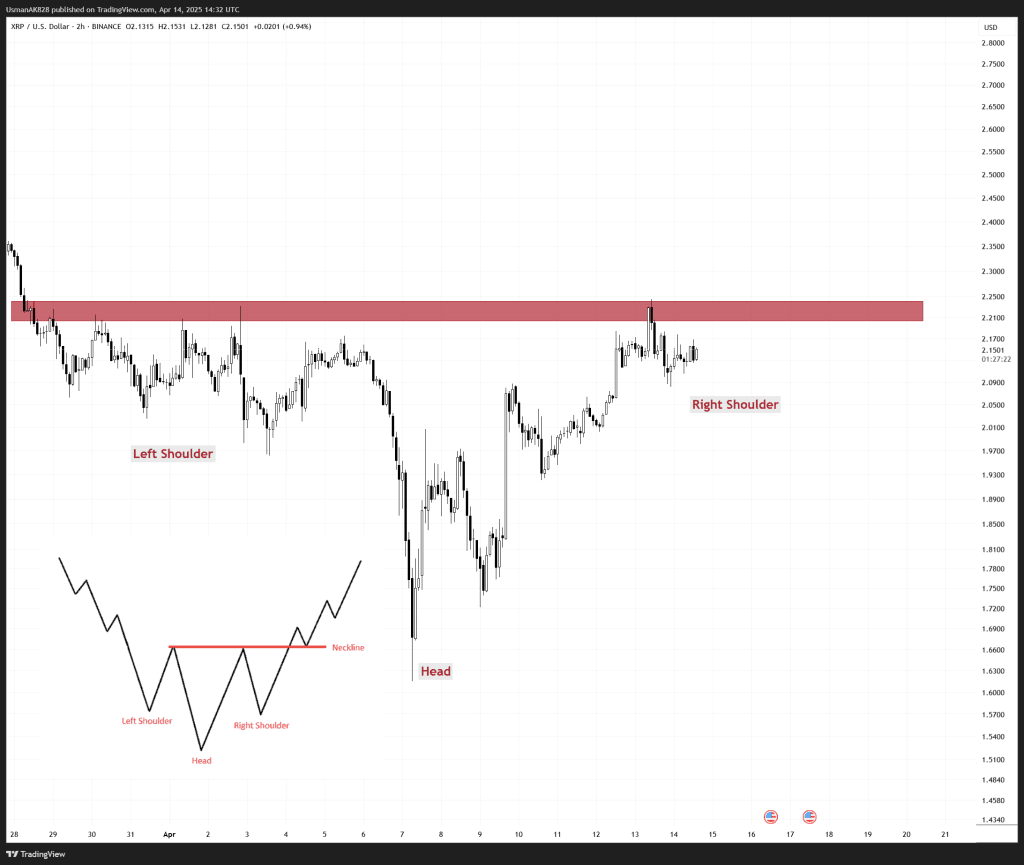

XRP Technical Analysis: 14 APR 2025

XRP is in a potential inverse head and shoulder pattern. Source: TradingView

General View

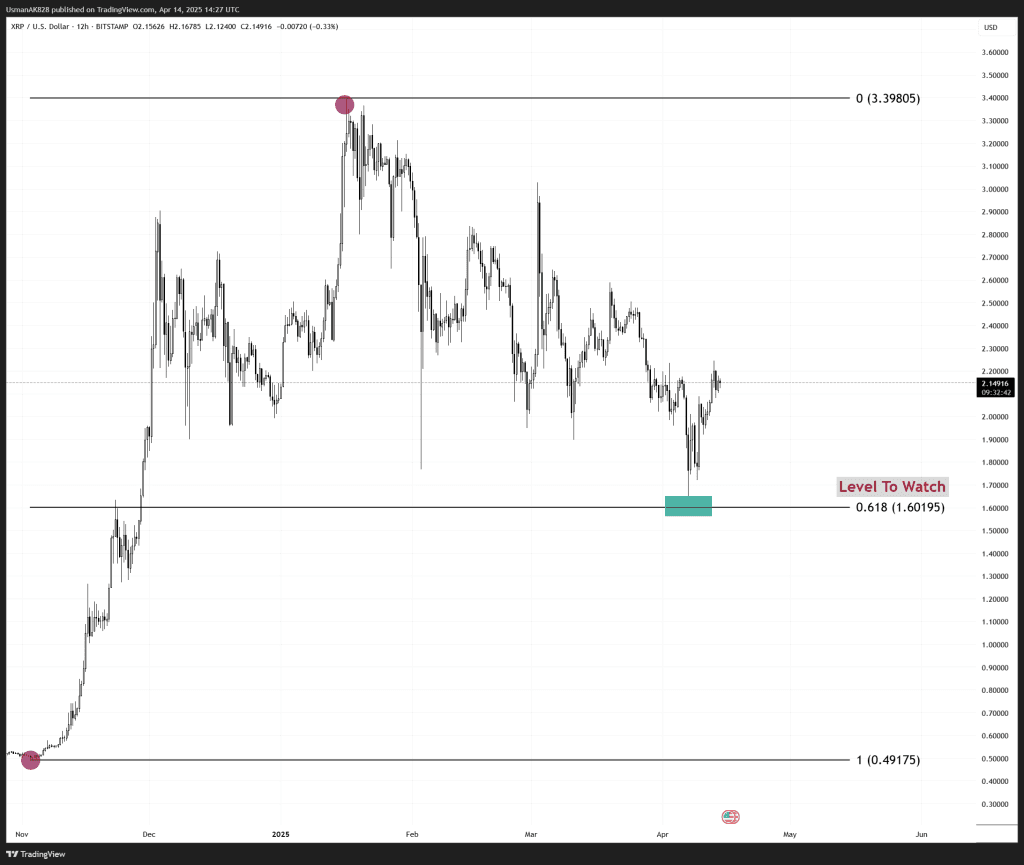

XRP, after honoring the 61.8% Fibonacci level, has shown a decent climb back higher. The structure now closely resembles an inverse Head and Shoulders pattern, which signals a reversal. Price is currently consolidating just below the neckline resistance, and if this strength persists, XRP could be setting up for an upside breakout.

On The Upside

A confirmed breakout above the neckline at $2.25 would mark a shift in trend for XRP, with the price then aiming for higher levels initially towards $2.32 followed by $2.40 levels. This is where some short-term challenges are likely to draw attention once again. Having said that, the target for the pattern is $2.70 level.

On The Downside

Failure to clear the $2.25 neckline could lead to a temporary rejection. In that case, the $2.05 to $2.00 psychological zone once again comes into play. Ideally, bulls do not want to retest lower levels if they are to demonstrate their strength. As of now, any deeper corrective drop remains unlikely. However, in a worst-case scenario, bulls must defend the $1.92 level otherwise, XRP could take a dive toward its recent lows.

XRP reacts positively towards the 61.8% Fibonacci level. Source: TradingView