- Robinhood may soon bring Wall Street to the blockchain for its EU users, with plans to introduce tokenized versions of U.S. stocks.

- This way, instead of having to buy equities directly, investors from all over the world can simply buy the tokenized versions and trade as normal.

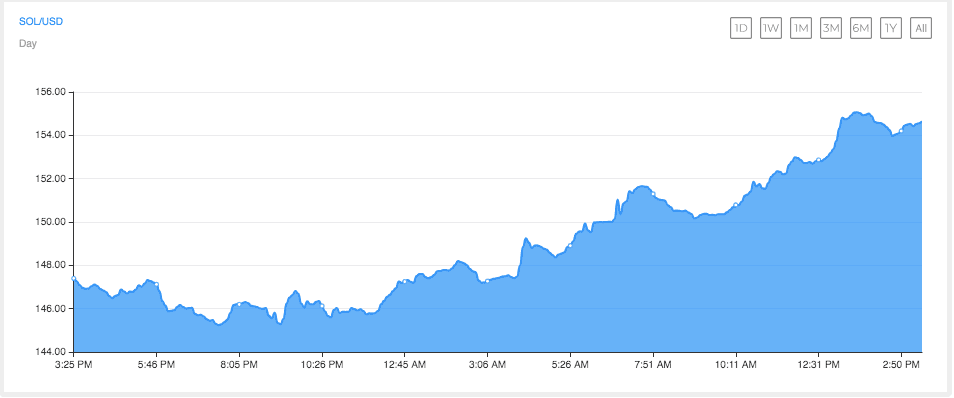

- Analysts see an incoming price surge for Solana, with more calls for a push towards $200.

Every day, Trad-Fi and Defi continue to take steps towards one another. The latest updates involve Robinhood considering launching tokenized versions of U.S. stocks for its European Union (EU) clientele. This new headway could be a major win for the convergence of blockchain and mainstream finance. Here’s why global access to American equity markets could become reality very soon, and what this could mean for Solana.

Improving Access to U.S. Markets

The last few years have seen international investors struggle with buying US stocks. These investors have suffered everything from regulatory constraints to tiresome onboarding processes. However, Robinhood is stepping in to fill the gaps by using blockchain technology to create tokenized assets that represent U.S. equities. This way, instead of having to buy these equities directly, investors from all over the world can simply buy the tokenized versions and trade as normal.

Robinhood is reportedly considering building this new system on either Solana or Arbitrum. These two were chosen because they are some of the most popular and efficient networks on the market. The planned expansion comes after a series of impressive financial milestones from Robinhood, including its acquisition of a brokerage license in Lithuania.

The regulatory approval for this new system has already been secured in parts of the EU, and Robinhood is closer than ever to scaling its services across the continent. Per Bloomberg, the tokenized platform will come with a collaboration with a crypto-native financial services firm. While more specifics are under wraps, the US market is about to become more accessible with the help of blockchain’s speed and global reach.

24/7 Stock Trading?

One of the most attractive parts of Robinhood’s plans is the possibility of 24/7 trading of U.S. equities. Blockchain is a lot unlike regular stocks, in that it doesn’t operate on fixed hours. These tokenized stocks will be free to trade globally at any time, and will open the doors for both retail and institutional investors. This around-the-clock access is expected to bring deeper liquidity to markets that are usually untradeable over weekends and holidays.

Retail traders in the EU will have more control, better price discovery and will be able to respond to news in real time. In addition, tokenized assets offer better settlement mechanics and are a lot more programmable than traditional financial markets. This makes them attractive to savvy investors, hedge funds, family offices and asset managers looking to improve their portfolios.

In addition to this major news, Armani Ferrante, the founder of Backpack recently announced the official launch of the platform’s SOL reserve pledge plan. According to Ferrante’s announcement, fees collected from the platform will be directly distributed to borrowers and will likely involve depositors in the future. This stands as one of the many wins that Solana has been making over the last few months.

What It Means for Solana

Solana seems to be flexing its strength in response to the latest developments. As per price data lately, the token has climbed about 3.3%, changing hands near $152 at publication.

Analyst World of Charts recently pointed out that this impressive move from Solana could only just be the beginning, as the cryptocurrency is now trading within a falling wedge formation.

World of Charts suggests that if SOL rallies above this pattern, it could ignite a swift move, possibly propelling the price toward $200 in the near term. Already, Solana’s network metrics are looking strong with analysts like Crypto Rand pointing towards a combined upward move from networks like Solana, Base, and SUi. If Robinhood indeed moves ahead with these plans, Solana could benefit massively from the resulting wave of institutional adoption.