- Ethereum has seen one of the most brutal crashes of the year, after seeing its price tumble to a two-year low of around $1,410.

- Much of this sell-off seemed to have come from short-term holders, who saw more than $500 million in losses alone, per data from Santiment.

- A drop to $1,000 is possible, but MACD and RSI hint that bear strength may be fading.

Ethereum is currently facing one of its harshest challenges in recent years. Over the last few days, the cryptocurrency has seen one of the most brutal crashes of the year, seeing its price tumble to a two-year low of around $1,410.

Even though the cryptocurrency has recovered slightly above the $1,500 zone, the wider market trend shows that there might be more pain ahead for the crypto industry, especially if the DeFi liquidations continue to pile up.

ETH Tumbles as Short-Term Holders Flee

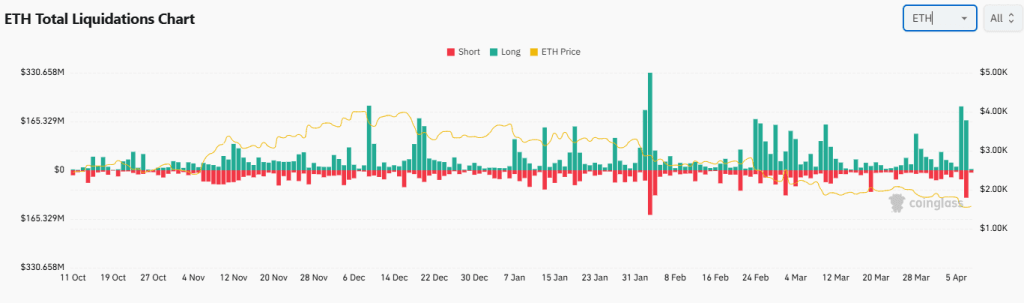

Ethereum dropped by more than 27% in just two days this week. According to data from Coinglass, this move triggered nearly $300 million in ETH liquidations across the derivatives market.

Interestingly, much of this sell-off seemed to have come from short-term holders, who saw more than $500 million in losses alone, per data from Santiment. This kind of panic-selling often shows a great deal of fear and capitulation.

Most of the ETH being sold had been acquired less than three months ago, indicating that the investors who are currently selling were the ones who bought close to the yearly top. These investors now appear to be jumping ship, especially as prices are now heading south. If the more seasoned holders start to capitulate and follow in the footsteps of the short-term holders, Ethereum could be in for some serious pain ahead.

DeFi Liquidations Are Adding Fuel to the Fire

Another main issue with Ethereum’s rapid price decline comes from the defi liquidations. As the price of the cryptocurrency dropped, many traders with leveraged positions were forced to liquidate, leading to a wide outbreak of liquidations, according to Coinglass data.

One of the most brutal examples of this was from Sky (formerly Maker), which recently liquidated a whale’s collateral worth 53,074 ETH (or about $74 million).

LookOnChain says a whale added 10,000 ETH and 3.52M DAI to avoid liquidation at $1,119. This means that If Ethereum drops below the $1,119 price level, this whale could lose it all. Aave also saw $162 million in liquidations on Monday alone, with prices continuing to flirt with major support zones. The DeFi landscape could be a major pressure point for Ethereum in the future, and the future appears uncertain.

Is a Drop to $1,000 Possible?

From a technical standpoint, Ethereum appears to be in serious trouble if the bulls do not step in soon.

The cryptocurrency is now trading near the $1,522 zone and is clinging to the lower boundary of the descending channel illustrated. This channel has held since December of last year, and a break below this support zone could send prices tumbling lower.

With this in mind, if the bulls manage to defend Ethereum at this key price level, prices could push higher. The $1,800 mark is a major resistance for Ethereum at this point, considering how it is reinforced by the upper trendline of this channel.

Still, the MACD histogram is in negative territory, and the RSI on the daily chart is deeply oversold. This means that while the bears have all the muscle, their strength could be waning after taking in so much profit.