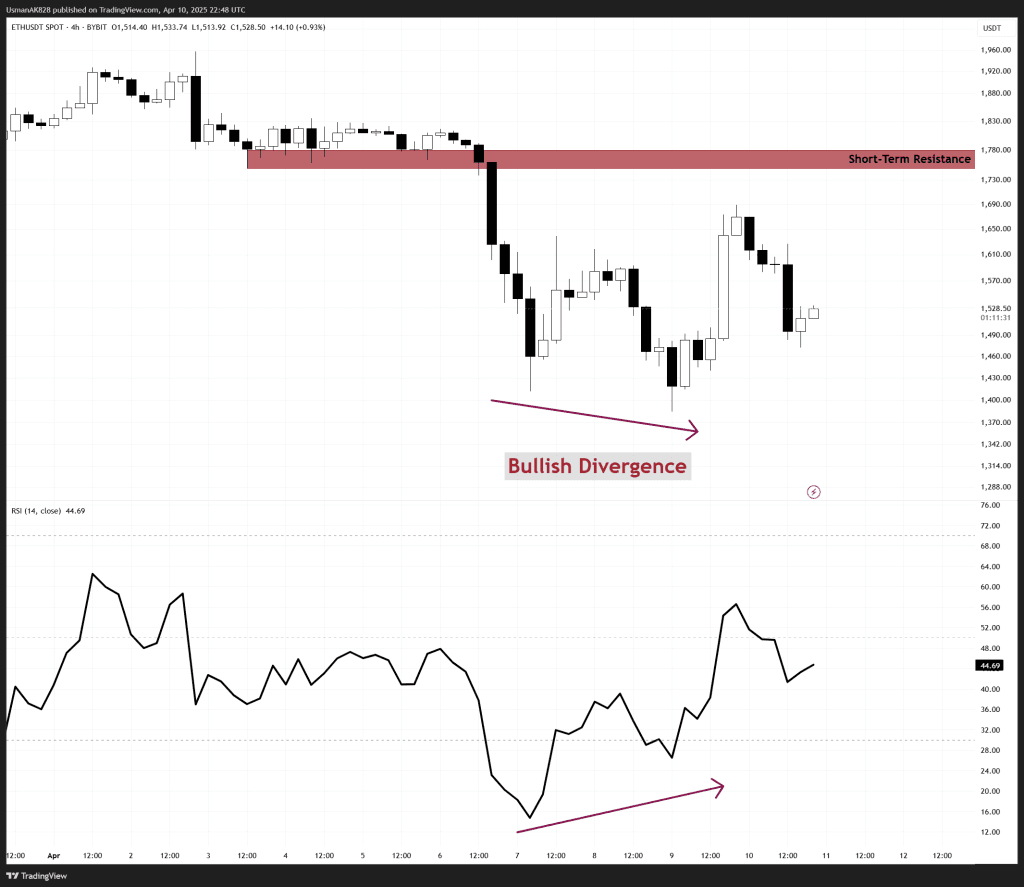

Ethereum Technical Analysis: 11 APR 2025

Ethereum lower-time frame printing bullish divergence! Source: TradingView

General View

Ethereum has bounced back in recent sessions, recovering a portion of its sharp sell-off and re-entering a short-term congestion zone. Bulls have managed to capitalize on a developing bullish divergence on the RSI, showing resilience despite broader weakness. While the structure remains fragile, this rebound has put Ethereum back into a potential recovery path. However, any sustainable upside will require strong momentum and follow-through above the current resistance levels.

On The Upside

The immediate challenge lies between the $1570 and $1600 levels. Above these primary resistances, the next layer is positioned between $1640 and $1670, both of which are expected to be challenging for the bulls. However, for the session, $1780 remains a key level, as a breakout above it would likely trigger a much stronger upside move.

On The Downside

The short-term supports are forming around the $1460 to $1480 range. A breakdown below this could put renewed pressure on the bulls and expose ETH to a retest of the recent lows near $1,370. If this level fails to hold, the broader downtrend may resume, however, as of now, the chances for a successful base are higher.

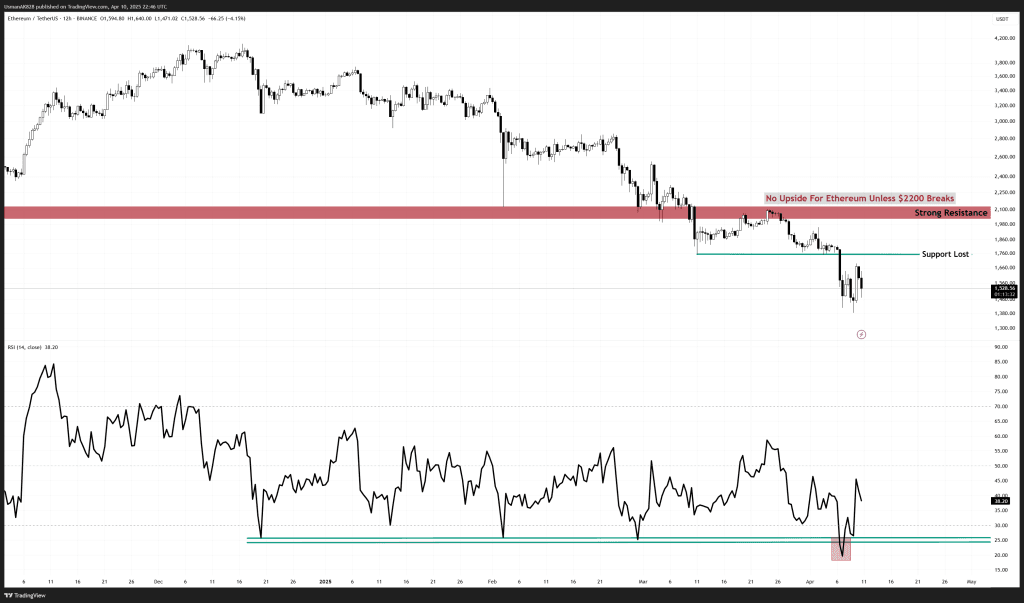

Ethereum price chart for 11th April 2025. Source: TradingView