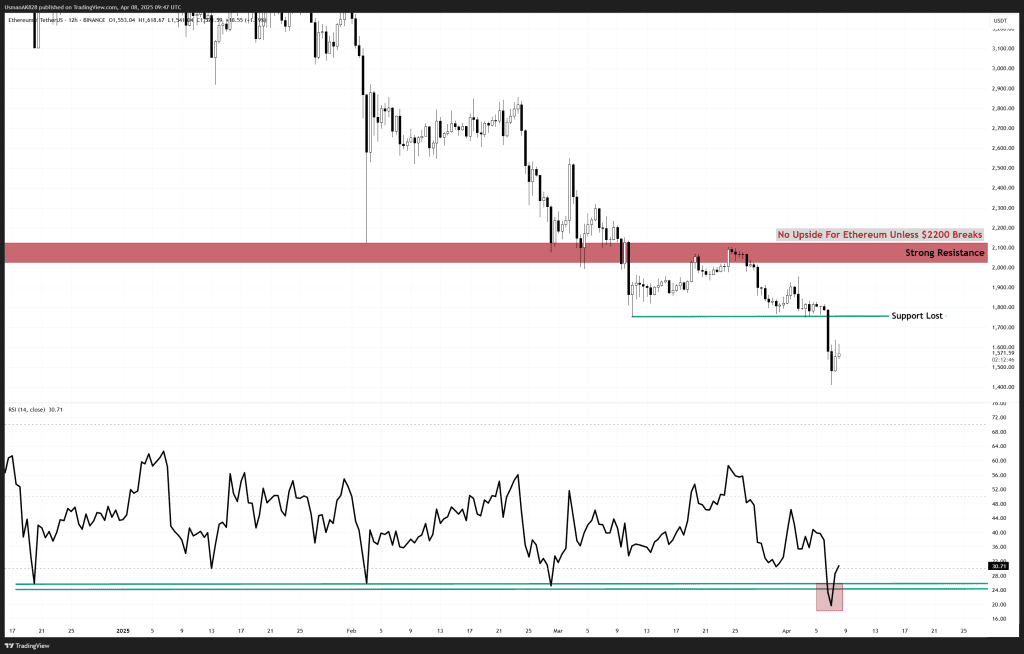

Ethereum Technical Analysis: 8 APR 2025

Ethereum’s RSI slips to its lowest levels since August 2024. Source: TradingView

General View

Ethereum remains under pressure after losing the key $1,700 support, a level that had kept the price stable for several weeks. The breakdown has exposed the weakness in structure, and RSI dropped to its lowest level since August, highlighting the intensity of recent selling and the overall weakness in momentum. However, after such an aggressive flush, the market may be setting up for a short-term relief move. If bulls can maintain the current reaction, a recovery toward the 61.8% or even the 75% Fibonacci retracement level could materialize before sellers step in again.

On The Upside

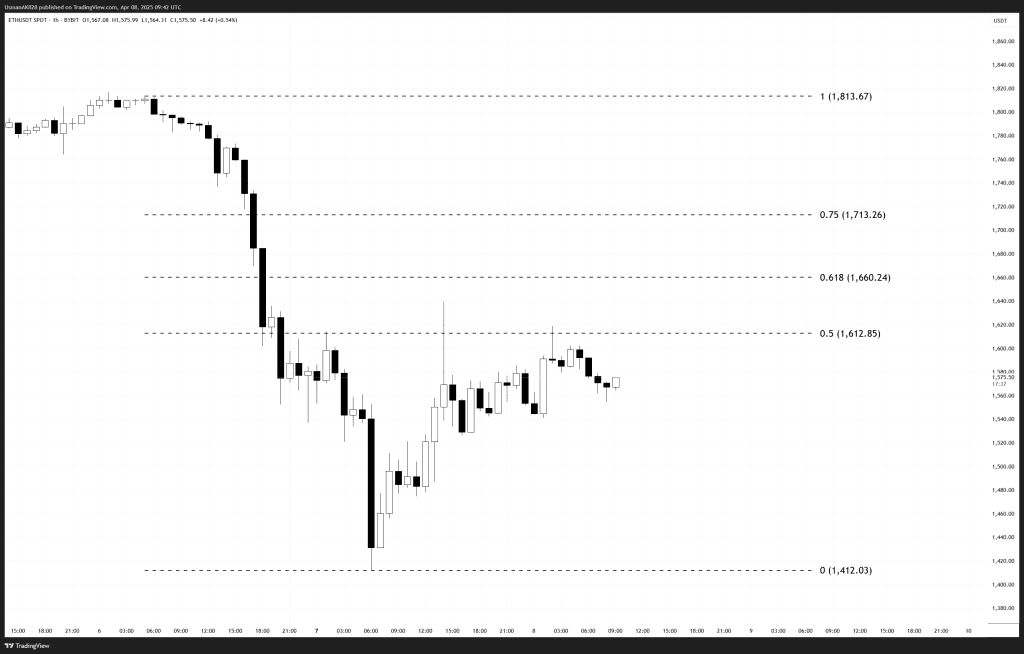

Ethereum is facing primary resistance at the $1615 level, which is a 50% Fibonacci point. If bulls can show any strength above this point, it could stretch the short-covering wave toward the $1660 and $1715 levels. This is where sellers are likely to step in again and negate any bullish momentum, eventually pushing for aggressive profit-taking.

On The Downside

The recent breakdown beneath $1760 opened the door for a deeper drop. Since losing this level, Ethereum has fallen by almost 20%. As for the session, the primary support for the day is at the $1530 to $1520 levels. The longer the price holds above these supports, the greater the chances for aggressive short-coverings. Any break below $1520, and the price gets exposed to the $1450 and $1420 levels once again.

Ethereum’s key short-term levels to watch for the session. Source: TradingView