- Metaplanet set to up its BTC stash by securing $21.25M through interest bonds and aims to reach 10,000 BTC stash by year’s end.

- The firm now holds 5,555 BTC and ranks as the largest corporate BTC holder in the Asian continent based on recent reports.

- Metaplanet stock surges over 1,600% YTD, fueled by aggressive BTC accumulation and investor confidence in its strategy.

Metaplanet has issued yet another interest-free bond to equity hedge fund company EVO FUND to buy more Bitcoin as it seeks to become the largest corporate BTC treasury globally. At the same time, Bitcoin crossed the $100,00 market in the recent intraday session.

Metaplanet Raises $21.25M to Buy More Bitcoin

In a May 9 disclosure, the Japanese company announced it has secured $21.25 million (¥3.22 billion) to buy more Bitcoin following its latest “0% Ordinary Bonds” issuance, referred to as the 14th Series of Ordinary Bonds.

The firm stated:

Metaplanet Issues 21.25 Million USD in 0% Ordinary Bonds to Purchase Additional $BTC,

Each bond has a face value of USD 625,000 and will be repaid at full value by November 7, 2025, with no interest accrued. Furthermore, bondholders may request early redemption by notifying the company in advance. Metaplanet reserves the right to redeem bonds early if sufficient funds are raised by exercising specific stock acquisition rights.

The company explained that this issuance is expected to have minimal impact on its consolidated financial results for the fiscal year ending December 2025. Moreover, the bonds bear no interest and are unsecured, meaning they are not backed by any collateral or third-party guarantee.

Zero-coupon bonds do not pay interest. Instead, the holder purchases them at a lower price than the face value and profits from the difference between the purchase price and the face value at maturity. Since its crossover to a Bitcoin treasury in April 2024, the company has adopted Strategy’s Bitcoin accumulation model, aiming to hold 10,000 BTC by the end of the year. At present, the firm is the largest corporate BTC holder in Asia and the eleventh largest globally, as per BitcoinTreasuries.NET.

Bitcoin Holdings Surge as Stock Jumps 1,600%

Two days ago, the Tokyo-based firm secured $25 million (¥3.6 billion) in non-interest-bearing bonds to bump its BTC coffers. In a follow-up statement, the company disclosed another 555 BTC investment, bringing its total holdings to 5,555 BTC.

Market experts speculate that the firm’s recent bond issuance could fund the purchase of 206 Bitcoin. Data from Google Finance shows that the company’s stock has skyrocketed over 1,600% year-to-date and is changing hands at 511 Japanese yen ($3.50).

BTC Nears $103K Amid Bullish Surge and Greedy Sentiment

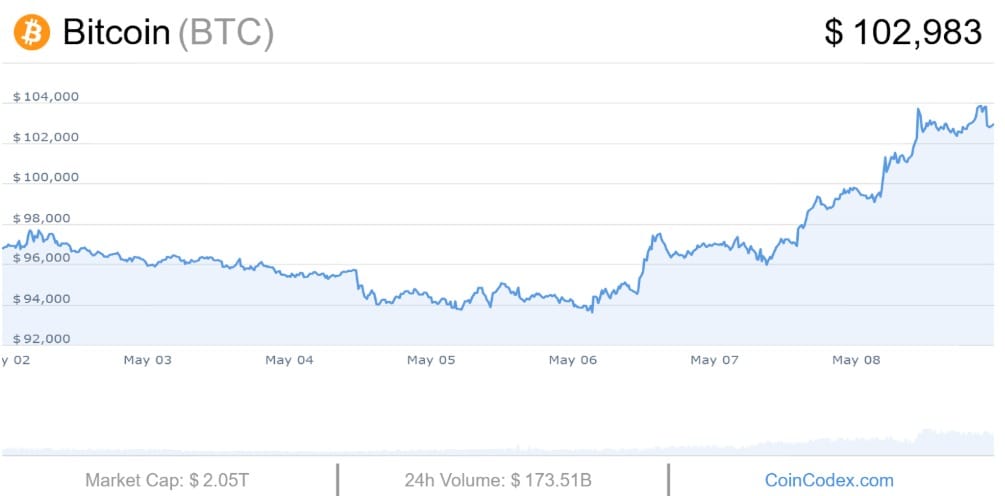

Bitcoin trades at $102,983 after rallying over 3% in the recent intraday market. II has shot up by 68% in the past year and outstripped the performance of several top coins.

The apex asset currently holds a bullish market sentiment and a high Fear and Greed score of 73 (Greed). It also saw 20/30 green market outings and trades close to its cycle high of $104,336, per Coincodex data.