- China pegged its daily yuan fix below the 7.2 level to ease tariff impacts and increase exports of products from the country.

- Experts predict yuan devaluation may trigger capital outflows and draw parallels to previous events.

- China performed a similar currency devaluation in 2015, which led to a 60% Bitcoin rally months after the initial drop.

The yuan (CNY) hit its lowest levels since 2023 on Tuesday after China eased its grip on the currency as analysts expect the yuan’s fall to act as a stimulus to Bitcoin (BTC) based on historical precedent.

PBOC Sets Yuan Fix Below Key Level, Signaling Shift Toward Managed Depreciation

China’s apex bank pegged the daily CNY fix at 7.2038 per dollar on Tuesday, according to a Reuters report. The yuan breached the 7.2 mark for the first time since September. Many market participants have previously seen this level as a soft red line adopted by China’s apex bank. In the past years, the USD/CNY currency pair has occasionally traded above this level.

But it could now establish a foothold after China’s apex bank set the daily midpoint beyond the 7.2 level. This move could set the stage for the weakening of the CNY to raise exports and potentially absorb the negative impact of the intensifying trade war with the US.

Currencies like the USD are classified as free float, meaning their value is determined by supply and demand. On the other hand, the CNY’s exchange rate is fixed by the government, which allows a maximum of 2% fluctuation on either side of the daily fix.

Head of China macro strategy at Standard Chartered Bank Becky Liu remarked that the fixing,

could mean China’s foreign-exchange regime is now changed to managed depreciation rather than a firm cap under 7.35” for the spot yuan,

Liu added:

China is allowing greater foreign-exchange flexibility as part of the tools to alleviate growth pressure amid aggressive tariff hikes.

CNY’s Fall Could Stimulate BTC as Experts Predict Capital Flights

Market commentators believe that the yuan’s managed depreciation could trigger capital flight from China and act as a stimulus to cryptocurrencies.

Markus Thielen, Founder of 10x Research, explained that the recent tariff imposition on China could cause economic pressure on Asia’s largest economy. He added that the nation could strike back by devaluing the CNY and increasing liquidity in its financial system. This could trigger a capital flight and potentially spark a Bitcoin uptrend.

Ben Zhou, CEO and founder of the crypto exchange Bybit, also maintained a similar stance, noting that yuan depreciation usually favors Bitcoin.

Zhou stated:

China will try to lower RMB to counter the tariff, historically, whenever RMB drops, a lot of Chinese capital flow into BTC, bullish for BTC,

On August 11, 2015, the PBOC pulled off the highest single-day current depreciation when the yuan was devalued by 1.9%. This event crashed the global financial market and sent the US stocks southbound. Bitcoin tanked by 20% but recovered quickly and rallied close to 60% in the next four months.

Bitcoin Struggles Amid Bearish Trends and Market Fear

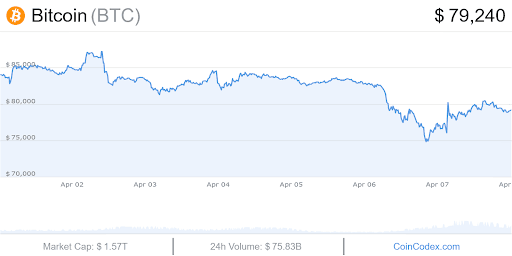

Although historical precedents suggest a positive Bitcoin reaction to CNY depreciation, its current price trend tells a different story. At the time of writing, Bitcoin trades at $79,102 following a 2.57% intraday uptick. However, it trades within the red zone in its weekly and monthly charts.

Per Coincodex data, the coin is positioned below the 200 SMA and is its market out remains bearish. Furthermore, BTC is currently overwhelmed by high market fear, as shown by its Fear and Greed score of 24.