- XRP has struggled to stay above the $2.2 mark after facing strong selling pressure and outflows of capital worth $300 million in April.

- According to Egrag Crypto, a possible dip in XRP’s price to $1.40 could be incoming unless this cryptocurrency can close above $2.30–$2.50.

- Ali Martinez says XRP is facing a “key resistance” around the $2.2 zone, where a price move above $2.2 could open the door towards $2.4 or even higher.

April has been anything but smooth for XRP, the native token of the Ripple ecosystem. The cryptocurrency has struggled to stay above the $2.2 mark after facing strong selling pressure and outflows of capital. Despite briefly rallying through the weekend, the wider market sentiment has yet to flip bullish, and there are ongoing warnings that XRP could crash lower unless certain resistances are reclaimed. Let’s go through the current state of XRP, as well as what could come next for its price.

$300M in Outflows Raises Red Flags

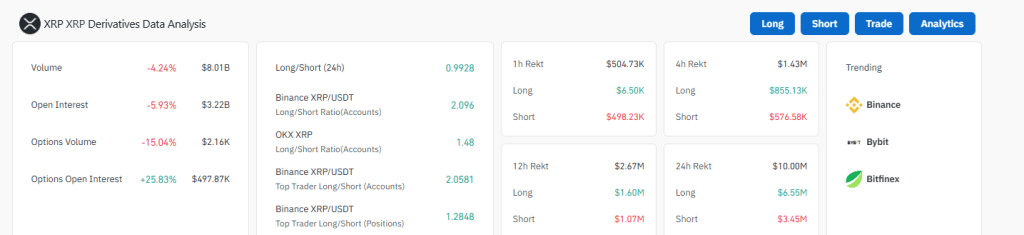

XRP has seen net capital outflows of around $300 million in the first two weeks of April alone, according to Coinglass data. Said data also show that inflows during the same period came in at just $56 million, showing that investor sentiment is turning bearish. Even on days when XRP’s price showed recovery signals, its trading volumes remained low, indicating that buying interest is weak.

All of these outflows have made it hard for XRP to hold any gains so far, and each time the price has attempted to reach higher, it has been dragged down again by a barrage of profit-taking. While this behavior doesn’t exactly point toward an incoming downtrend, it does raise concerns about the XRP bulls’ ability to beat the bears. Interestingly, even though April’s outflows have been high, they have slowed down considerably compared to those of similar periods in January and March.

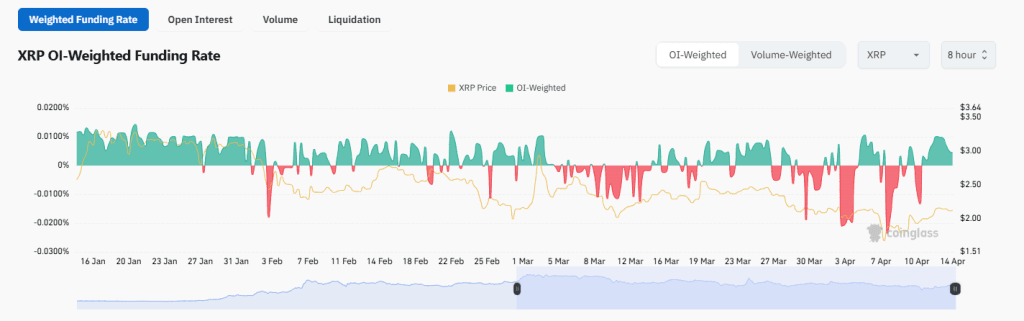

Analytics also show that XRP’s funding rates have flipped bullish once again, after turning wildly bearish as of late.

Analysts Brace for a Pullback to $1.40

According to analysts, XRP could be facing several scenarios over the coming days or weeks. One of these analysts is Egrag Crypto, who recently warned that a possible dip in XRP’s price to $1.40 could be incoming. According to the analyst, unless this cryptocurrency can close above the $2.30–$2.50 zone on the five-day chart, it is likely to retest lower support levels, including $1.85.

Despite this pessimism, Egrag Crypto believes that XRP still targets the $7.50, $13, and even $27 price levels, depending on how well it performs in relation to shifts in narrative. He believes that XRP could eventually climb higher, especially if the macroeconomic factors start to turn bullish once again in the ongoing tariff war and the Ripple/SEC case.

Volatility with a Side of Hope

On the other end, the past few days have seen XRP swinging between gains and losses. For example, it saw an opening on Sunday’s trading with $2.153 before quickly dropping to around the $2.127 support and then climbing towards $2.231.

All before facing rejection once again. The cryptocurrency’s RSI on the daily chart shows overbought conditions, and as of writing, XRP is trading just near the $2 mark.

According to insights from renowned analyst Ali Martinez in a recent tweet, XRP is facing a “key resistance” around the $2.2 zone. More importantly, the cryptocurrency is trading within an ascending channel formation. This means that a move above this $2.2 price level could open the door towards $2.4 or even higher.

Overall, XRP’s 200-day Exponential Moving Average (EMA) sits strongly around $1.95, while resistance from the 50-day and 100-day EMAs sits at $2.25. If a breakout above this $2.2 price level occurs, XRP could beat Ali’s $2.4 prediction and even hit as high as $3.