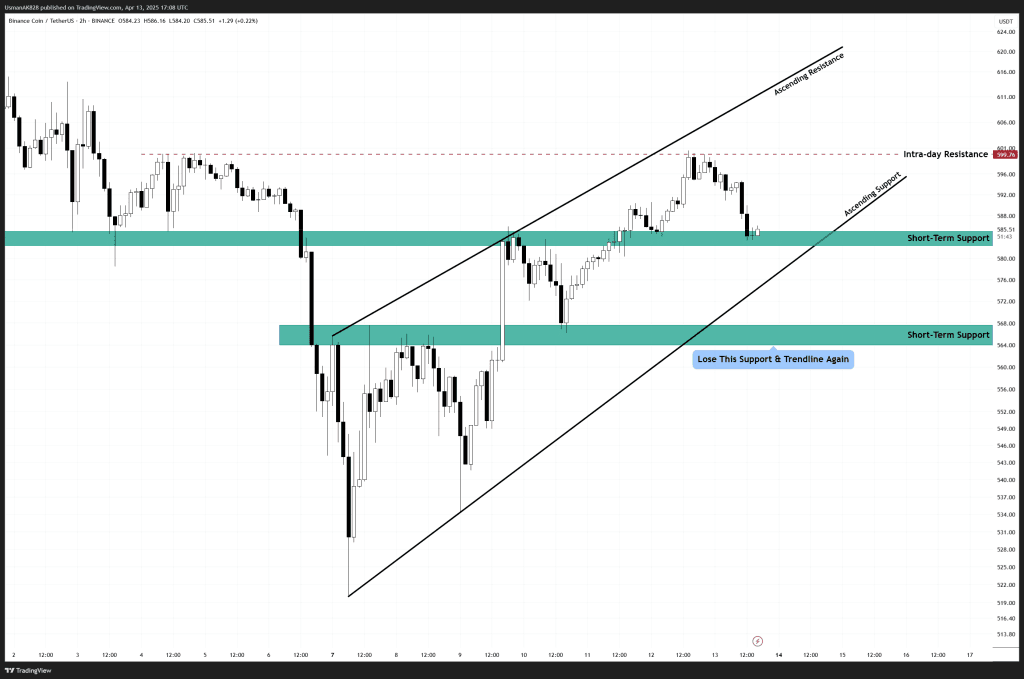

BNB Technical Analysis: 13 APR 2025

BNB has gradually been recovering in an upward channel. Source: TradingView

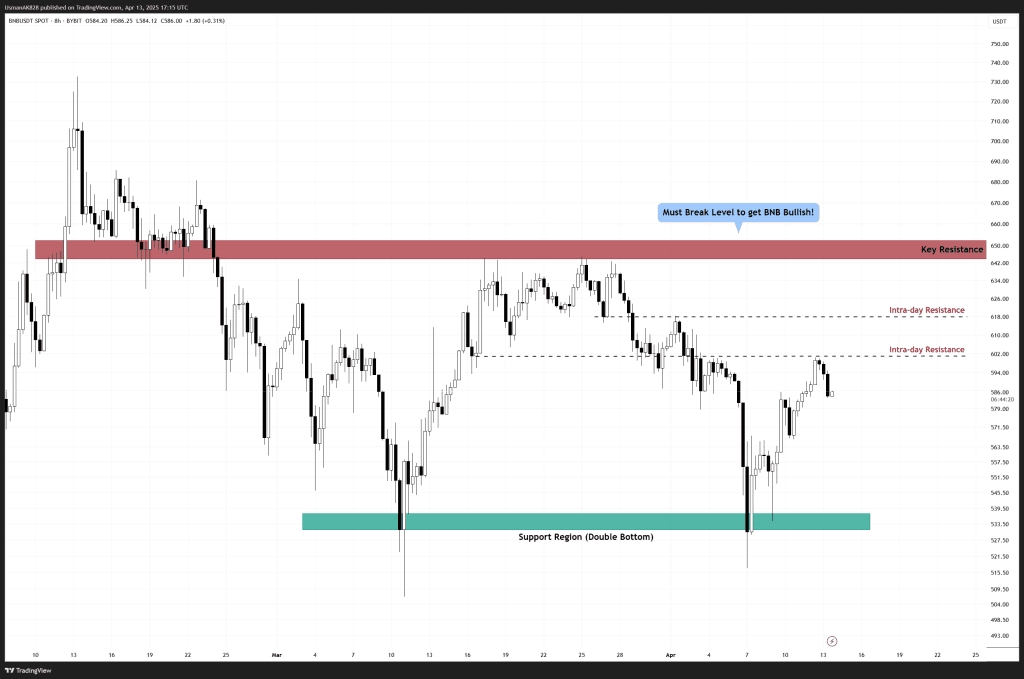

General View

BNB has been in a gradual trend higher after holding onto the double bottom lows. BNB is currently pushing higher in an upward channel. The recent climb has nearly erased the sharp losses from early April, putting BNB back into the same congestion zone it struggled with last month. Momentum may be cooling slightly, but buyers are still holding the line. If this strength holds through the next few sessions, BNB could be setting the stage for a renewed push toward the key resistance zone.

On The Upside

BNB has been holding well, however, the price needs to grab strength above the $600 mark to transition into an even stronger bullish momentum. Strength above $600 open the upside towards $620 followed by $650 which is the next important resistance level for the bulls.

On The Downside

Immediate support rests along the ascending trendline and short-term demand at $585. A breakdown below this area could signal weakness and potentially drive BNB toward the $565 zone. This is where bulls ideally need to hold to avoid another retest of the double bottom lows. As long as $565 is maintained, bulls are in a comfortable spot.

BNB gets knocked by the intra-day resistance level. Source: TradingView