- Teucrium’s 2X XRP ETF ($XXRP) launched on NYSE Arca with $5M in day-one volume.

- According to Bloomberg ETF analyst Eric Balchunas, this figure places the XXRP ETF in the top 5% of all new ETF launches.

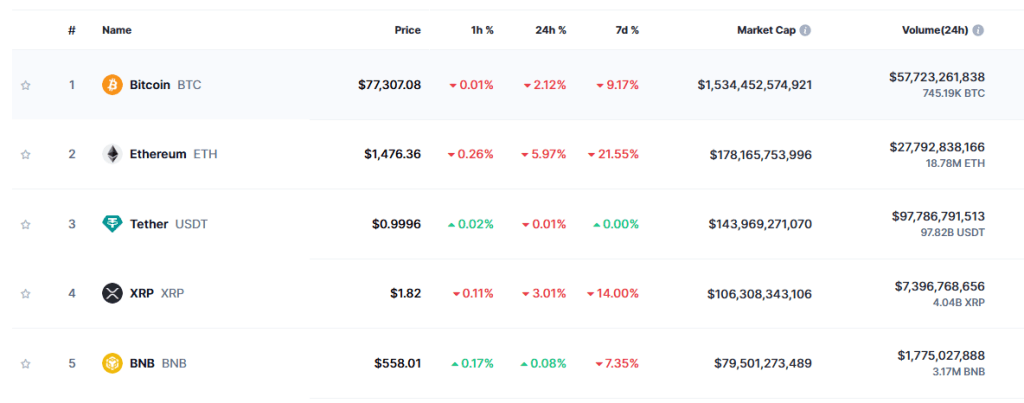

- Experts call for XRP to flip Ethereum’s market cap, but it hinges on breaking $1.97.

Ripple is back in the spotlight once again. This time, the hype isn’t merely because of its ongoing legal battles with the SEC. This week, the launch of Teucrium’s 2X Daily XRP ETF ($XXRP) on NYSE Arca drew major attention from traders and analysts. Bloomberg ETF analyst Eric Balchunas even called its $5 million opening day volume “very respectable.”

Amid all of this, there are increasing calls for the cryptocurrency to possibly “flip Ethereum” by the end of the year. Here’s what all of this means for XRP and its investors.

XXRP ETF Impresses on Day One

Teucrium’s 2X Daily XRP ETF officially launched on 8 April. This ETF offers traders a leveraged investment vehicle designed to mirror the daily price movements of XRP twice over. Interestingly, its first 24 hours of trading saw the ETF hit a volume of $5 million.

According to Bloomberg ETF analyst Eric Balchunas, this figure places the XXRP ETF in the top 5% of all new ETF launches. To add some perspective to this, the 2X Solana ETF ($SOLT) launched recently as well but only pulled in one-fourth of XXRP’s volume.

As it stands, there are now increasing calls for XRP to flip Ethereum by year-end. According to pro-XRP lawyer John Deaton, “XRP has much more appeal than industry players want to admit.” Deaton went further to add that XRP has a good chance of flipping Ethereum (likely by market cap) by the end of the year.

Can XRP Really Flip Ethereum?

According to data from CoinMarketCap, XRP currently ranks 4th among other cryptocurrencies in terms of market cap. The cryptocurrency is dwarfed only by Tether’s USDT, Ethereum, and Bitcoin, with a market cap of $106 billion.

Ethereum, on the other hand, has $178 billion in market cap, despite its crash below the $1,500 zone. This would mean that Ethereum is $72 billion ahead of XRP (the market caps of Tron, Dogecoin, and Cardano combined).

Assuming XRP were to flip Ethereum indeed and achieve a market cap of around $180 billion relative to $178 billion, the price of the cryptocurrency would need to rise from its current $1.82 to $3. This is assuming its circulating supply remains constant at 58.27 billion tokens and Ethereum remains relatively stagnant in price.

As expected, XRP flipping Ethereum does not present itself as some “wild impossibility,” and speculators just might see this happen soon.

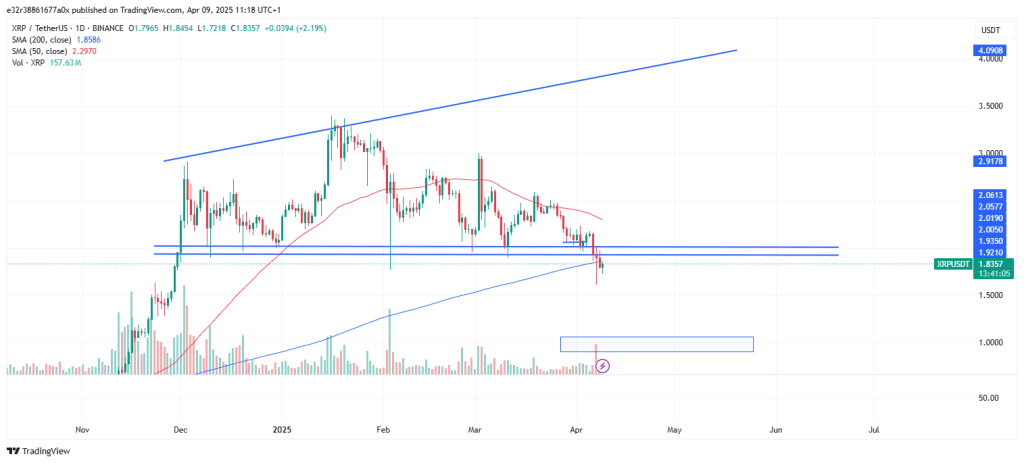

Price Action: The Bulls and Bears Are in a Tug-of-War

Despite all the positive developments around ETFs, the price action of XRP hasn’t yet caught up to the excitement. The cryptocurrency recently attempted to break above the $1.97 resistance level but was quickly rejected. Sellers re-entered the market around $1.80, and the price dropped as low as $1.7720 before stabilizing around $1.82, where it now sits.

XRP is now trading between its 200- and 50-day Simple Moving Averages (SMAs), which might act as some form of dynamic support and resistance for the time being. So far, the price direction of the cryptocurrency will depend heavily on whichever of these moving averages breaks first.

If XRP clears the $1.97 resistance, though, the cryptocurrency could rally into a fresh uptrend. However, if the resistance holds firm, XRP could be in for another drop towards $1.1 or lower.