- 72% of Binance traders are currently long on Dogecoin, signaling strong bullish sentiment on the exchange.

- Despite this optimism on Binance, market-wide data shows a slight majority of traders still holding short positions on DOGE.

- An emerging Ascending Wedge pattern could fuel a potential 580% rally, with a price target of $1.161 if confirmed.

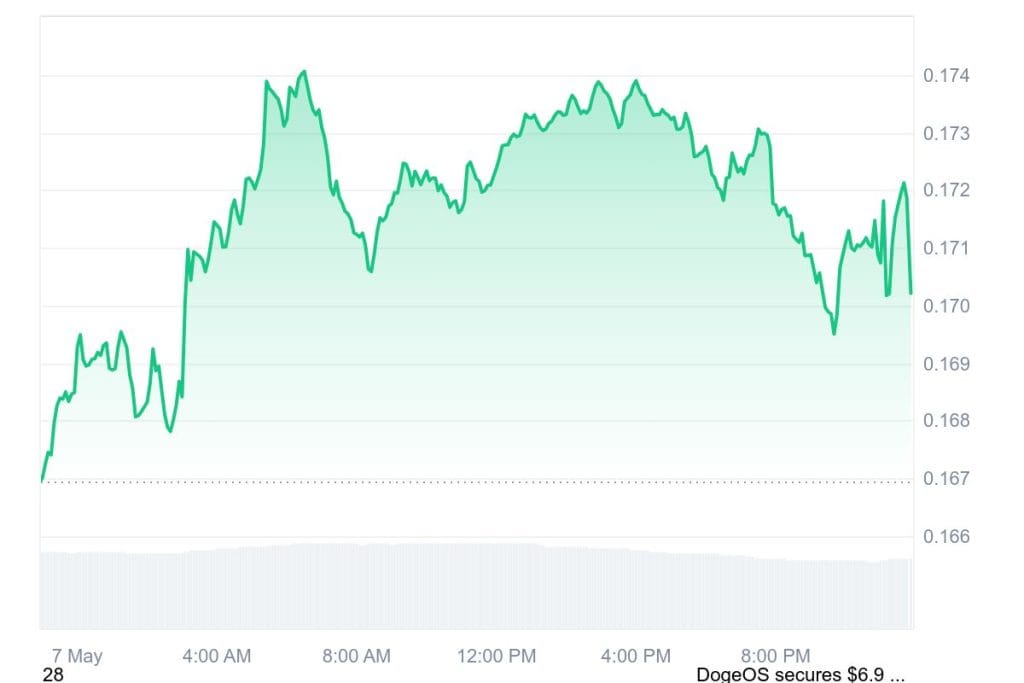

However, despite recent price declines, a net 65% of Dogecoin investors are bullish about the price of the memecoin, with the most bullish sentiment on Binance, the world’s largest cryptocurrency exchange. The meme coin hasn’t had the best of sessions recently, but it seems that a good chunk of traders are in for a rebound rather than more downside.

Majority of Binance Traders Expect Dogecoin Price Rebound

Coinglass data shows that Binance users are still quite optimistic about the price of Dogecoin. According to the metric, known as the Long/Short Ratio (L/S Ratio), tracking the percentage of bullish, or long, against bearish, or short, bets on cryptocurrencies, 72.46% of all open Dogecoin positions on Binance are long. As a result, there are only 27.54% positions against the coin, which represents a significant inclination towards a bullish sentiment among the platform’s users.

An increase in the number of long positions indicates that many traders see the recent price slump as a chance to get in on the action rather than a sign that prices may lose further.

However, the case is more bullish on Binance than on the rest of the crypto market. Again, data from Coinglass covering all exchanges they track tells another story where short positions still have the upper hand, at least slightly. Overall, 51.86% of all open Dogecoin positions in the market are short, worth over $1.15 billion. Only under $1.1 billion is in the long positions, and they are just 48.19%.

Across all exchanges, the narrow gap between long and short positions suggests that overall sellers still have the upper hand on market sentiment. Dogecoin’s ongoing price weakens still, yet daily trading volumes are now clocking in at more than $700 million, which may be explained for the most part by this longer prevailing bearish pressure.

Can Dogecoin Stage a Strong Comeback?

The sentiment on Binance is lower than in the rest of the market, but this is just an indicator of the split mindedness of traders with the meme coin struggling to find its footing in the north.

Traders are taking a more measured approach to their Dogecoin trading, looking to hedge their bets somewhat following the recent depreciation, and are wary of crypto market fear at the moment. Unsafe uncertainty has given rise to this conservative trading behavior. However, all historical trends suggest the saying ‘the darkest moment is just before dawn’ is all but a given; with markets undergoing reversals more often than not when the broader sentiment is not weighing up a rebound.

There is a creation of a strong Ascending Wedge pattern in Dogecoin’s price chart. If this pattern resolves, it could indicate the start of a sustained rally for the meme coin, the analysis said. From here, the upside target assessed is at $1.161, equal to more than 580% of today’s prices.