- Mt. Gox transferred 11,501 BTC, worth $1B, hinting at creditor payouts and possible exchange sell-offs soon.

- Bitcoin’s price fluctuates near $87K, with analysts eyeing $90K if resistance breaks.

- Repayments from Mt. Gox’s 2014 collapse continue, stirring short-term market swings as traders watch.

Mt. Gox has shifted a hefty pile of Bitcoin yet again. This time, it’s over 11,500 BTC, sparking talk about whether it’ll flood exchanges and push prices down. Bitcoin’s value has been bouncing around lately, though some experts see it climbing past $90k soon. These transfers tie into the exchange’s long-running effort to pay back creditors.

Mt. Gox Transfers Over 11,500 BTC

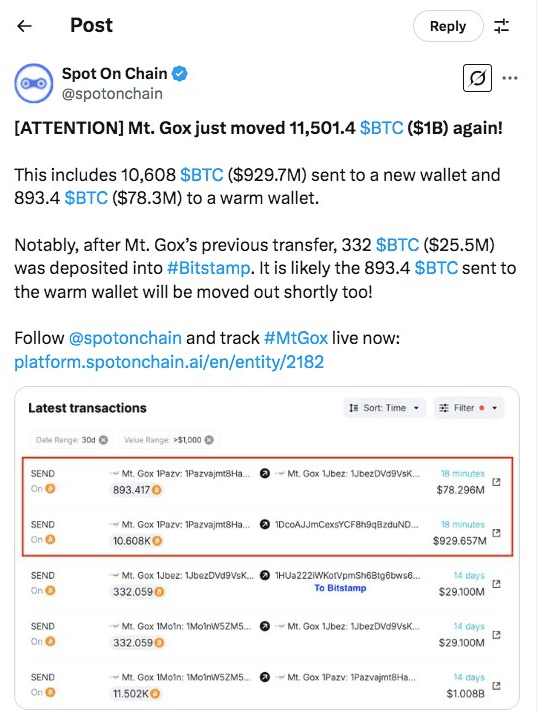

Blockchain tracking platform Spot On Chain reported that Mt. Gox moved 11,501.4 BTC, worth approximately $1 billion. The transfer included 10,608 BTC sent to a new wallet and 893.4 BTC directed to a warm wallet.

Previous transactions suggest that BTC moved to warm wallets and is often later transferred to exchanges. Earlier this month, 332 BTC from a similar transaction was deposited into Bitstamp. These transfers align with the long-running repayment process for creditors of the defunct exchange.

Mt. Gox, which collapsed in 2014 after losing 850,000 BTC in a hack, has been gradually repaying creditors. The latest movement marks the third major BTC transfer this month. Analyst Crypto Patel noted that this pattern of transfers could indicate an acceleration of repayments. Given the size of the transactions, traders are monitoring whether any portion of the moved BTC will be liquidated on exchanges.

Market Reaction and BTC Price Movements

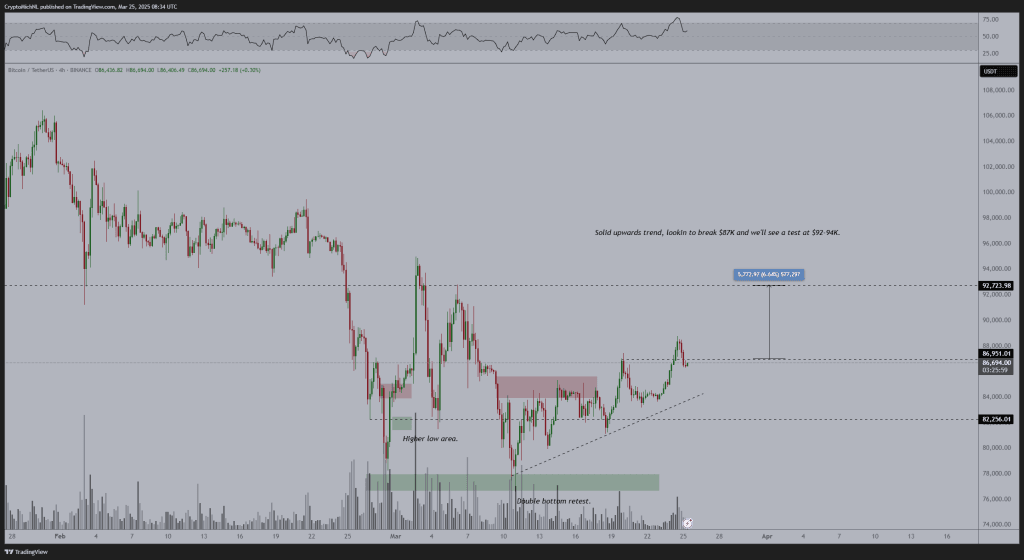

Bitcoin’s price keeps jumping as traders digest Mt. Gox’s latest move. During the transfer, BTC sat near $87,000, down from its $100,000-plus high. CoinGecko shows it swung between $86,358 and $88,713 over the last day. For the week, it drifted from $81,259 up to $88,474.

If creditors cash out and pressure builds, BTC might slip below $86,000, finding a floor near $81,000. Climbing past $88,000 could spark a run toward $90,000, maybe even February’s peaks about $100k.

There are different perspectives on the potential impact of these payouts. While one could view them as routine transactions, they could also increase the possibility that large exchange sales could influence market prices. Previous Mt. Gox transfers have sometimes led to short-term market fluctuations.

Bullish Predictions for Bitcoin

Even with worries about Bitcoin sales, some pros see a bright future. Crypto trader Michaël van de Poppe noted its recent climb, betting on a push to $90,000.

He spotted a “bull flag” shape on the charts, a sign it might surge soon. Big investors jumping in and friendlier rules have boosted Bitcoin this year.

While Mt. Gox’s payouts stir some doubts, for now, the bigger picture looks solid. If Bitcoin holds steady and clears hurdles, it could charge back to record highs.