- BlackRock’s IBIT led all spot Bitcoin ETFs with $531M in inflows, pushing its assets to $58.68B and total inflows to $44.21B.

- Total spot Bitcoin ETF net assets hit $110.68B, representing 5.91% of Bitcoin’s market cap amid varied fund flows.

- Despite active trading, all nine U.S. Ethereum ETFs saw zero flows, with $6.31B in assets and minor daily price drops.

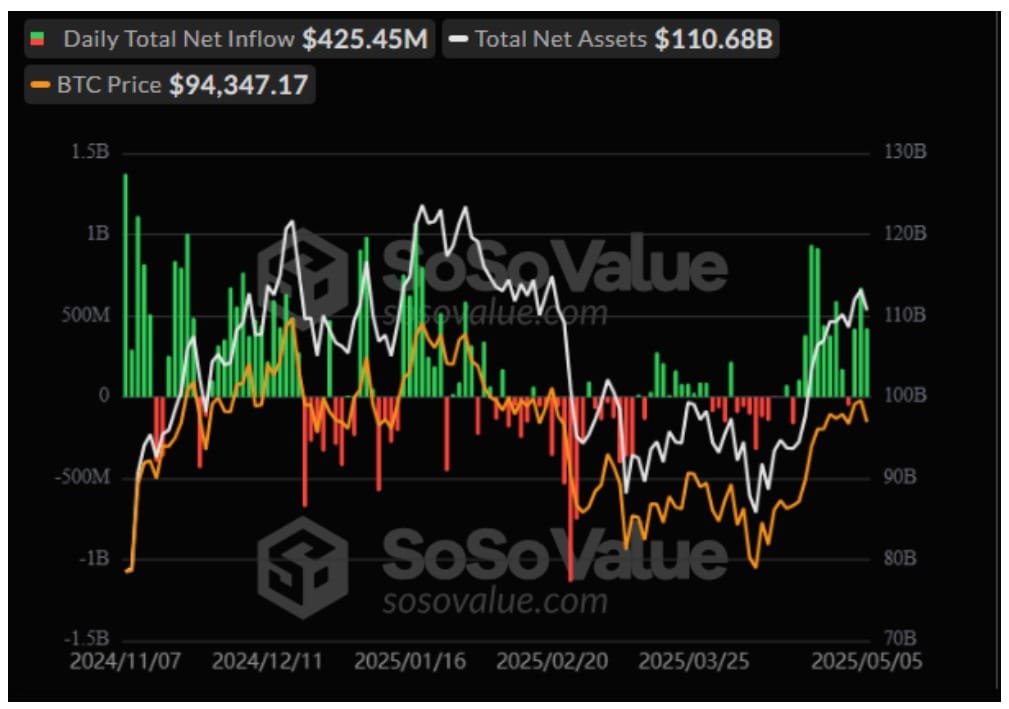

Spot Bitcoin exchange-traded funds (ETFs) collectively posted significant inflows on May 5, continuing their inflow streaks into this asset class in the past three days. This sustained inflow trend reflects growing investor interest and increasing institutional adoption of spot Bitcoin ETFs. During this period, Ethereum funds witnessed zero capital movements across all investment vehicles.

IBIT Tops Spot Bitcoin ETFs with $531M Inflows Amid Mixed Flows

Data from SoSoValue shows that BlackRock’s IBIT was the only vehicle that attracted capital inflows on the day. The fund shoveled in net inflows of $531.18 million, bringing its cumulative net inflow to $44.21 billion. In addition, its net assets rose to $58.68 billion, firmly establishing the fund as the dominant spot Bitcoin ETF in the market.

At the same time, five ETFs recorded net outflows on May 5, while the remaining six funds recorded zero net flows. Fidelity’s FBTC suffered the highest liquidity outflows, recording capital withdrawals of $57.82 million. Still, its cumulative inflow remains strong at $11.60 billion, and it holds $18.74 billion in net assets, second only to IBIT.

Grayscale’s GBTC posted a diminished holding of $16.37 million as it struggles to regain market footing. This brought its cumulative net outflow to $22.76 billion, though it still maintains $17.94 billion in net assets.

