- China is selling 15,000 seized Bitcoins worth up to $1.4 billion, diverging from other nations planning BTC reserves.

- Local governments use offshore firms to liquidate digital assets, raising concerns over China’s strict cryptocurrency ban.

- The BTC sell-off could pressure global crypto markets, impacting Bitcoin prices and investor sentiment amid economic uncertainties.

At a time when most countries, like the U.S., are looking to stock BTC as a national reserve, China remains on a different approach with the sale of 15,000 seized Bitcoins, valued at around $1.2 to $1.4 billion, according to Reuters. All these Bitcoins are reported to have been seized from various criminal cases, including money laundering and other illegal ways of transferring funds. After that massive selling, the BTC balance sheets of local governments will stay empty.

After the year 2021, when China prohibited cryptocurrency, no clear regulations on seized digital assets in the country have been established. Consequently, a very random approach has been created. Among many cities that lack money and are in immediate need of cash, are pushing courts for permission to sell their BTC through private offshore channels.

Why China Sells Bitcoins, While Other Countries Plan BTC Reserve

The country’s plans to sell the coins are a response to the increased demand for funds. The state’s budget shows a 65% increase in revenue from fines and confiscation within five years, and, therefore, reaching 378 billion yuan in 2023. Digital currency-related cases are partly the reason for the surge, and that is why investigations of money laundering increased to 3,032 last year. In total, crimes involving digital assets surged to over 430 billion yuan ($59 billion).

Local authorities have turned to private tech firms to move the seized coins. One company, Jiafenxiang, based in Shenzhen, reportedly sold more than 3 billion yuan worth of digital assets on offshore platforms for cities like Hua’an, Taizhou, and Xuzhou. The U.S. dollar earnings from these sales were then converted into yuan and wired into local government accounts, creating an unorthodox yet highly effective revenue stream.

While the tactic fills gaps in public financing, it’s raised eyebrows. Critics like Professor Chen Shi argue it clashes with China’s strict crypto ban. Legal minds across the board are now calling for a national strategy instead of this city-by-city scramble.

Ru Haiyang, co-CEO at Hong Kong’s HashKey crypto exchange, echoes that sentiment, suggesting China treat these seized coins as strategic assets rather than quick cash. Legal experts such as Sun Jun are urging reforms to clarify crypto’s legal status, establish disposal protocols, and properly vet third-party firms involved in sales.

“It is a highly profitable business that attracts more and more participants,” said Sun Jun.

Selling Pressure on Broader Crypto Market

If China’s sell-off is carried out as planned, the market could be flooded, and Bitcoin’s price may be dragged down while many investors are hoping next bull run for the cryptocurrency. Risk is increased by world disputes, such as Trump’s tax of 245% on China, which has also pushed the global crypto markets into a downturn.

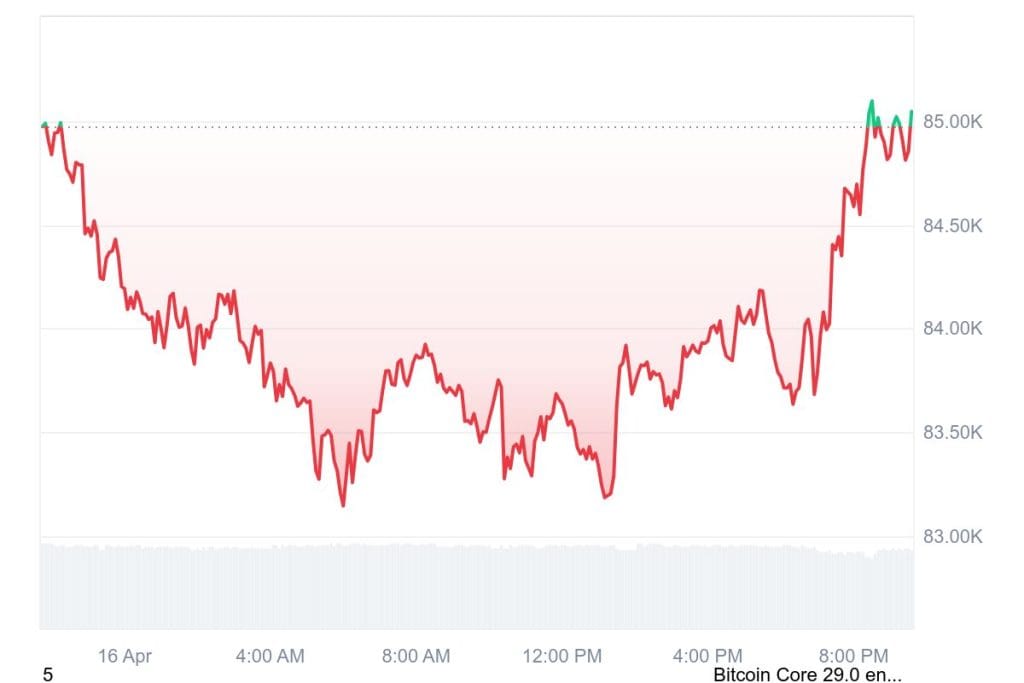

The 15,000 Bitcoin sale idea has already pushed the Bitcoin price by almost 1%. The market could again fall to the $80k zone if there is panic selling. However, the possibility exists that a rejection of the sale in court and the acquisition of the national reserve may lead to the bulls expecting the price to reach $90k, helped along by MicroStrategy’s recent buying spree.

Apart from the China Bitcoin selling pressure, the Coinbase April 15 report predicts that a broader crypto market rebound is likely in Q3. According to the report, the altcoins market cap decreased by 41% from its December 2024 highs of $1.6 trillion. Bitcoin can fall 20% in a week but still be in an overall rise, or the opposite.