- According to reports, the Ethereum Foundation transferred 1,000 ETH, worth approximately $1.53 million, out of its treasuries for grants.

- Bloomberg’s Seyffart says Ethereum ETFs may get staking approval by May.

- Staking could be the catalyst that the Ethereum ETF market needs to close the wide inflow gap against the Bitcoin ETFs.

The Ethereum ecosystem has seen some fresh momentum this week. According to reports, the Ethereum Foundation transferred 1,000 ETH, worth approximately $1.53 million, out of its treasuries for grants. This move has not only reconfirmed the Foundation’s commitment to decentralized development but is also triggering ripples across the crypto market.

At the same time, speculation about a staking-enabled Ether ETF in the US could be inching closer. Here are some things to keep in mind as the market eyes regulatory clarity and technological innovation.

Ethereum Foundation’s Grant Boost And Why It Matters

Per reports from LookOnChain, 11 April saw the Ethereum Foundation transfer 1,000 ETH out of its treasuries to an undisclosed recipient at around 14:30 UTC. LookOnChain notes that the transfer of such a large amount of ETH (worth around $1.53 million) was purposed for grants.

Over the years, grants have been a major part of the foundation’s continued support for developers and projects contributing to the Ethereum ecosystem. Grant rounds in the past have helped to launch everything from scalability solutions to protocol development initiatives to public-good infrastructure and much more.

While many speculators have expressed confusion or even displeasure about the constant spending of the foundation’s funds, the grants serve as a signal that the Ethereum Foundation is confident in the ecosystem. Over the long term, these initiatives tend to be bullish. So far, Ethereum’s trading volumes have jumped by around 2.5% within the hour, with prices managing to hold above the $1,500 price level.

Ether ETFs Set to Receive Staking Capabilities

In a separate development, Bloomberg analyst James Seyffart recently revealed that the Ethereum ETFs could be on the waitlist for staking as early as May. This comes after the US’ SEC recently approved options contracts tied to spot Ethereum ETFs.

For some context, options trading gives investors the right (but not the obligation) to buy or sell ETH at a predetermined price. This means that investors can now implement hedging strategies and manage their portfolios much better. In essence, crypto is now even closer to traditional finance structures.

However, while the Options update is great news, the real game changer for the Ethereum ecosystem could be staking. This capability will allow Ethereum holders to lock up their tokens and contribute to the security of the network in exchange for staking rewards. This means that if the ETFs are allowed to stake, it could provide an additional layer of income for investors and could make staking ETFs more attractive than their non-staking counterparts.

Why Staking in ETFs Could Be a Big Deal

The SEC has not yet approved the staking capabilities for the Ether ETFs. However, Seyffart believes that we could be seeing progress soon. The final deadline for the decision is set for late October, with possible updates expected in May and August.

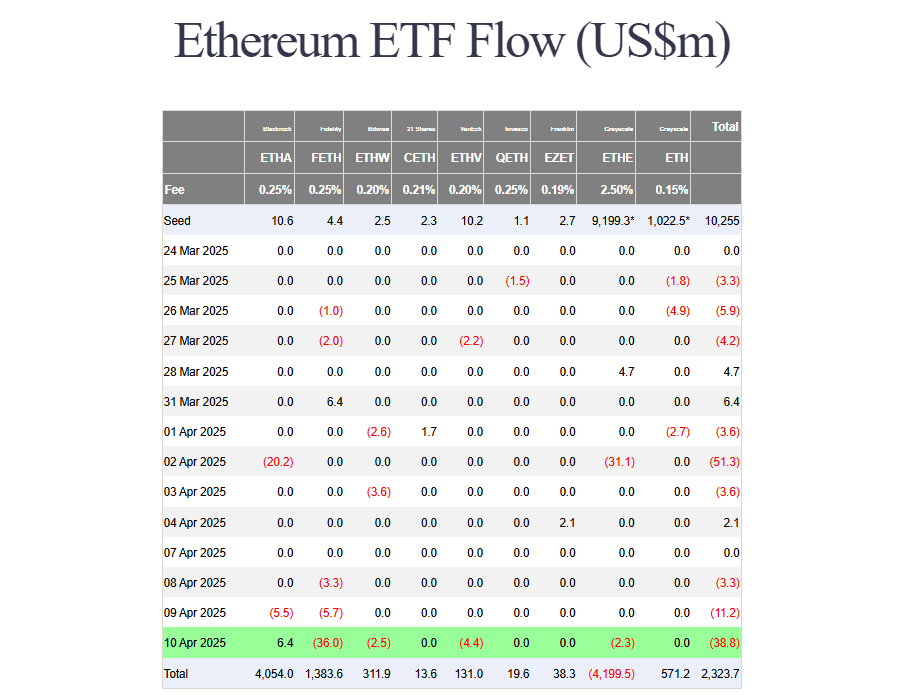

This timeline leaves some room for optimism, especially with how the ETH ETFs have underperformed compared to their Bitcoin counterparts. Farside investors’ data shows that these products have only seen modest inflows of around $2.4 billion, as opposed to the Bitcoin ETF market with a relatively massive $35 billion.

Staking could be the catalyst that the Ethereum ETF market needs to close such a wide gap, or at least diminish it.