GameStop Move Heavily Into Bitcoin: The recent announcement has sent the entire crypto space buzzing. OnMarch 26 2025, they announced plans to raise a whooping $1.3B to buy BTC which is considered as a treasury asset.

This move has got the crypto world buzzing, and it’s shaking up GameStop’s stock too. Here’s the breakdown below.

Reason Why This Bitcoin Scoop is a Big Deal

GameStop is trending after they decided to venture into crypto, just like Strategy™ (formerly MicroStrategy – CNBC Wed, Feb 5 20253:14 PM EST ) went all-in a while back. With Bitcoin hovering around the $86,000 – $88,000 mark (dipped a bit from that $100k high earlier this year), a brick-and-mortar spot like GameStop dropping $1.3 billion is a clear sign crypto is hitting the mainstream. It’s a bold move, no doubt, and could totally attract more companies to jump on the Bitcoin trend.

What is Going On Between GameStop and Bitcoin?

The Plan: $1.3 Billion for Bitcoin

GameStop let the cat out on March 26th, that they’re going to raise $1.3 billion by issuing convertible senior notes – basically, borrowing some serious cash to buy Bitcoin. This comes right after their announcement on March 25th that the bigwigs gave the thumbs up for Bitcoin to become a treasury reserve. They’re not exactly short on cash either, sitting on $4.77 billion already, so they’re geared up to make this happen. GameStop’s saying the money’s for “general corporate purposes,” which definitely includes stacking up on Bitcoin to fit their new investment game plan.

Taking Notes from the Strategy Guys

GameStop’s not exactly inventing the wheel here. Strategy™, formerly MicroStrategy, with Michael Saylor at the helm, has been a Bitcoin whale for ages, holding Bitcoin worth billions. Funny enough, GameStop’s CEO, Ryan Cohen, even teased some crypto vibes back in February with a photo op alongside Saylor. Now, it looks like they’re running a similar play, and yeah, everyone’s got an opinion on it.

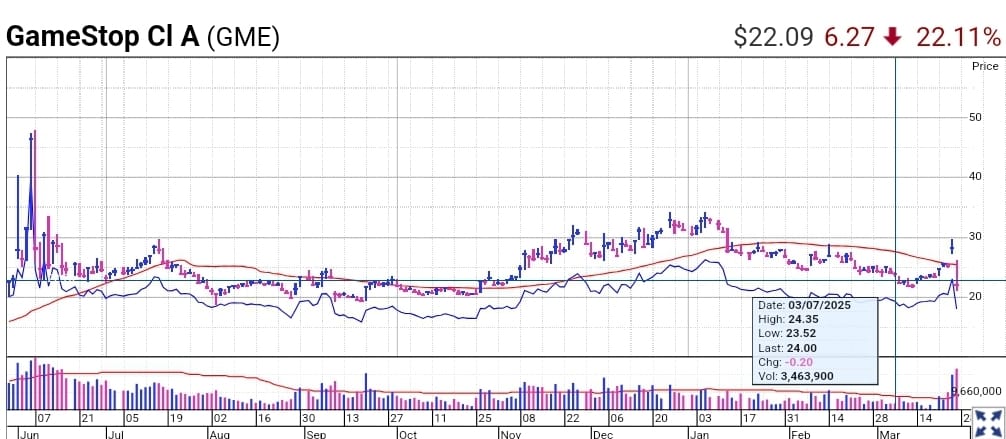

How the News Shook Up GameStop’s Stock Price

GameStop’s stock ($GME) jumped big after the news. On March 25th, it shot up 16% in after-hours trading. By March 26th, it hit $28.79 in pre-market, a solid 17% jump. However, things are not always ideal as planned. On March 27th. However, the stock tumbled 22% during Thursday trade. after the $1.3 billion raise was confirmed. Maybe some investors are side-eyeing the debt, but overall, the vibe seems pretty energetic.

What the Charts Are Telling Us

Before all this Bitcoin buzz, $GME was chilling around $24.50. That March 25th announcement gave it a good push to $28.79 – not bad at all. The 22% dip to $22 on March 27th Could be some folks taking profits or just a bit of uncertainty. But the thing is trading volume on March 26th was through the roof! Millions of shares were changing hands, you could see on the chart. Though Bitcoin’s chart a little less steady, down to $87k from that $100k mark earlier this year