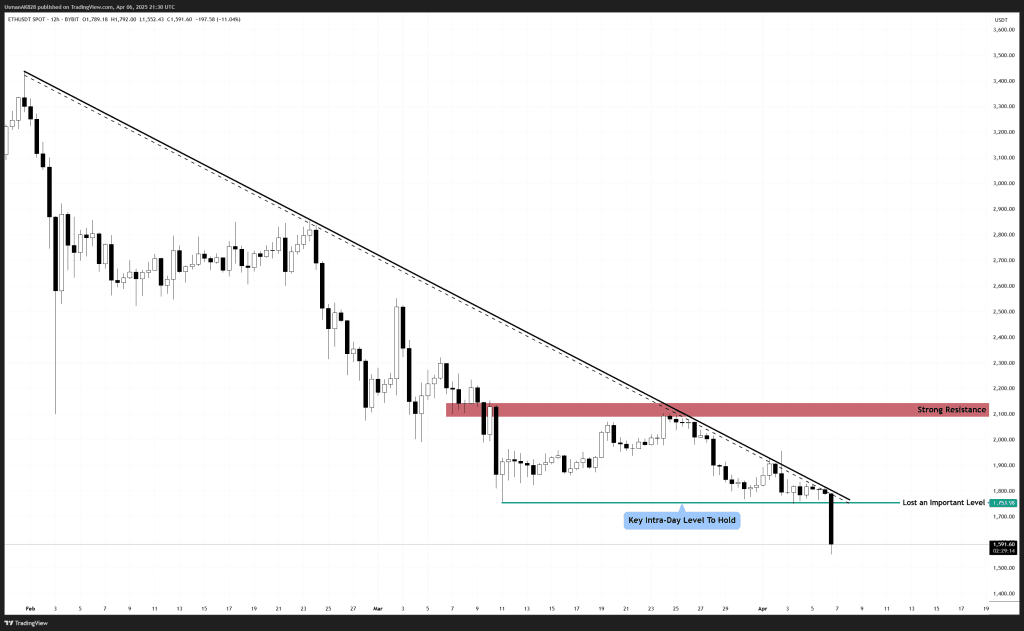

Ethereum Technical Analysis: 7 APR 2025

Ethereum loses key support level and enters a heavy selling phase. Source: TradingView

General View

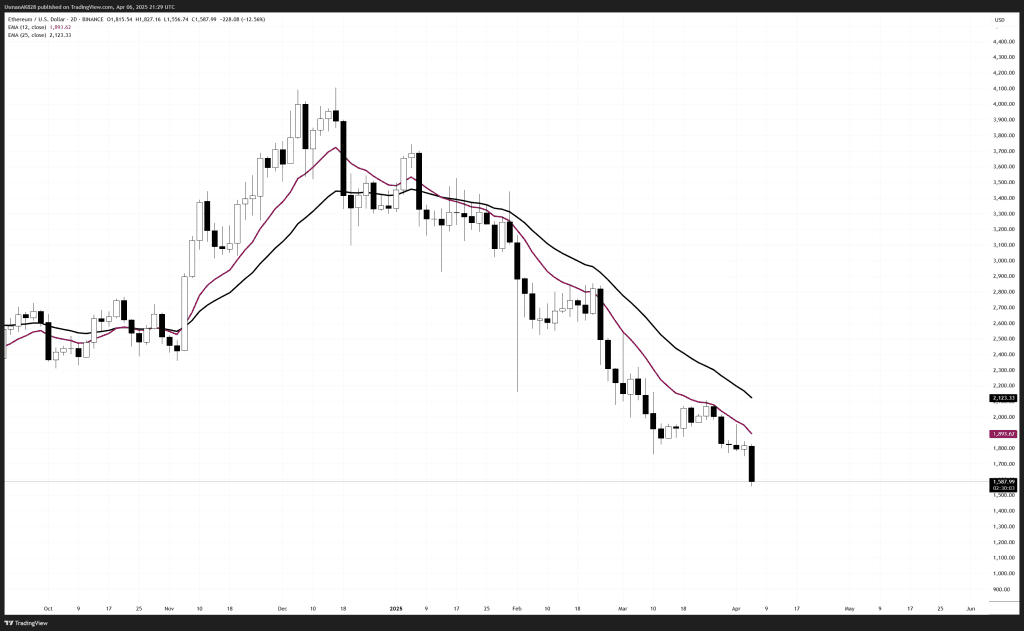

Ethereum has broken down from a multi-week structure, losing a key intra-day level that had previously offered stability. Price continues to move within a well-defined descending trendline, and the broader structure remains heavy. Since February 2025, the EMA-12 and EMA-25 have consistently capped upside attempts, reinforcing the dominance of short- and medium-term bearish momentum. So far, bulls have failed to find acceptance above these EMAs, and unless that changes, any strength will likely be met with renewed selling pressure.

On The Upside

Ethereum’s oscillating indicators are slipping into oversold territory, which could spark short-covering moves toward the $1620 and $1680 zone. This is where renewed selling pressure is expected to re-emerge. However, if bulls manage to break above this zone, short-covering could accelerate, with $1735 coming into view. Reclaiming this level would confirm a bullish divergence, potentially shifting momentum back in favor of the bulls.

On The Downside

The loss of the $1730 intra-day level has opened the door to further weakness. The price is now approaching the $1590 zone, but a failure to stabilize here could see Ethereum capitulating lower toward $1520 and potentially into the $ 1,480s, where some structural support exists.

Ethereum’s EMA band enforcing “Sell on Strength”. Source: TradingView