Other funds with outflows included ARKB (Ark & 21Shares), which lost $6.14 million despite a total cumulative inflow of $2.64 billion and $4.53 billion in net assets. Bitwise’s BITB experienced a significant outflow of $22.66 million, reducing its short-term momentum even though it has accumulated $2.04 billion in net inflows and manages $3.64 billion in assets. Franklin’s EZBC also recorded a modest outflow of $2.74 million but remains net positive with $259.73 million in cumulative inflows and $492.52 million in net assets.

Zooming in, Grayscale’s BTC, Invesco BTCO, and Valkyrie’s BRRR recorded neutral capital movements. WisdomTree’s BTCW, Hashdex’s DEFI, and VanEck’s HODL ended the day without capital flow into each fund. Yesterday’s market outing takes the cumulative total net inflow across all spot Bitcoin ETFs to $40.66 billion and the total daily net inflow to $425.45 million. Likewise, the total net assets amount to $110.68 billion, representing approximately 5.91% of Bitcoin’s total market cap.

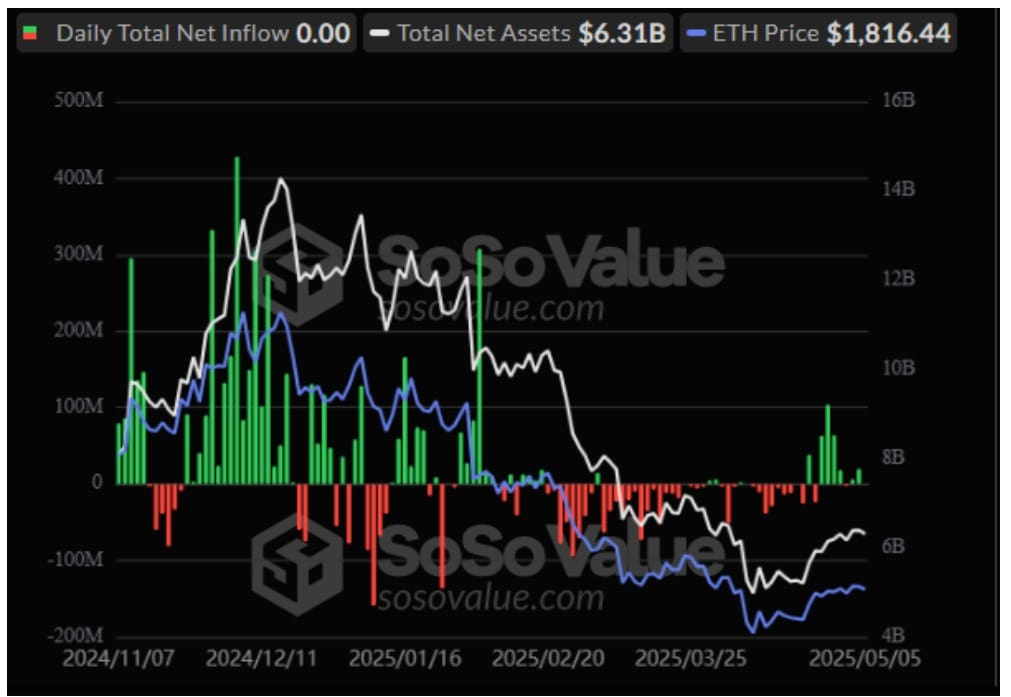

Ethereum ETFs Flat on Flows Despite $6.31B in Assets and Active Trading

While Bitcoin ETFs posted a return, all nine U.S. spot Ethereum ETFs recorded zero net inflows or outflows, indicating a complete lack of capital movement throughout the day. Despite the stillness in fund flows, the Ethereum ETF market held a cumulative total net inflow of $2.51 billion, with $6.31 billion in total net assets, representing 2.89% of Ethereum’s market cap.

BlackRock’s ETHA remained the largest by assets, holding $2.30 billion, followed closely by Grayscale’s ETHE at $2.06 billion. Notably, ETHE still shows a negative cumulative net inflow of -$4.30 billion, a reflection of significant past outflows.

Grayscale’s ETH reported net inflows and net assets of $616.98 million and $875.61 million, respectively. Meanwhile, Fidelity’s FETH followed with $1.46 billion in net inflows and $770.63 million in assets. Across the board, ETFs posted modest price declines. Daily price changes ranged from -1.14% to -1.44%, reflecting a slight downturn in Ethereum’s market price. Trading activity persisted, with ETHA leading in volume at 4.63 million shares traded and $63.47 million in value.