The Japanese cryptocurrency for the NFT game De:Lithe Last Memories was pulled from trading platforms after players discovered a way to rack up unlimited earnings.

GEEK Delisted After Failing Exchange Standards

Enish, the game’s maker, announced that their token, GEEK, the main currency in the blockchain-based roguelike gacha De:Lithe Last Memories, was dropped from the Bitget exchange on April 9, 2025, for not meeting its standards. On April 24, Enish shared news of another delisting from Gate.io, leaving GEEK with no market price to reference. As a result, Enish stopped some in-game features until the problem is sorted out.

Rule Change Leads to Economic Collapse

As a blockchain game, Last Memories used a first-come, first-served system, limiting how many players could cash out in-game assets each day. Players complained these limits were too tough, so on October 18, 2024, Enish said they’d ease restrictions, starting with a 10-times boost to GEEK’s conversion cap.

YouTube gaming commentator Nagaido pegged this as the start of the game’s economic collapse. A promotional deal, part of the withdrawal relief, let players set up a profit cycle by buying and cashing out assets, which sank GEEK’s value further.

The 1.4x Profit Loop

The deal encouraged:

- Trading GEEK (swappable for real money) for xGEEK (used only in-game)

- Giving players bonus xGEEK Lite for each trade

- Players could use this bonus to buy more NFT characters

- Earning extra GEEK to swap back to xGEEK while keeping the surplus

Nagaido said this cycle could bring a 1.4x profit per round.

Further Inflation via NFT Character Sales

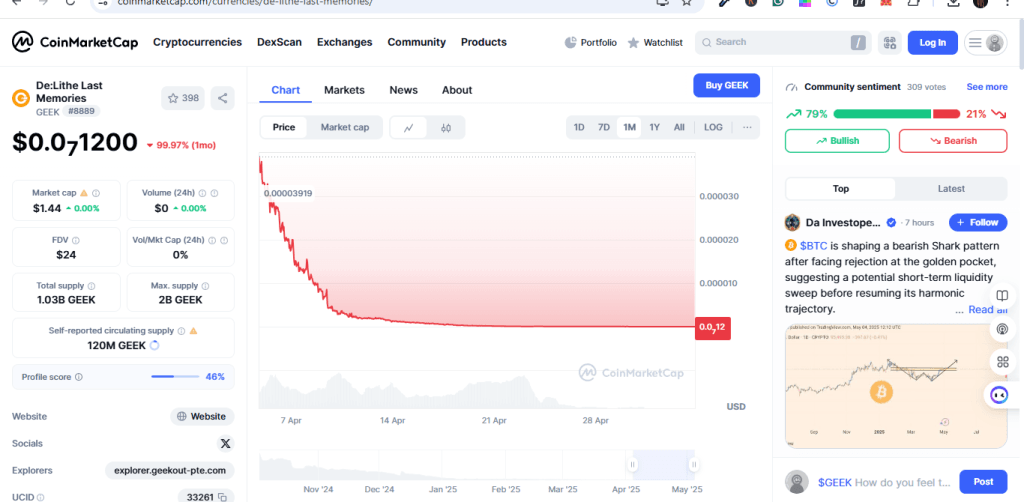

Another problem came with NFT character sales in November and December 2024, in which players could cash out for 1.2x more GEEK than their yen value. Fluctuation of the price of GEEK since the game’s launch in 2024; image courtesy of CoinMarketCap

Enish Attempts Damage Control

Enish tried to fix the damage and get the game’s economy back on track by bringing back withdrawal limits on January 10, 2025. We have seen GEEK prices falling recently. As prices drop, players get more GEEK from xGEEK trades. This makes withdrawal tasks simpler, increasing personal withdrawal caps, a cycle that worsens the price fall.

This led to GEEK’s removal from Bitget in April 2025, followed by its delisting from GitHub, erasing its market price reference and making it unusable for trading. Enish is now talking with GEEK’s issuer to fix these issues and revive the currency.

On a related note, Enish revealed around December 2024 that it had hit its 10th straight year of financial losses, reporting an interim net loss of 745 million yen (roughly $4.9 million) that year.

What Went wrong?

The team behind GEEK offered no long-term plan. There was no ceiling on supply, no meaningful use for the token, and no system to keep the economy in check. Players came in for quick gains and left when the market crumbled.

Strong games do the opposite.

The Sandbox, for example, limits its token supply and ties it to in-game decisions. Splinterlands burns unused tokens to prevent inflation and keep demand steady. Illuvium lets players vote on updates and earn by staying active. These are not just design choices, they are survival tools.

Final Thoughts

To avoid losses, players need to read past the headlines. A good game has a clear plan for how its economy works. It gives players something to do with the token, not just trade it. And the developers? Their track record matters. A shaky past usually leads to a shaky future.

In the end, token mechanics are make-or-break. GEEK had the style but not the structure. That’s a lesson players can’t afford to ignore.